Just like market volatility, bad behavior clusters.

For every Fiduciary Advisor, there are thousands of Wolves on Wall Street.

Bad guys don’t operate in a vacuum. Often it’s not just one bad apple. It’s the entire orchard. Rotten cultures are highly infectious.

This week’s 403(b) atrocity du-jour involves an insurance company and a Florida Teachers Union. They thought it would be an excellent idea to conspire in a scam to sell expensive annuities to public school teachers.

According to The Wall Street Journal:

Florida teachers saving for retirement through 403(b) plans—similar to corporate 401(k) plans—weren’t told about an arrangement by which the parent of Valic Financial Advisors Inc. paid hundreds of thousands of dollars to an entity owned by local affiliates of the Florida Education Association, which in turn promoted Valic Financial Advisors’ services, the Securities and Exchange Commission said Tuesday.

Pay to Play is alive and well in our nation’s public schools. For its complicity in the scheme, VALIC coughed up nearly $40,000,000 in fines.

When asked to comment, I expressed no shock. The only people surprised by this are those not paying attention to this massively conflicted space. We have dealt with worst of the worst for over a decade, so excuse us for being a bit jaded.

My reply to The InvestmentNews summed up our experiences in this abomination of a retirement space.

The SEC has a long way to go to clean up the $1.1 trillion 403(b) sector, said Tony Isola, head of the 403(b) practice at Ritholtz Wealth Management.

“It’s a drop in the bucket compared to what’s going on,” Isola said. “It’s a start. It’s going to send some shock waves through people. They’re used to acting with impunity. Hopefully, this will lead to other cases. There’s always more than one cockroach.”

When Dina traveled to Congress a year and a half ago, she warned the House Financial Services Committee about stuff like this. Not surprisingly, it fell on deaf ears.

Why?

Insurance companies make enormous contributions to members of both political parties. Insurers know how to hedge their bets.

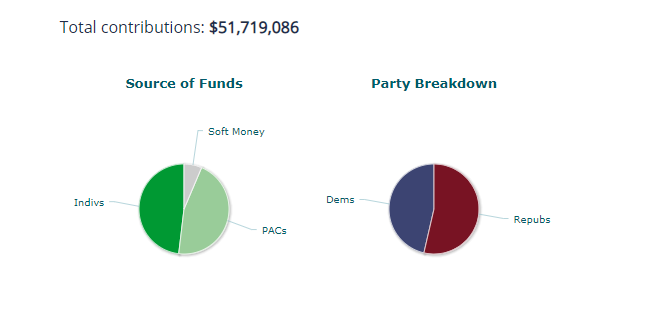

So far, in the 2020 election cycle, insurers have contributed over $50 million to Republicans and Democrats alike.

Source: OpenSecrets.org

Unfortunately, this isn’t a recent phenomenon. In reading the epic biography, The Power Broker: Robert Moses and Fall of New York, This is how the game is played and will probably always be. Reformers never run out of targets. In 1914, NY’s, Al Smith challenged Republicans as they attempted to water down a proposed workers’ compensation bill. Albany simmered with high-priced lobbyists representing insurance companies. Sound familiar?

Smith lost his sh*t as he directly challenged opponents of the bill.

“And for whom are you doing this? Does the working man want it? No! Does the compensation commission? Then what other party is there? The Casualty Company! That’s who you are working for.

You have gone the limit for the casualty companies. The people’s case is lost.”

We are all too familiar with this strategy.

The more things change, the more they stay the same.