Who would’ve thought this could ever happen?

We’re having the equivalent of a great depression style bank run on toilet paper.

On a more serious note, some scary stuff is occurring.

The world’s mobilizing for war against one of nature’s serial killers.

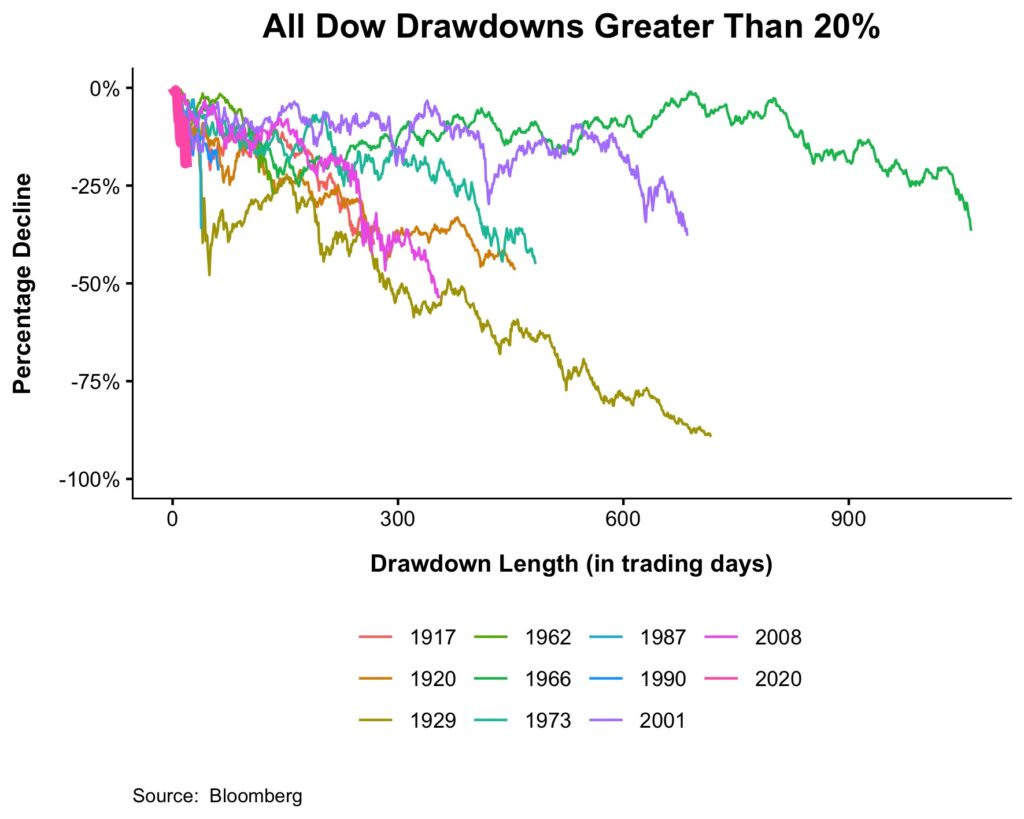

The stock market entered its fastest journey into a bear market – EVER.

America is likely to enter a recession if it’s not in one already.

A nefarious scheme was hatched to collapse the price of crude oil.

Pro and college sports are cancelled.

Disney World Closed!

Despite our greatest fears, this too shall pass.

Investors must focus on what they CAN control, not what they can’t. Always beginning with their behaviour.

Jason Zweig offers sage advice.

Controlling the controllable doesn’t just mean shrugging off whatever is out of your power. It also means putting some calm and serious thought into what is within your power. Your future success may depend less on what markets do—and more on spending a few quiet minutes figuring out who you are as an investor.

Telling people “Don’t Panic” in a condescending manner doesn’t cut it. Listening with empathy and providing an action plan comforts rather than scolds.

Lisa Damour of The New York Times shares some clues in her terrific piece, 5 Ways to Help Teens Manage Anxiety About the Coronavirus.

Stressed out investors need to focus on these seven action steps.

- Normalizing Anxiety: It’s perfectly normal to be losing your sh*t in unprecedented times. Healthy anxiety has a purpose. Alerting us to potential threats. In this case, seeing the possibility of your 401(k) get cut in half for the third time in twenty years or losing your health or job. Normal anxiety doesn’t mean you need medication. Instead, implement a healthy action regime of taking care of body and mind through exercise, meditation, sleep, and proper eating.

