It depends on how you spend it.

Becoming a mall rat won’t do the trick. The dopamine rush fueled by mindless purchases leads only to a severe case of FOMO.

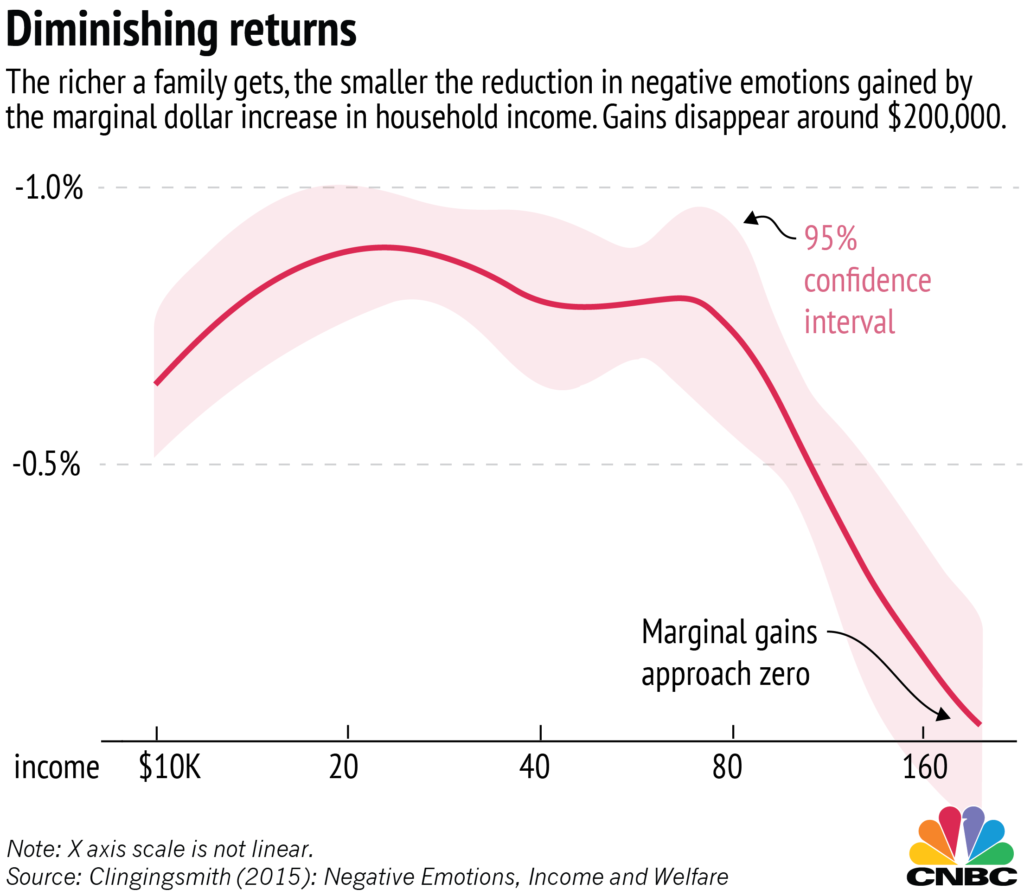

Income isn’t a golden ticket either.

How should you handle money to fill your life with bliss instead of envy?

Gretchen Rubin has seven terrific ideas from her bestseller The Happiness Project.

- Strengthen Social Ties: Close relationships are one of the most important elements of a happy life. Money spent travelling to see friends or relatives are sound investments in happiness. Throw a party, meet your besties at a restaurant, or go to the ball game with your brother. Don’t skimp on social spending.

- End Marital Conflict: Unhappy marriages lead to unhappy lives. Not all marital problems can be solved with money but it does help. Mundane chores often are the source of much bickering and resentment. Nagging destroys relationships. Hire a painter, landscaper, or cleaning service. Your marriage will thank you for it later.

- Upgrade Your Exercise: Data proves physical activity improves your mood substantially. Hire a trainer, join a tennis club, or buy that mountain bike. The $150 monthly Cross-fit bill is pretty cheap if you actually go. There’s no better investment than ploughing money into your health. You’ll receive dividends in perpetuity.

