Our world is full of distractions. We do our best to maximize their potential.

Smartphones, consumerism, video games, alcohol, social media, gambling, and workaholism top the list.

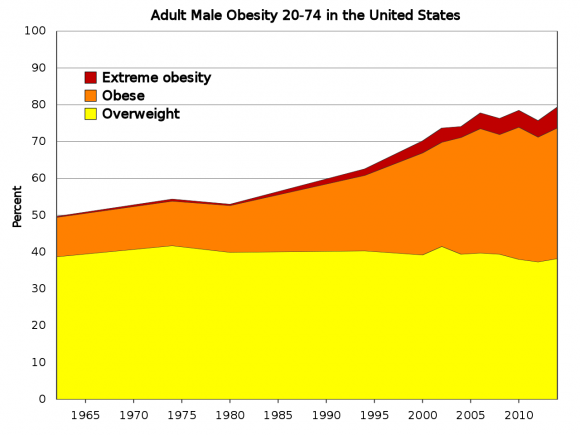

Overeating is our most destructive behaviour pattern.

Its toxic effects are devastating.

Sitting still or focusing on speaking with someone without manically playing with your smartphone are becoming relics from days gone by.

What are we running from?

Distractions act as symptoms for more deeply rooted issues. Focusing on these behaviours functions as a band-aid, not a cure.

Seth Godin states,

“The idea that we can strip mine attention, wasting what we don’t need, is long gone. Like oysters and oil before it, attention is a scarce resource, and we need to use it wisely. Too often, it feels cheaper to simply take what we can get, but when we overreach, the cost in trust is real.”

Sitting still might be the cure for what ails us.

The same goes for investing.

We distract ourselves with a full buffet of financial intoxicants, keeping us from reaching our goals and dreams.

Why we push sound financial advice away, not how we do it – is the issue.

Excessive trading, spending, and media consumption function as forms of financial poison.

There are multiple symptoms for this disease.

The refusal to let go of money saved for decades brings its own set of problems.

Maybe you were raised in depravity and having money gives you license to spend uncontrollably or turn you into a hoarder.

Depression-era folks can’t shake the horrors of that period and refuse to spend even though they’re considered affluent.

Some were taught to never speak about money and distract themselves with trinkets.

Others cojoin their self and net-worth.

Many think money is bad – Not understanding that money can make good people better and bad people worse.

We turn to intoxicants. avoiding what really troubles us.

Money worshipers and avoiders end up in the same miserable place.

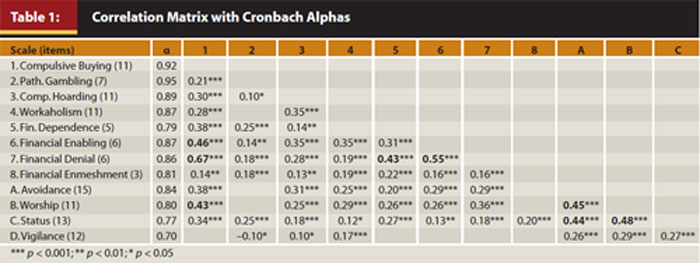

We all have our own Money Scripts.

“Money scripts may seem irrational to an outsider, but for the person living them, they are completely logical. identifying them helps clients recognize the roots of their money-related anxieties, and eventually, it’s hoped, end their harmful financial behaviours.”

The only thing we differ in is the severity of our symptoms.

Source: Journal of Financial Planning

Even financial advisors struggle. My colleague Blair Duquesnay wrote:

“I found it difficult to finish reading the chapter without stopping to think about my personal money scripts, those of my closest family and friends, or of clients. I have never examined my money scripts, and I plan to take the assessment to find out. I have to admit, I’m a little nervous about what I might discover, but knowing oneself is a critical component to success.”

Most need a financial therapist more than an advisor.

Leslie Albrecht wrote a terrific article defending this idea.

“Financial therapy sits at the intersection of financial advice and psychoanalysis. It’s a therapy that helps people uncover the source of emotions guiding their money decisions and, in the process, end self-destructive behaviours related to money.”

Money stresses us out. According to the American Psychological Association, since 2007 money is number the number one stress inducer in their annual survey.

BTW, the survey began in 2007!

Often good financial advice is overwhelmed by a tidal wave of financial intoxicants.

“Only about 20% of financial planning clients respond to logic and education,” states Rick Kahler, a financial advisor.

Many believe the ideal team to help people with money issues should be composed of therapists working with financial planners.

“A person can benefit from financial therapy when their behaviours are not in line with their values, Another way to say that is when someone is stuck or when someone knows I should be doing this — I should be saving, I should be spending less, I should be paying attention to my retirement — but it doesn’t happen.” Kahler continues.

Money often turns into a curse rather than a blessing due to past experiences and reactivity.

The bottom line – if we don’t understand why we continuously gravitate toward financial intoxicants, we can never break these destructive tendencies.

It’s not easy to change a lifetime worth of bad habits.

It’s even harder to live with their adverse consequences

Sources: Why the best person to give you money advice may NOT be an accountant or financial adviser by Leslie Albrecht, MarketWatch and The Greatest Value Investment Of All Time by Phil Pearlman, Eight Fat Swine, Money Scripts, by Blair Duquesnay, The Belle Curve

.