Imagine paying for college with a subscription plan that’s cheaper than your monthly cable bill.

Prepaid-tuition plans might be the answer to your prayers.

Just like regular 529s, pre-paid tuition plans are tax-advantaged. Earnings and distributions are tax-free provided you follow certain guidelines.

PREPAID TUITION PLAN

- This plan enables the account holder to buy credit units at higher-learning institutions that will be used in the future to pay tuition and administrative fees (as well as room/board, in some cases).

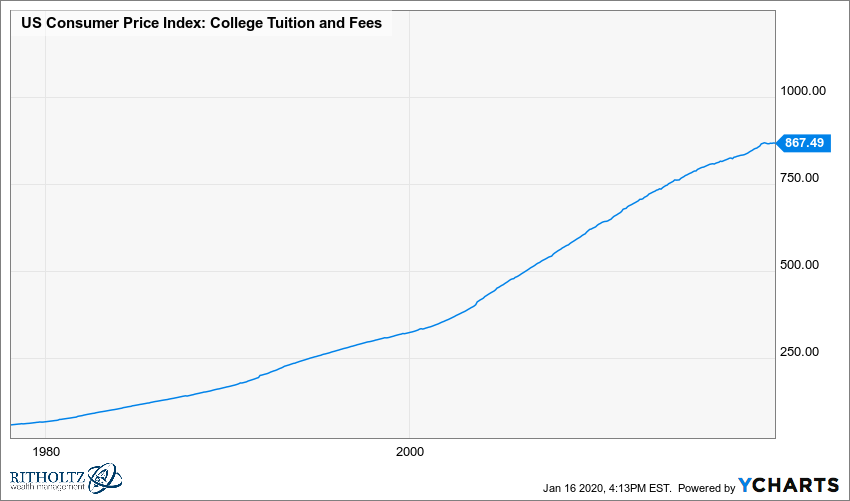

- Tuition costs are essentially locked; enrolled students pay tuition at a fixed rate determined at the time of the initial investment, meaning rates won’t be adjusted at a later rate — protecting against future inflation.

- Plans often are guaranteed by the state, which mitigates market risk somewhat.

- Most plans impose an age or grade limit on beneficiaries (such as 18 years).

- Individuals may set up a prepaid tuition plan only during a standard enrollment period

The big difference – pre-paid options guarantee funds will be available for tuition regardless of market volatility.

Here’s how they operate according to the Wall Street Journal:

“You contribute a target amount to the plans—the cost of a semester, say, or even four years—based on a calculation that takes into account today’s rates. Then the plan operators promise that the amount of money in your account will grow to match college costs down the road, or they’ll make up the difference.”

12 states offer this program. There is a caveat. Some state plans have residency requirements and require the funds to be used for in-state schools.

There’s also a Private College 529 Plan. Over 300 private colleges and universities participate, greatly enhancing the variety of options available.

Benefits can be transferred to a beneficiary or refunded if they’re not used.

Here’s an example of how this works.

“For a four-year Florida University plan covering the same number of state universities, the newborn’s family could make 223 payments of $186.28 a month, or $41,540.44, for an estimated benefit beginning in 2038 of $66,500. The family could also choose to plunk down a lump sum of $29,472.26 at the outset for the same expected benefit.”

Here is how savings can potentially work purchasing a year of tuition at the average private school rate 5, 10, or 18 years before a student or beneficiary enrols. This assumes 4% annual tuition increases.

Private College 529 Plan provides an illustration here comparing current. future, and resulting savings from using a pre-paid plan.

Nothing is perfect. They’re downsides to going down this road. Including the fact that only 68% of people know what a 529 plan is despite the explosive tuition increases.

Each plan and state have their own rules. Including participation requirements, enrollment period, contribution amounts, tuition-package options and guidelines where the money can be used.

Not all plans are guaranteed by the same provider and tax ramifications can get murky.

A huge chunk of college costs is the bells and whistles that come with living on campus. Some pre-paid plans don’t cover room and board.

“Prepaid-tuition plans have more constraints and won’t be the right fit for every family. Many of the plans have in-state residency requirements, meaning that states may impose limits on who can participate. Prepaid plans also can be stingier about what expenses are considered “qualified.” Some prepaid plans, for example, don’t cover room, board and other costs that are permitted use of funds in 529 savings plans.”

Despite these drawbacks, pre-paid plans may make sense for certain individuals. Especially those families who know what school their kids will choose.

About 75% of students attend in-state schools. Negating concerns about residency requirements. Pre-paid plans are terrific for families having large lump sums available for this goal.

Finally, pre-paid plans provide more certainty. Taking the market risk out of the college planning equation is more important for many parents than where their child’s school is located.

Like anything else, do your due diligence regarding pre-paid plans costs and benefits if this is something that interests you.

To increase your probability of success there’s no law against using both a pre-paid and regular 529 to finance tuition and room/board.

Diversifying investment strategies is never a bad idea. Especially if the cost of college continues its upward trajectory.

Even worse is missing loan payments. Resulting in wage garnishment, credit destruction and even the suspension of professional or drivers license.

Most aren’t aware that applying for federal student loans also requires male students 18-25 to register for Selected Service.

Who knew the subscription economy also included paying for college?

If you want to learn more – check out Savingforcollege.com’s online tool.

Sources: What You Need to Know About Prepaid College-Tuition Plans, by Cheryl Winokur Munk, The Wall Street Journal, Best Colleges –Saving for College