There are many unpredictable variables regarding investing, the truth shouldn’t be one of them.

“I’m sick to death of hearing things from uptight, short-sighted, narrow-minded hypocrites. All I want is the truth.” – John Lennon

Who knew this Ex-Beatle would be such an acute observer of the shenanigans of Wall Street’s financial salespeople and their paid mouthpieces?

The truth is a rare commodity when paychecks are on the line.

Alluring deceit is a feature, not a bug of a good part of the financial services industry.

The Iron Law of economics is people respond to incentives – good or bad.

Quotas and vacation trips for selling financial products epitomize the latter.

We are on the receiving end of many “interesting” financial questions Last week this came in. “A friend of ours who recently moved his money out of Vanguard made a comment that Vanguard is risky because the money is, “not real.” What did he mean by that? “

My initial reaction was WTF? After some consideration, a lightbulb went on inside my head. The “friend” most likely exchanged his mutual funds for some sort of fixed or market indexed annuity. The neighbourhood annuity peddler probably told him unlike the money at Vanguard, these funds were guaranteed.

He conveniently left out these inconvenient truths:

The expenses and commissions that bludgeon promised returns.

The elimination of optionality. You can’t get a lump sum of your own money if you need it.

The possibility the insurance company might not be around a decade from now.

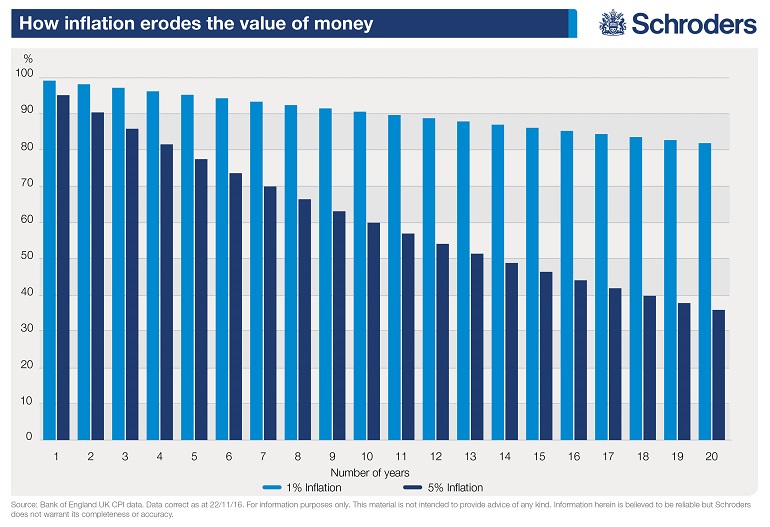

The devastating effects of inflation on low fixed rate returns over long periods of time.

Implying that $5 trillion in assets held at Vanguard was in some version of Facebook’s proposed Libra virtual currency is beyond deceitful.

This just came in hot off the presses.

https://twitter.com/jameslocke89/status/1152986374783602690?s=20

How can investors locate an oasis of truth in the conflicted oceans of financial treachery?

The truth is:

What matters most is your spending and savings rates. The rest is window dressing.

The market owes you nothing.

The bad news is a headline. Gradual improvement goes unnoticed.

Insure what you can’t afford to lose.

Your first investments should be in yourself, not the financial markets.

How well you control your behaviour determines the size of your net worth.

If you don’t have an “edge”, buy index funds.

Managing taxes and investment costs are a risk-free method for increasing returns.

A diversified portfolio will always leave you with regret. If not, it’s not diversified.

Risk and return are conjoined twins.

The people who suffer permanent injuries on rollercoasters jump off. The same advice goes for bear markets.

Despite conventional wisdom, the best long term investment isn’t your home.

If you feel safe and comfortable with your investments, something is probably wrong.

Most financial education is marketing in disguise.

Risk never disappears. It’s just transferred someplace else.

Good investing is pretty boring.

The ultimate widow maker trades involve penny stocks and naked options.

The President can’t control the stock market.

If day trading classes were valuable, why are they advertising on mid-day sports talk radio?

The smart money isn’t always so smart.

Lennon got it right in his desperate search for honesty in a very dishonest world. I’ve had enough of watching scenes with schizophrenic, egocentric, paranoiac, prima-donnas.”

Fill in the blank with the conflicted brokerage/insurance firm of your choice.

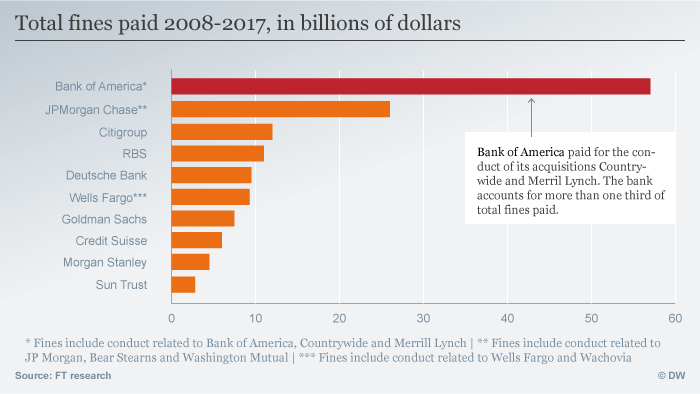

In case you think I am being to0 cynical – think again.

Martin Whitman, the founder of Third Avenue funds, willingly joins Lennon in the “Where is the truth chorus?”

When asked about Wall Street ‘professionals’. he devastatingly replied.

When you use the word ‘professional’ on Wall Street, it doesn’t mean they know anything. All it means is that they do it for money.”

Whitman gave Lennon what he was looking for. – The truth

Personally, I prefer this version.