Come for the education, stay for the compounding.

What’s the best financial advice you can give to your teenagers?

Explain the concept of compound interest and help them open up a Roth IRA.

It’s that simple.

According to William Poundstone, proficiency in understanding how compound interest works is a notable predictor of income, wealth, and happiness.

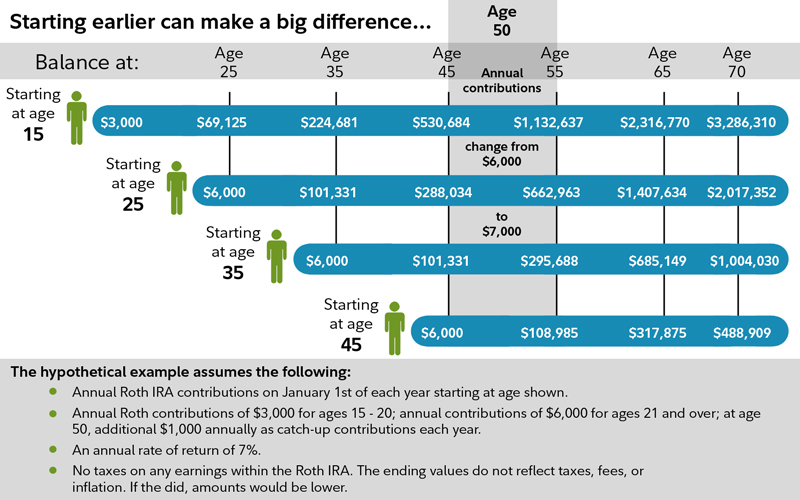

Showing teens a chart like this is imperative to ward off the temptations of Door-Dash, video games, and their like.

It takes some work on your part, but the future rewards for your kids are priceless.

Our experience with our twin 17-year-old sons is helpful for parents looking to launch their children into great money habits.

Both boys found jobs this summer at a local Modells. Unfortunately, the store declared bankruptcy and is now in the process of a firesale for its creditors.

This summer job opened up a terrific $15 an hour opportunity selling sneakers to bargain hunters.

They understand compounding pretty well. Having investment accounts since they were in third grade helped the process along.

Explaining the enormous tax-free withdrawal benefit of a Roth sealed the deal. We decided to turn it up a notch.

Our proposal – We’ll match every dollar you contribute 100%.

A kid doesn’t need honors Calculus to accept this offer. It’s always fun to finesse your parents.

They both agreed immediately. We had Erika set up accounts for them that very day.

This offer was a game-changer. Dina offered one of our sons $20 to work on a shredding project. He agreed but wanted the money contributed to his Roth instead of getting the cash. The matching incentive was too overwhelming even for a 17-year-old with other things on his mind.

Last year my one son made $1,500. So he has until July 15 to find his 2019 contribution. He agreed to put in $750 to get the full match and then make a similar 2020 contribution.

Our other son decided not to work last summer. Guess what? No 2019 Roth For You!

Adding this recitation to our proposal was another value add to our plan.

This match provided another life lesson. Their future employer won’t be as generous as their parents, but the experience is undeniable. Always take advantage of free money when it’s offered.

Throw in the concept of low-cost index funds, and you have a near-perfect recipe for future investing success.

There are some rules to implement this strategy, so make sure yo follow them.

- The child must have earned the income. This means that the income was reported to them on a W2 or 1099, or possibly the child was self-employed. The income must be reported on an income tax return in order to account for the income, even if no tax was owed on the earnings. (Note: don’t get carried away with this idea and “invent” income for your child. Allowance for mowing the yard or cleaning her room does not generally count as income.)

- The Roth IRA contribution must be made before the tax return is filed for the year in question. For the 2020 tax year, for example, the contribution to the Roth account must generally be made by April 15, 2021.

Source: Getting Your Financial Ducks In A Row

Parents strive to give their kids an edge in life.

Setting up a Roth IRA provides all of this and so much more.

If you have any questions, don’t hesitate to reach out.

Your children will thank you later.