It’s impossible to calculate the price tag of “suitable financial advice;” often, it is never disclosed as merely suitable. Opportunity costs created by avoiding low-cost index funds are enormous.

How about the tax consequences of withdrawing money from retirement accounts to purchase expensive insurance products?

Suitability is no match for unbiased, comprehensive financial planning.

According to the Barbara Roper, the director of investor protection for the Consumer Federation of America, “The industry has spent decades trying to persuade the public that brokers are trusted investment advisers who just happen to be paid through commissions, rather than fees.”

In court, they tell a different tale.

“Industry trade associations argued that brokers are merely salespeople whose investment recommendations cannot reasonably be included in the definition of fiduciary investment advice.”

Watching sixty-second insurer-financed commercials touting their “advice” doesn’t lead to price discovery. Salespeople work under the suitability standard. They give conflicting advice and receive commissions; and, it’s perfectly legal.

The fiduciary standard mandates advisors prioritize client’s best interests.

Why would clients choose door one? Just 42% of investors correctly identified the term fiduciary.

Bob Veres provides an example of “suitable advice” that the industry lobbies to keep in place:

“In another example of the damage caused by ‘suitable’ advice, Vawter worked with a 55-year-old single school teacher, with no kids, whose prior ‘financial planner’ had advised her to take a 72(t) withdrawal plan from her IRA, which would be used to pay $50,000 annual premiums on a cash value life insurance policy. ‘Due to her substandard health, the underwriting probably increased the premiums by 100%,’ says Vawter. ‘And she didn’t need a death benefit in the first place.’ By the time Vawter came into the picture, this person had paid $150,000 in premiums, and the cash surrender value was $75,000. The policy carried a 20-year surrender period. She eventually cashed out and received $25,000, and of course, she had to continue taking the 72(t) withdrawals, losing the benefit of long-term tax deferral to take income which she didn’t need.”

“The financial impact of ‘suitable’ advice? ‘This,’ says Vawter, ‘was a conservative investor who lost 85% of her principal in three years of a bull market.’”

Can investors rely on Congress to protect them? Not according to Rep. Bill Huizenga, Chairman of the House Financial Services Subcommittee on Capital Markets.

“I don’t believe that there’s a systemic and widespread issue. We are talking about tens of dollars here. That’s not tens of hundreds, not tens of thousands.”

He needs a math lesson. It’s estimated that investors pay $17 BILLION in unnecessary fees each year.

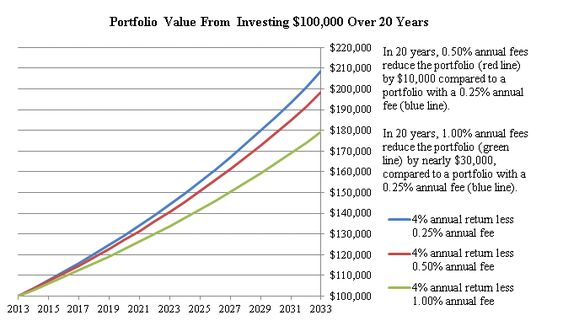

This chart shows the effects of a 1% fee. Financial salespeople often charge between 2-4% for expensive and unnecessary products combined with often dangerous, conflicted advice.

Source: SEC

“Like many lawmakers on the House Committee, Mr. Huizenga has received the most campaign donations from the financial services and insurance industries. He said these contributions don’t affect his policy stances.”

Wait – what?

Rep. Huizenga’s solution, “Let’s let the industry work this out.”

The “industry” has worked this out — breaking the backs of clients’ portfolios with gargantuan fees.

The problem is systemic. Toxic incentives benefit salespeople over clients and pollute the financial waters for real advisors. Suspicion and mistrust lead to bad decisions or inertia.

https://twitter.com/BarbaraRoper1/status/983725084224319493

What’s the solution?

The SEC just came out with their own plan. “Suitability Plus” or “Fiduciary Lite” won’t solve the problem.

It shouldn’t take a 1,000-page document to define doing the right thing.

Ask yourself: Is “suitable advice” the best you can do for your hard-earned money?

Sources: “Casting Doubt On Conflicts,” by Mark Schoeff Jr., The InvestmentNews; “The Real Cost(s) of Suitability” by Bob Veres, Inside Information