Compounding is rocket fuel for gardeners and investors. Growing plants or money takes time; lots of it.

Unfortunately, get rich quick syndrome is a popular addiction.

Mother Nature (and your portfolio) could care less about you being a cool kid.

We moved into our home 17 years ago. Things were pretty barren. Compounding changed things.

Investing and gardening are similar. Pick a style and stick with it. Some prefer carefree wildflowers, others choose high-maintenance orchids and bonsai trees; either is fine. Don’t switch from a wildflower meadow to a complex Japanese garden without giving both plenty of time to prosper.

Most gardening and investing styles work over the long haul. Value, growth, small company, or momentum strategies tend to reward investors handsomely over long periods. None works if you abandon them.

Constantly uprooting plants or chasing changing investment fads get you nowhere — fast.

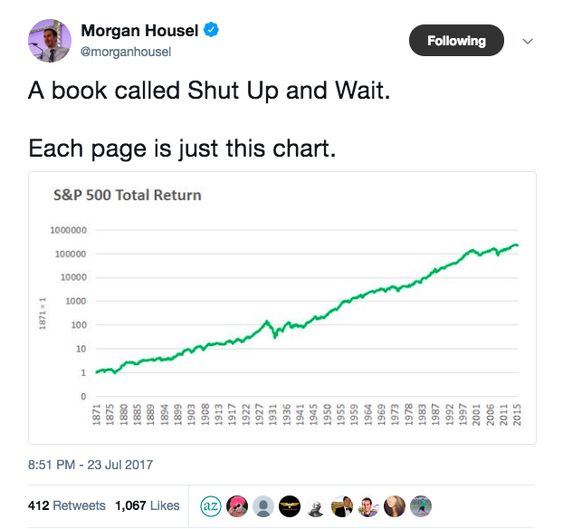

Market returns are a force of nature; resistance is futile.

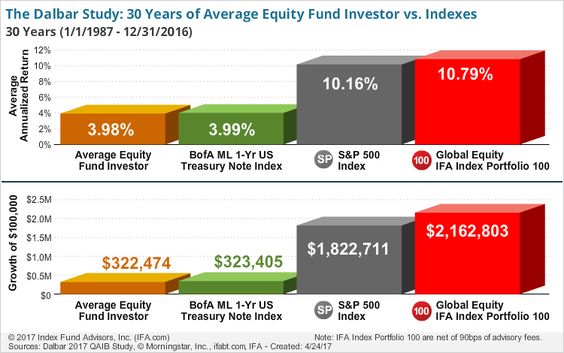

Costs matter for gardeners and investors. Buying seeds or young plants is much cheaper than purchasing an established Bradford Pear. Some plants self-sow. They drop seeds and create new plants year after year, which is not much different than collecting ever-increasing dividends from profitable global companies.

Forfeiting this compounding is a terrible idea.

Compound and compound some more.

Investors can pick low-cost market-tracking index funds or pay a small fortune to a manager to try and beat the market, which would be like allowing next year’s seedlings to grow in someone else’s yard. Giving away 2-3% in fees is the same as forfeiting your dividends. Gardens and portfolios require constant reinvestment to maximize the miracle of compounding.

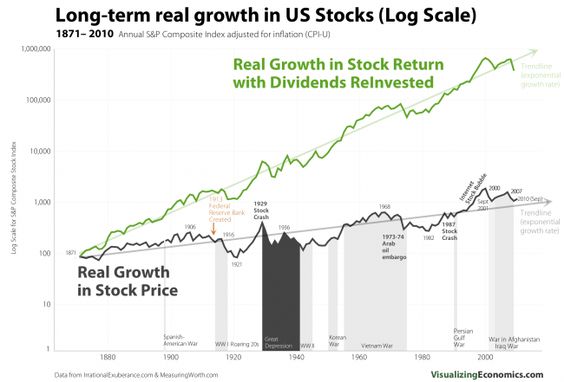

Things sometimes don’t go as planned. Disease, hail-storms, felled trees, rodents, and nibbling deer are constant challenges. The solution is not giving up and paving over your greenery with concrete.

Instead, monitor and adjust. Find plants that are adaptable to your ecosystem. Plant specimens in protected areas. None of these solutions can be implemented if you’re in constant freak-out mode.

Markets function similarly. The remedy for man-made or natural calamities is not to take your ball and go home. Construct a well-diversified all-weather portfolio. Violent markets storms are the reality, not bugs in the system. In both instances, this too shall pass.

The best gardens are diversified. Flowers bloom in the spring, summer, and fall. Bright foliage is constant. Choose plants with low flowering correlations to ensure something is always working.

The same holds true for investment portfolios. Combine large, medium and small stocks with high-quality bonds from sound global companies and nations. It’s not a smart idea to have all your flowers or investments shine at once. Barren landscapes and investment accounts provide little enjoyment.

They encourage you to do the worst possible thing, which is to quit.

Sit back and let both nature and markets do the work. I planted this White Pine 17 years ago. It was 6 inches. (BTW, I got it for free from the National Arbor Society.)

Money works the same way. Portfolios double every 10 years with a 7% average return.

Gardening and investing provide immeasurable rewards to the patient and even-tempered. Doing too much can ruin a garden.

In the words of Huma Yasin, “There are phases of life when, despite our best efforts, everything seems to go awry. And then there are times when even in the absence of any exertion, things fall into place.”

Digging up plants every day to check the growth of their roots or manically changing your investment style lead to similar results.

Neither makes your plants or money grow any faster.

It just might kill both.

Gardening in 90-degree heat just might kill me!