Break the rules to learn about money.

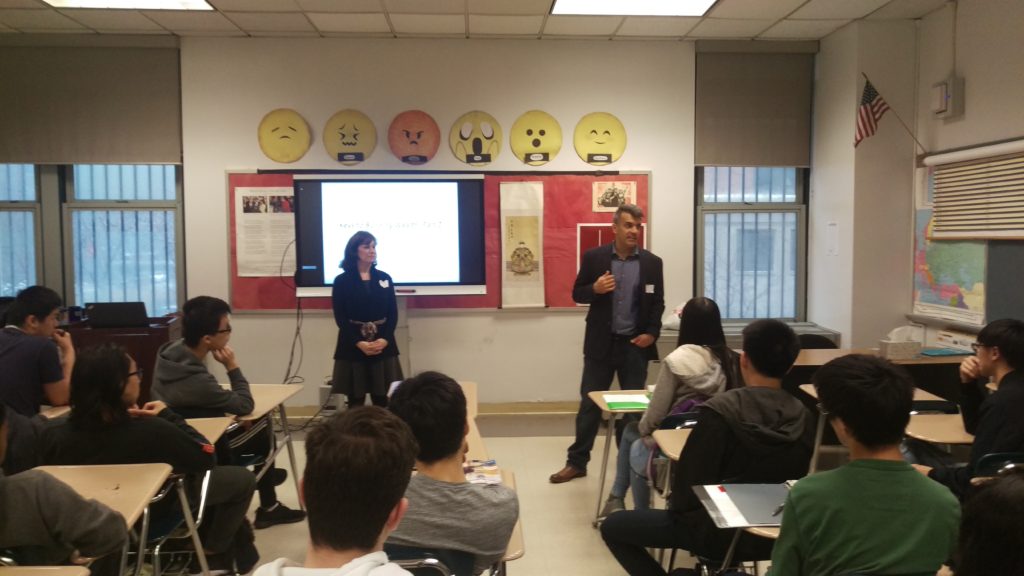

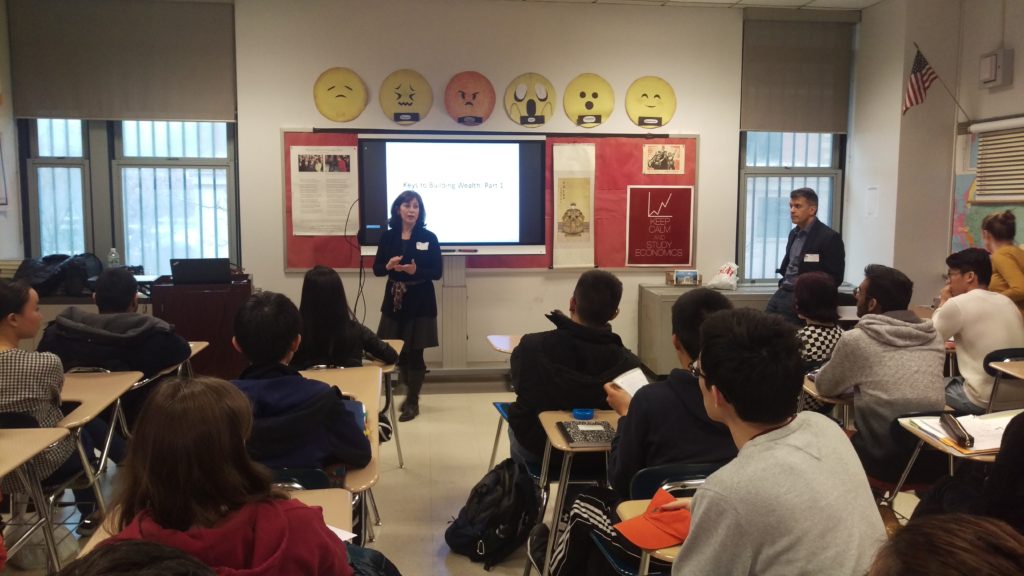

Dina and I, along with Anora Gaudiano of MarketWatch, visited one of New York City’s most prestigious and ultra-competitive schools – Stuyvesant High School. Kudos to them for taking a much-needed step in educating their student body about personal finance.

Financial literacy courses are greatly lacking across the board; even in high caliber schools. Hannah Milic wrote about her personal experience at the prestigious Beacon High School, in an article called “I learned nothing at one of NYC’s elite high schools.”

While Beacon provides a highly competitive academic education, Milic questions the usefulness of her education in the real world.

“I had no idea how a mortgage worked, what to do with an income-tax form, what having a credit card entailed.”

Our mission to help teachers apply more financial literacy into their classrooms was embraced by Stuyvesant and we are happy to offer it to others, as it is noticeably absent from most curriculum. Only 16.4% of high schools require a personal finance class to graduate.

Financial literacy month should be every month.

We spoke to three senior economic classes at Stuyvesant High School. Aside from the fact that one student defined the S&P 500 as having fifty stocks in it, we had a positive experience.

The students and teachers couldn’t have been nicer. They even gave us mugs.

Here are twelve teen-finance highlights. (Which should have included the advice NOT to sleep over at Walmart, snort condoms, or play Fortnite 24/7.)

- Budget your money between 50% wants, 30% needs, and 20% savings and good things will happen.

- 1600 on your SAT won’t make you a good investor; emotional intelligence will.

- Make mistakes; it’s the only way you will learn.

- Read – a lot.

- The power of compounding is real; earn more interest than you pay.

- The most important investment is in yourself, not the stock market.

- Most people hate their jobs; don’t be part of this squad.

- If you are a good person, more money will compound these qualities.

- Our industry really needs idealistic young people, especially WOMEN.

- Borrow only for things that grow in value.

- Diversify. A mutual fund is like an egg carton; the eggs are the individual investments. If one breaks you can still eat breakfast.

- Question adults. They don’t know everything.

As we are witnessing in Parkland, Florida, sometimes the kids know more.

This article by Inc.’s Amy Morin goes further.

“School rewards people who follow the rules, not people who shake things up.”

“It’s the kids who are willing to break the rules who go on to become entrepreneurs, innovators, and millionaires.”

A 2012 study published in the Journal of Personality and Social Psychology found that agreeable people earn less money.

The Illinois Valedictorian Project found that valedictorians were less likely to become millionaires than their peers. The high school valedictorians did well in college and went on to have prestigious careers, but they weren’t likely to be the highest earning people in their class.

We don’t advocate disrespect or lawlessness, but kids need to learn how to constructively challenge authority. In my teaching experience, students that parroted back information to please and receive good grades had the least mastery of the subject matter and lacked creativity.

Other students who received Bs and Cs, but asked challenging questions and provided new perspectives, offered the most future career potential. The real world likes these qualities a lot.

These kids are like value stocks. Rewards come with patience, not high test scores.

We know so many successful, great people we admire that weren’t “Rhodes Scholars.”

Our advice: Dare to be different with your money and your life.

Rebelling comes naturally to kids.

We rage against the financial fee machine on a daily basis.

Hopefully, we can teach others to do the same; it’s time for schools to climb aboard.