Moods are fleeting; consequences aren’t.

Letting temporary emotions influence your investment decisions is like drinking salt water to quench your thirst.

COVID-19 is a firehose of negativity, a form of second-hand background smoke that potentially can ruin your retirement.

Behavioral scientists call this “ambient emotions” or background feelings.

The Wall Street Journal elaborates.

While ambient emotions are easy to ignore—like the effects of background music or the weather, we often aren’t even aware of the—research by Norbert Schwarz of the University of Southern California and Gerald Clore of the University of Virginia, among others, has shown that even fleeting moods can influence decision making.

Older investors are especially prone to these behavioral assassins.

Possessing valid concerns about catching the virus combined with shorter investing horizons makes dramatic market swings that much more terrifying.

Fear, anger, and sadness are the clear winners in this negative emotion lottery.

Background feelings trick some retirement investors into making permanent decisions for temporary financial problems.

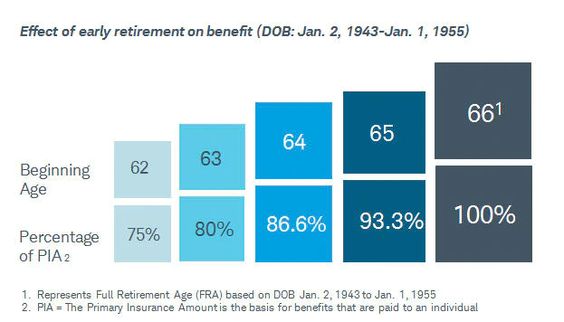

Fear motivates retirees to take social security much earlier than necessary. This results in leaving tens of thousands of dollars on the table. Not taking advantage of the almost 7% increase in annual payments by waiting has significant real-world consequences.

Source: ssa.gov

Anger causes the opposite effect. According to the Journal:

Research shows that they are likely to become risk-seeking, an effect especially strong among men. For retirees, this could mean drawing down assets too quickly or potentially selecting a portfolio with excessive risk.

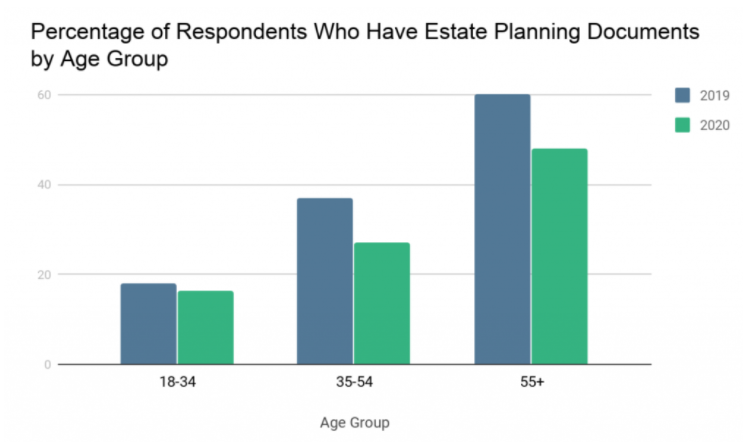

Finally, sadness brings its own unique set of problems. Sadness is classified as an avoidant emotion. It causes us to procrastinate on things that are important but not urgent.

Drafting a will or estate plan falls under this category.

Source: caring.com

In March, I felt all of these feelings big time.

Though I am in charge of clients’ financial futures, I am also a human being. It seemed like the world was ending, and what made it worse, I constantly had to comfort people while I needed comforting myself.

Deep down, I knew the country would get through this, but that didn’t make my job any easier.

What got me through was giving sound advice to others. This has been scientifically proven as a way to deter ambient emotions. Constantly going over market history with clients and prioritizing their health over any financial matters brought me out of my funk.

Using the troves of data to justify my optimism about the future was a win-win situation. My arguments became more convincing, and my clients felt less stress in their lives. We both felt much better.

Explaining to people why feeling ambient emotions were O.K. but acting on them wasn’t – morphed into a game-changer.

The more I spoke and, more importantly, listened, a virtuous rather than destructive cycle commenced.

Ignoring these feeling are impossible. Acknowledging them is the essential ingredient preventing the destruction of any long term financial plan.

Putting yourself in someone else’s shoes lets empathy bloom.

Letting fleeting moods direct the course of your finances is a big mistake.

Helping others heal is the best medicine for troubled times.

Letting your subconscious rise to the surface and directly facing your worst fears is a liberating experience – For everyone.

Source: How COVID-19 May Be Unconsciously Affecting Your Financial Decisions, by Shlomo Benartzi and John Payne, The Wall Street Journal