Focusing on what you CAN control is key to getting through a health or financial crisis.

Carl Richard’s outlines a terrific four-step action plan.

Do Nothing.

Find something you can control.

Do something proactive and productive.

Rinse and Repeat.

Try focusing on #3.

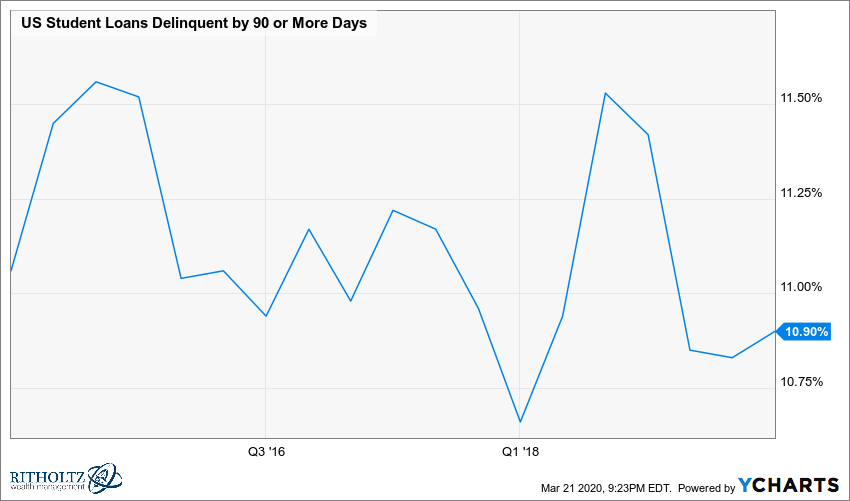

While the financial markets have been slammed, the bull is rampaging through the student loan market.

Rates have fallen dramatically. Welcome news in uncertain times for the 43 million Americans holding $1.5 trillion in outstanding debt accumulated over the last several years.

Many have struggled to keep up with payments. This will most likely rise significantly in the coming months.

This year undergraduate federal student loans could fall by 2.5% to an all-time low of just below 2% according to loan expert Mark Kantrowitz.

Federal loans are tied to U.S. government bonds. The financial crisis has forced the Federal Reserve to lower rates to zero dramatically lowering the rates charged to student borrowers.

Talk about making lemonade from lemons.

Anne Tergesen and Josh Mitchell discuss the opportunities these actions have created in their article Punging Rates Spell Opportunity for Student-Loan Borrowers.

Federal loans are set annually using a formula based on the yield of the 10 year Treasury Note.

Private loans often use a formula comprised of the one-month LIBOR rate and the borrower’s credit history.

The different formulas produce unequal outcomes.

Mr Kantrowitz expects rates on federal loans for the coming school year to decline to about 1.9% from 4.53% for undergraduates; to about 3.5% from 6.08% on Stafford loans for graduate students; and to about 4.5% from 7.08% on Plus loans for some graduate students and parents of undergraduates.

Private loans will decrease to around 2.8%.

Refinancing private loans at lower rates is a no- brainer.

Having no prepayment penalties or fees gives borrowers further incentive to act.

Good credit and prospects for future employment are necessary for refinancing. (This could be problematic in a recession) Visit sites like Social Finance and CommonBond Inc. to compare deals.

Refinancing a Federal Loan is another matter. This is important because the government is the largest holder of college debt. Controlling $1.2 trillion in direct loans to 35 million borrowers.

Tergesen states,

Borrowers can refinance their federal loans, too, but they should weigh any interest-rate reduction against the benefits they will lose by swapping their federal loans for private loans.

Unlike private loans, federal loans offer options for suspending payments when jobless for up to three years. Debt is eliminated if the borrower dies or is permanently disabled. They also cap repayment on a percentage of discretionary income and forgive remaining debt after 10-25 years of on-time payments.

Recently, interest on federal loans was waived by the President to help spur the economy. This was done automatically and retroactive to March 13. It might not make sense to refinance if your interest rate is currently zero. Borrowers are still required to make the same payments but its now 100% principal. This drastically reduces the term of the loan. Make sure this is occurring with your payments.

In addition, President Trump stated on Friday borrowers can suspend payments for two months without penalty on all federal loans and a portion of private debt. Borrowers need to call their servicers and enrol in the forbearance program

If you decide to refinance to a private loan make sure its a fixed-rate loan. Variable rates may offer lower initial terms but can reset dramatically depending on the fine print.

If you’re worried about the coronavirus or losing your job in these uncertain times, stick with your federal loans and don’t refinance them into private debt. They cast a wider safety net with a variety of payment options if trouble arrives unannounced at your doorstep.

Taking positive actions during a crisis is a form of therapy.

If you’re burdened by student loan debt or know someone that is, every crisis provides opportunities.

This time isn’t any different.