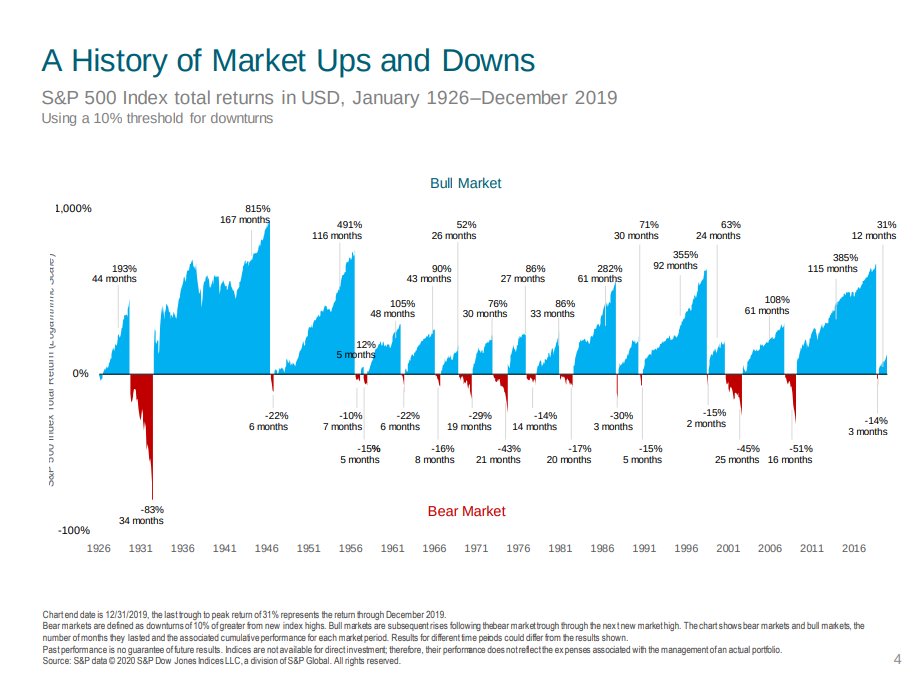

- Maintaining Perspective: This includes not overestimating danger or more importantly underestimating your ability to protect yourself. Filter your news by reading select data-driven sources, not hyperbolic eye-ball seekers. Increase your savings and lower expenses. Read market history. Keeping things on an even keel is difficult but imperative.

- Shifting the Spotlight: Losing money in the markets is very painful. If that’s your biggest problem, consider yourself lucky. In the upcoming days and weeks, many will lose their jobs and find themselves in a crisis situation. This is a fantastic opportunity to start volunteering if you haven’t done so already. You’ll be surprised how much better this will make you feel.

- Distracting Yourself: When we fixate on the bad stuff, it hijacks our minds. Take a break from social media rumour-mongering and hourly market alerts. Binge-watch that series you’ve been putting off, avoiding films like Contagion or Outbreak. Better yet, get all the paperwork together to refinance your mortgage.

- Choosing Your Friends Carefully: Is this the best time to be hanging out with or texting Mary the Hypochondriac? Is your College Friend who’s predicting the next Great Depression the person you should be leaning on for advice right now? It’s more important than ever to eliminate toxic people from your life. Everybody’s not panicking, you’re only hearing from the people who are. This is the perfect time to cull the prophets of doom.

- Avoiding Considering Only Extreme Scenarios: Thinking everything’s fine or this is a rerun of the financial crisis isn’t the path to follow. Plugging into the incessant chatter of 24/7 scare tactics feeds this beast. Consider other possible scenarios instead of only the best and worst cases.

- Understanding – This Is Why You Have a Plan: No good financial plan was created assuming everything is always going to be peaches and cream. Moments like this are the reason plans are created in the first place. If you don’t have a plan, make one or find yourself a new advisor.

Step back and take a deep breath. Nothing in life is permanent including bear markets.

Think different, seeing the world through the goggles of past assumptions will goose up cortisol production.

If all else fails. remember Josh Brown’s ABC’s. Always Be Cool.

I’ll leave you with something from Ben Carlson, a voice of reason in a blogosphere of melodrama.

Here’s something I can say with 100% certainty — every bear market in the history of U.S. stocks has led to new all-time highs at some point in the future.

Remember, things will get better with or without self-induced anxiety.

Choosing from the without column makes this ordeal much less painful.