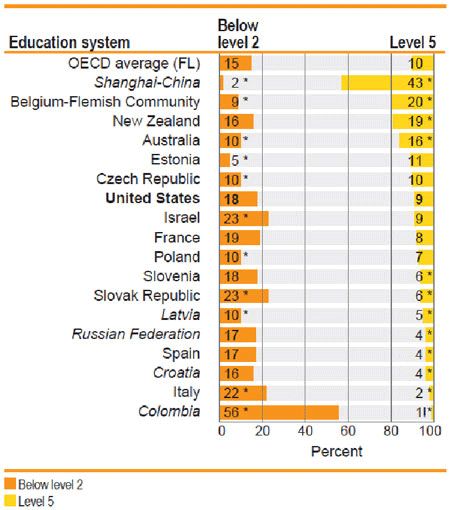

Regarding personal finance, most students and their teachers are functionally illiterate.

On a global basis, our schools are below average at providing a sound financial education.

Source: National Center for Education Statistics

According to Financial Education Stalls, Threatening Kids’ Future Economic Health by Annie Nova, CNBC, the facts are damning.

- More than half of states don’t require high school students to take an economics class.

- Only 17 states require high school students to take a course in personal finance.

- Studies show that students without a financial education are more likely to have low credit scores and other financial problems.

Some data shows more math classes would be a better strategy, but the jury is still out.

A 2014 Federal Reserve report found that students exposed to personal finance education had credit scores that were 7 to 29 points higher than those of students who didn’t have such classes.

Leveraging math by integrating it with personal finance will provide maximum value.

I learned a long time ago the best way to motivate students is to make the subject REAL to them. Explaining why it’s important to THEIR lives.

This counters the inevitable, “When am I ever going to use this?”

Teaching students about investing, combined with subject level math, is a home run.

So, of course, that is why this strategy is not implemented.

A big reason for the abject failure of personal finance education in public schools are the teachers.

Though well-meaning, most have trouble understanding the most basic of financial concepts; let alone teaching them to others.

We are trying to do something about this. Working with partners like Next Gen Personal Finance, we are disrupting the status quo.

A huge factor why teachers cannot teach money management is the bubbling cesspool of financial exploitation existing in their schools; more commonly known as the non-ERISA 403(b) plan.

Scheming, commission-hungry financial salespeople manipulate teachers into buying fee-laden, inappropriate retirement products like indexed and variable annuities.

Their biggest crime is their failure to educate teachers on the basics of investing. In fact, they teach them exactly what you are not supposed to do!

Ignoring evidence and relying on emotion as a basis for investment decisions.

When we bring teachers into our program, we not only liberate them from awful products, we explain WHY. We teach them the basic fundamentals of concepts like insurance, college planning, and debt management.

Our hope is they will bring their new knowledge into their classroom. We are there to help them every step of the way.

My friend Tim Ranzetta (read about him here) recently did a podcast with me about this and other issues. (I had a cold at the time. A net positive since it helped calm me down.)

Here is a highlight.

“[403(b)] is an absolute travesty… There’s really only little oversight, so the school district’s only obligation is one of an administrator… but as far as the investment choices, there is absolutely no oversight. It’s a horrific, exploitative mess.” If you would like to listen to the whole thing, click here.

This is much bigger story than a teacher’s retirement problem. The most valuable resource we possess, our children, are secondary victims of conflicted financial salespeople.

Not on our watch.