Social Security is a hidden gem. Too bad most people don’t possess the proper tools to unlock its value.

According to InvestmentNews, 47% of Americans failed this basic five-question quiz.

- 51% believe their benefits wouldn’t be reduced if claimed at 65.

- 46% think a spouse can’t receive benefits if they have no work history.

- 80% believe they can receive two checks if their spouse dies.

- 83% feel they will get the same benefit whether they start collecting before or after full retirement age.

- 15% think their benefit won’t be reduced if they collect Social Security and continue to work before full retirement age.

All of the above are false.

Bill Sweet, our resident tax master, created an excellent presentation on this subject.

Some of his main points:

- The average retirement monthly benefit is $1,258.

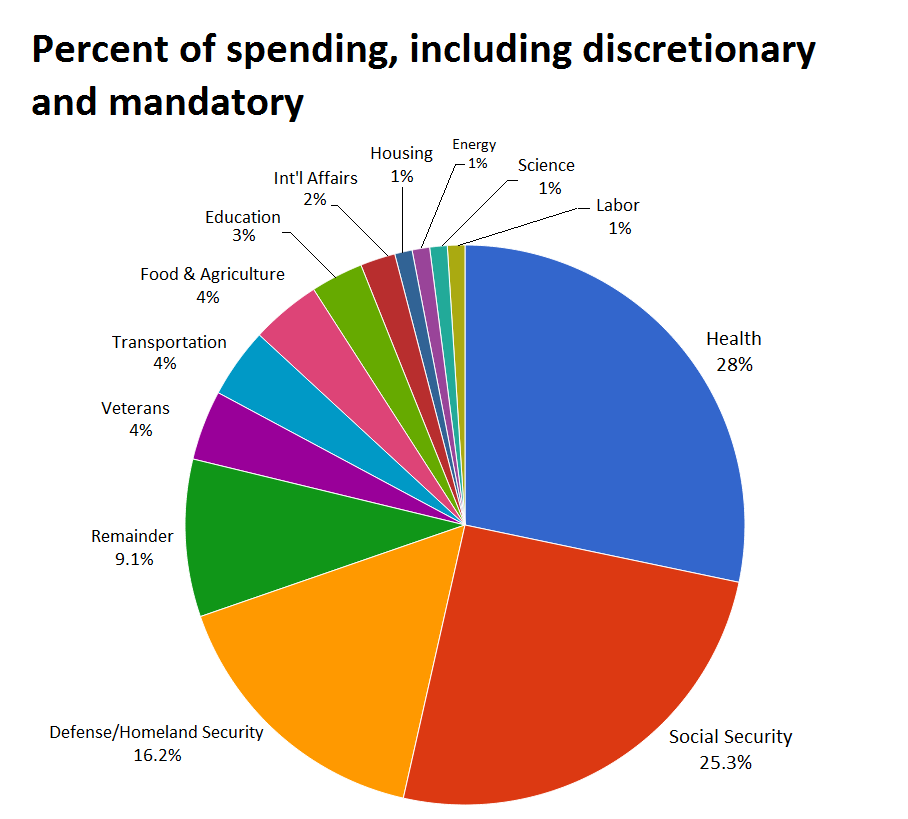

- Social Security is funded by the payroll tax.

- The system is healthy until 2030.

- Benefits taken at full retirement age( with life expectancies of 82.5 and 85.1 for a male/female couple) could be worth a total of $854,000.

- The average median home value is $221,800; Social Security might be your largest asset.

- At 42%, Social Security is the greatest source of income for the typical American household.

- Only 3% of private sector workers have pensions. Guaranteed lifetime income is very rare.

- Social Security Primary Insurance Amount is calculated by using the highest average 35 years of earnings.

- Social Security adjusts annually for inflation; most pensions don’t.

- The earliest anyone born after 1943 can collect their full retirement age benefit is 66. If you are born after 1960, you must wait until 67.

- The soonest you can file for Social Security is age 62 (without special circumstances). For each year filed early, there is a penalty of about 6%.

Despite this, 72% of Americans collect at age 62.

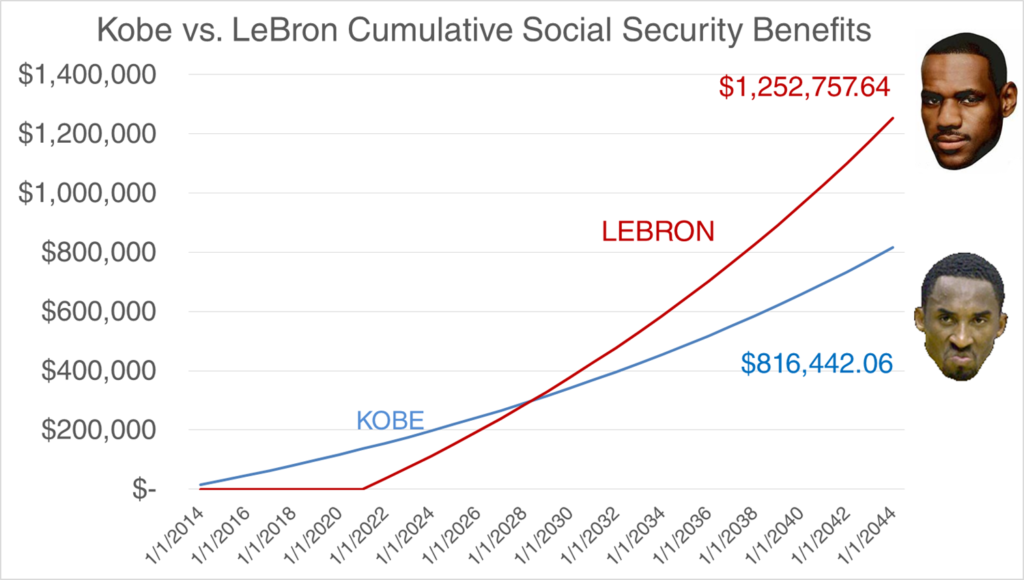

If you delay collecting until age 70, benefits will increase by 64%!

For example, Kobe and Lebron have the same annual benefit, but Kobe files early at age 62; Lebron waits until age 70 (J.R. Smith forgot to file).

- At full retirement age, a spouse can collect 50% of their partner’s benefit, even if they have never worked.

- A divorced individual may be entitled to 50% of their ex-spouse’s benefits.

- 85% of benefits are taxed if joint filers make $44,000+ ($34,000 for single filers).

Many advisors provide no guidance on Social Security strategies. Worse, many say this: “Take Social Security as soon ASAP — before it goes bankrupt.”

High-net-worth individuals often look at Social Security as an afterthought instead of a valuable component of a holistic financial plan.

I love leaving money on the table (said no one ever).

Recently, I did this podcast with my friend, George Grombacher, for Money Savage. We speak about some of the issues mentioned above; don’t worry, it’s short. Try this cool calculator. You don’t have to believe me on the value of delaying filing.

Planning to die early so you can receive a check at age 62 isn’t an optimal strategy.

If you would like to learn more about how we incorporate Social Security along with your other assets into our financial planning process, let us know.

Failing a test is not the end of the world. Not learning from your mistakes can be.

Sources: Charts from the “Tax-Master”, Bill Sweet; “Almost half of near-retirees fail basic Social Security quiz”, by Mary Beth Franklin, InvestmentNews