How can investors free themselves from ignorance and misinformation?

Most of us live in a world of our own creation – not reality.

Relying on unreliable memories.

Postponing things until conditions are more favourable.

Removing the words ‘letting go” from our vocabulary.

Perceiving things instead of observing them.

Not realizing our egos are the true enemies.

Creating stories instead of measuring facts.

Being more attached to what we think we know than learning something new.

Looking backwards while trying to forecast an unpredictable future.

Habitually reacting to every stressor.

Clinging to every temporary event.

Becoming addicted to the gratification of our wants and the habits of wanting itself.

Not practising the wisdom of no.

Craving for a past that never existed.

Believing things will last forever instead of worshipping at the altar of impermanence.

Creating narratives as solutions to complex problems.

Refusing to accept the fact that anything can happen and the world isn’t out to get us.

Faithfully following these misconceptions, no matter how much trouble they cause.

Seeking answers to the wrong questions.

Not enjoying the best stuff in life while fretting when good times will end.

Viewing bad times as a permanent part of a new life of suffering.

Beating ourselves up over past mistakes.

Bailing out just before the sun is about to shine.

Believing we control our thoughts when they often control us.

Worshipping mental idols without any burden of proof.

Incessantly multi-tasking and ending up understanding nothing.

Becoming restless because we can’t focus our attention.

Incessantly seeking out transient excitement as a false remedy for boredom.

Focusing on end results no matter how irrational the process.

Letting the fear of the unknown run wild in our mind.

Demanding immediate answers to unanswerable questions.

Avoiding temporary pain at all costs.

Throwing the baby out with the bathwater.

Why do we act like this?

Why can’t we stop?

Why don’t we even notice?

We’re all guilty, some worse than others.

We’re human beings and this is a feature and not a bug of how we process information.

We don’t realize we are our own jailers.

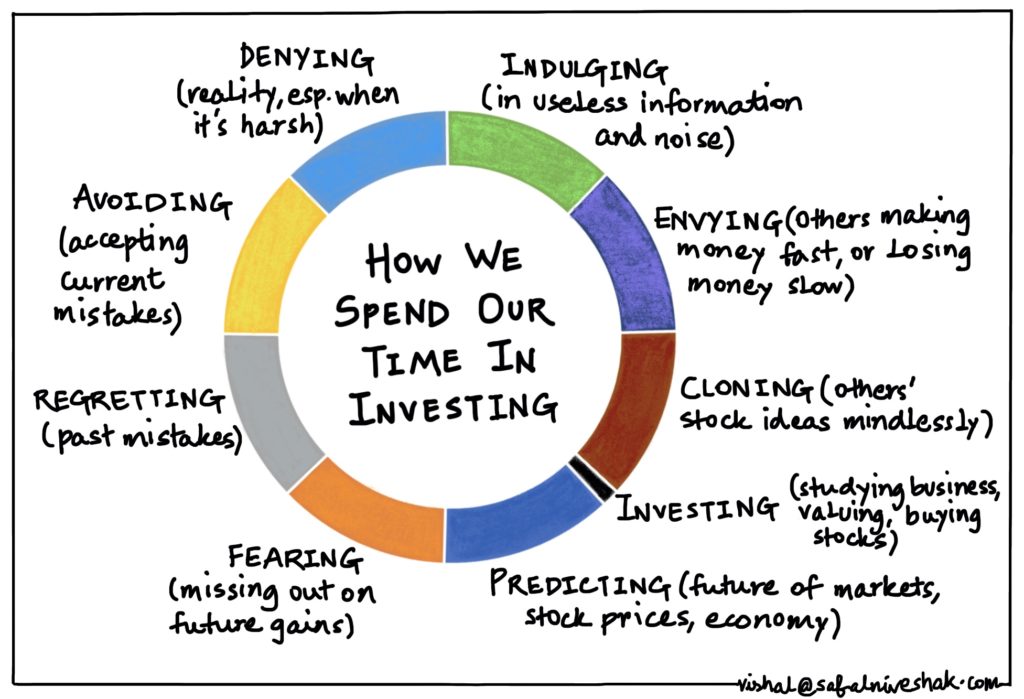

Take all of the above and mix it with a plunging stock market.

Source:https://www.safalniveshak.com/why-most-people-will-never-be-good-at-investing/

It doesn’t take a clinical psychologist to see where things are headed.

Changing lifetime patterns of behaviour isn’t easy.

The alternative is much worse.

Complex problems are often solved by the simplest solutions.

Start by paying attention

Drifting off course isn’t the problem. Not noticing when it’s happening is.

Always remember – we’re all a work in progress, not an unchangeable entity.

If you need some guidance in becoming a more enlightened investor, we’re here to help.

It’s never too late to change.