Less is more is a great investing strategy.

Conflicts of interests, sales pitches, and fees are a feature, not a bug, in financial services. To change this we need to learn a thing or two from successful tech companies.

Professor Scott Galloway discusses this in his brilliant book, The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google.

Galloway states, “The majority of stakeholder value created over the last decade has been a function of removal.”

He discusses how companies like Amazon dominate because they remove “friction” from our lives.

“It’s infinitely easier to hit a couple of keys on your computer to buy a book or piece of furniture than it is to drive down to the local mall, find a parking place, walk a half mile, be overwhelmed by tons of irrelevant merchandise, and then lug your shit back to your car for the drive home. Amazon has removed all that friction and brings your purchases to your door for less than the cost of gas for your car.”

Investors need their own Amazon.

We are working hard to try and disrupt the ground-zero for crappy investment products and bad advice: public school 403(b) plans.

Many retirement plans have problems. In Non-ERISA 403(b)-land they are magnified. Think of these 403(b)s as Australia. The snakes, bugs, and jellyfish are bigger, meaner and much more venomous.

403(b) investment frictions are more numerous than marauding food shoppers before a two-inch snowstorm on Long Island.

We agree with Professor Galloway. Less is more, and simplicity trumps complexity in regards to investing. We are going to change this world by eliminating lots of unnecessary and destructive stuff.

Our program vaporizes the following:

Too many choices: Teachers often have over a dozen choices on their vendor lists. These options come with dozens of their own investments. When faced with this overwhelming prospect two things tend to happen; an investor either makes a bad choice or succumbs to inertia. Neither is a recommended strategy for sound retirement planning.

We have created three portfolios comprised of five to six extremely low-cost and well-diversified index funds from one company: Vanguard. Public school teachers no longer have to be their own investment committee; or worse yet, get a recommendation from a financial salesperson.

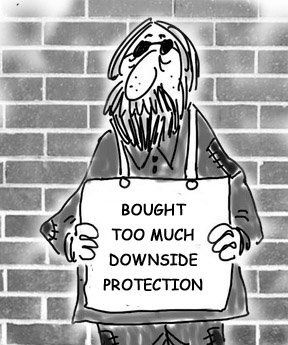

Complicated and egregiously expensive products: Public school teachers’ plans are loaded with expensive and unnecessary annuity products or costly and less-than-mediocre actively-managed mutual funds.

We can explain our investment style in two minutes to a third grader; no need for a 500-page prospectus. Owning the world’s stock and bond markets at a low cost tends to work out pretty well over long periods of time.

Ignorance: Most public school teachers we meet have absolutely no idea what they own. Acting like an ostrich does not keep the monsters away. Most teachers follow the herd. One teacher meets a likable salesperson in the Teacher’s Lounge and the next thing you know, everybody owns the same annuity product.

We base our recommendations on data and evidence. In fact, we use the same investment philosophy with our own money. Displacing fear with education helps us spread the word.

The suitability standard: Financial salespeople only provide advice that is suitable for their victims. By law, they do not have to look out for their clients’ best interests. They mislead teachers by calling themselves Wealth Mangers, Financial Advisors, or Retirement Specialists.

We make things simple. We are fee-only fiduciaries who receive no money from anyone except our clients. There is no such thing as being a little bit pregnant. The same can be said for financial advisors who say they “sometimes” look out for the best interests of their clients. It doesn’t work that way; pretty simple to understand.

Annoying and disingenuous financial salespeople: They purchase loyalty with trinkets and false promises. It is not uncommon to find them interrupting teachers in their classrooms to pitch unnecessary products. They are the lords of investment friction.

We don’t chase people and harass them. They chase us.

In the words of Professor Galloway, “Greater contribution comes from removing obstacles and time killers from our daily lives.”

We agree 100%. Removing confusion, complications, and portfolio-killing investments from teachers’ retirement plans (and anyone else’s plan) fits pretty nicely into this theme.

Let us know if you would like to embrace simplicity, transparency, and data regarding your investments.

We would love to add you to our growing movement.

Source: The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google. by Scott Galloway.