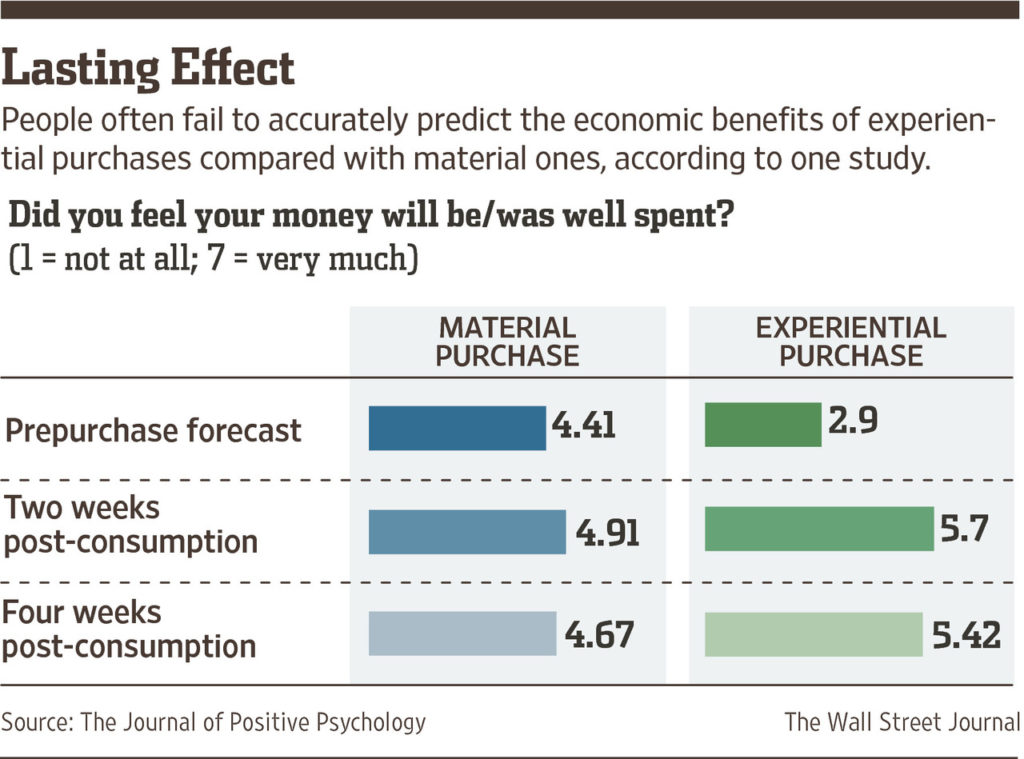

- Think About Fun: Experiences are more valuable than possessions. They may seem more expensive in the short run. Don’t be shortsighted. Just looking forward to the activity you planned will give more enjoyment than purchasing those brand new $200 sneakers.

- Serenity and Security: Does debt keep you up at night? Pay it off. Maybe you can get a higher return with the funds you’d apply to pay off a 4% mortgage. Who cares! If this gives you peace of mind, go for it. Life is not just about running the numbers.

- Pay More For Healthy Food: In most things other than investing, you get what you pay for. Dollar meals at McDonald’s are cheap and convenient. The long term health costs aren’t worth it. Fresh high-quality food is more valuable than gold. The extra few dollars spent on fresh fruit and vegetables is a wise decision.

- Spend Money On Someone Else: I love selfish and greedy people – said no one ever. Give to charity. Help out somebody going through hard times. You’ll feel wealthier because you can give money away. Giving gifts sparks more joy than receiving them. Don’t dispute the science, give freely and enjoy the results.

We all know rich people who are miserable. Maybe part of the problem is their misguided expectations about spending.

Elizabeth Dunn and Michael Horton the authors of Happy Money have an excellent take on societies spending problems.

“When it comes to increasing the amount of money they have, most people recognize that relying on their own intuition is insufficient, spawning an entire industry of financial advisors. But when it comes to spending that money, people are often content to rely on their hunches about what will make them happy. And yet, if human happiness is even half as complicated as the stock market, there is little reason to assume that intuition provides a sufficient guide.”

While we can’t control the markets, we have much more power over our happiness than we realize.

Start by spending money. Just make sure you think carefully about what you’re spending it on.

Sources: Happy Money by Elizabeth Dunn & Michael Norton, and The Happiness Project by Gretchen Rubin