Following the crowd gets pretty crowded.

Rational decisions are powerless in the epic battle versus social proof.

Robert Cialdini defines social proof as: “The principle asserts that people think it is appropriate for them to believe, feel, or do something to the extent that others, especially comparable others, are believing, feeling, or doing it.”

Decision-making appears more valid this way.

Why do so many public school teachers hold high-cost investment products in their 403(b) plans; receiving little benefit while conflicted salespeople immensely profit?

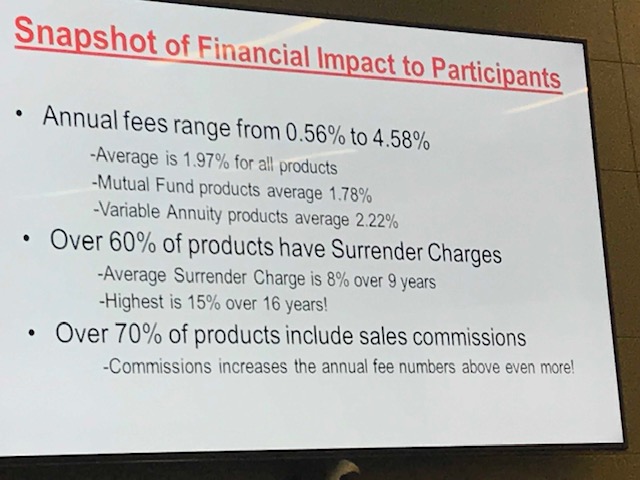

Second-grade math explains why low investment fees are far superior to high ones.

“I want to sacrifice 75% of my real returns to wasteful investment fees and enjoy being financially exploited” (said no one ever).

What gives?

Many insurance companies categorize teachers’ perceived unique needs and concerns to sell products to the entire group. This makes it easier for them to spread the word to their colleagues.

Unfortunately, the most “popular” investments for K-12 public school teachers are expensive annuity products and high-fee mutual funds.

Social proof on steroids.

Teachers’ “comparable others” invest this way. “It must be the right thing to do. It’s impossible for all of these people to be wrong. Isn’t it?”

Teachers use a “guy” that their colleagues strongly recommend.

This concept is morally and financially dangerous; I equate it to a form of group financial torture.

Speaking of torture, Cialdini sites this study cementing the power of social proof:

“After learning that the majority of their peers supported the military’s use of torture to gain information, 80% of group members found the practice more acceptable and demonstrated greater support for it in their public pronouncements and more revealingly their private opinions.”

Group dynamics have the potential to make the Spanish Inquisition great again.

Other industries use a different approach.

Cialdini points out, “Restaurant managers can increase the demand for particular dishes on their menus without the expense of upgrading the recipes with more costly ingredients, the kitchen staff with new personnel or the menu with flowery descriptions of the selected items. They have only to label the items as ‘most popular’ dishes. When this entirely honest yet rarely employed tactic was tried in a set of restaurants in Beijing China, each dish became 13 to 20% more popular.”

This is also why your friend’s social media posts make you spend more money.

According to Christopher Ingraham of The Washington Post:

“A boat parked in a driveway draws the attention of neighbors more than the absence of a boat. Similarly, it is more noticeable when a friend or acquaintance is encountered eating out or reports taking an expensive trip than when not, or buys an enjoyable product as compared with not doing so.”

We all want to keep up with – and invest like – the Joneses and stay ahead of everyone else.

Social proof comes across as both valid and feasible. It’s scary how easy it is to manipulate us; this includes investors, political partisans, Facebook addicts, and religious fanatics.

Blindly following anything without due diligence is a risky strategy, especially regarding your finances.

Follow the leader is a child’s game – not a retirement strategy.

Source: Pre-Suasion by Robert Cialdini