“To be a gross generalist, you can put more than half of investment products into what I call the basket of deplorables: overpriced, non-transparent, extremely conflicted, you name it. Unfortunately, there are people out there who believe the false stories sold to them.”

This is my “financial product” version of Hilary Clinton’s uncomplimentary description of Donald Trump’s supporters. While this current presidential election simultaneously nauseates and fascinates me, this is not where my true interests can be found.

My focus centers on the often deplorable list of investments sold as “suitable” retirement options to both retail and institutional investors.

The list is lengthy and very intolerant toward the idea of a fair deal for America’s retirement savers. There is no denying these products are toxic to the retirement savings of our citizens and institutions. Here we go:

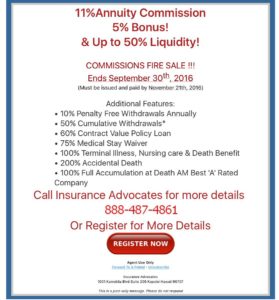

- Equity-Indexed Annuities – How about an investment with limited upside but large potential for a substantial loss? Throw in a 10% sales charge and no dividend participation (50% of historic market returns) and we have the ingredients for a deplorable retirement scenario.

- Funds with 12b-1 Fees – Fund size and investment returns are negatively correlated. Investors are paying a fee to brokers designed to increase assets and reduce returns. Kind of like paying a restaurant to give you food poisoning!

- Proprietary Mutual Funds – This is cross selling at its most heinous. Never buy a mutual fund created by a broker’s employer- this is the ultimate perverse incentive.

- Non-Traded REITs – A false promise of safety combined with 10% upfront commissions, this is a true sucker’s bet. Just because something is not traded doesn’t mean it cannot go down in value. By the way, their publicly traded cousins have vastly outperformed this group over time, because of greater transparency and lower fees.

- Commodity Funds – High risk combined with low returns rarely ends well. These products specialize in something called ”Contango.” Investor translation: Nearer dated futures’ prices are lower than the longer dated ones, or more commonly known as buy high and sell low, rinse and repeat.

- Variable Annuities – These are often sold on the pretense of guaranteed income and tax-deferred growth. In reality, very few investors need this product fraught with complexity and egregious fees. These are often placed inappropriately in tax-sheltered accounts; investors do not need both a belt and suspenders.

- Front-Loaded Mutual Funds – Investors pay a premium of 5.75%, and an additional 1% a year in fund fees to purchase an investment that is almost guaranteed to underperform an unmanaged index fund costing .05%, annually. There is NEVER a reason to pay this fee.

- Over-Niched ETFs – Healthcare Shares Dermatology and Wound Care ETF and Pure Drone Economy Strategy funds are all that needs to be said. The prosecution rests its case.

- Hedge Funds – 2% annual fees combined with 20% of yearly profit makes it pretty hard for investors to bring home any type of meaningful positive returns. While there is a small minority of hedge funds that are worth the steep price, they are either closed or have account minimums that rule out everyone except for the Bill Gates’ crowd.

- Market Linked C.D.s – The ultimate vanilla investment has been hijacked by Wall Street. Unless you enjoy paying a 3% commission and having the possibility of losing principal due to early withdrawal, run away from anyone who approaches you with this nonsense. Purchasing a complicated structure that will underperform your Credit Union’s basic offering is a deplorable choice.

This list of financial deplorables costs investors trillions of dollars in unnecessary fees (which kill returns). This story certainly “Trumps” anything Hilary Clinton has to say about Donald Trump’s supporters in every way, shape, or form in national importance.

There are few things more deplorable than this sad reality. In the words of our CEO Josh Brown, “These products are created by foxes, sold by wolves, and bought by sheep.”

“Deplorable” might as well be accepted as an asset class, judging by the length of this list.

Make your vote count and choose transparency, low fees and an investment advisor who will look out for your best interests.

This is one election where your vote does not have to be in a swing state to matter.

.

[…] investors. Anyway, my colleague has accumulated all these awful products in the post titled “The Financial Basket Of Deplorables“. If you think I get angry seeing repeated bombardments of credit card sales pumping in our […]

[…] The Financial Basket Of Deplorables (A Teachable Moment) […]

[…] The Basket Of Deplorable Investments by Tony Isola […]

[…] The Basket Of Deplorable Investments by Tony Isola […]

[…] The Basket Of Deplorable Investments by Tony Isola […]

[…] The Basket Of Deplorable Investments by Tony Isola […]

[…] The Basket Of Deplorable Investments by Tony Isola […]

[…] The Basket Of Deplorable Investments by Tony Isola […]

[…] edition. There are always several great choices worth reading. My personal favorite this week is Tony Isola’s list of “deplorable” investments. I see the ads for many of these and become ill. If there […]

[…] edition. There are always several great choices worth reading. My personal favorite this week is Tony Isola’s list of “deplorable” investments. I see the ads for many of these and become ill. If there was only […]

[…] The Basket Of Deplorable Investments by Tony Isola […]

[…] edition. There are always several great choices worth reading. My personal favorite this week is Tony Isola’s list of “deplorable” investments. I see the ads for many of these and become ill. If there […]

[…] A list of financial products investors can safely ignore. (tonyisola.com) […]