Can you imagine a world filled with simple investment choices and fiduciary advisors?

Reality bites.

Last week, we sponsored the BEST investment conference of the year – EBI West. Many of us participated in panel discussions.

The title of my panel:

- Clients are increasingly savvy, curious and vocal. How do you find new and interesting investment opportunities for them?

- What is your vetting process? What sort of screens do you utilize?

- What happens when a client is bullish on an investment idea—but it pushes the limits of suitability?

- What opportunities are you getting the most client questions about?

If I had my way, (I didn’t) the title would be slightly different.

Getting Rid Of Old Products: We Have Too Many That Suck

According to Rebecca Kennedy, “There are several studies which prove that the more choices we’re given, the more decision paralysis we experience.”

Product gluttony increases the risk of bad choices and raises costs.

When the moderator (and new Ritholtz Wealth colleague) Tadas Viskanta turned to me, I expanded on this.

Too many investors are being screwed by financial predators. Complicated and expensive products are their WMDs.

I calmly (relatively speaking) pointed out a few tidbits:

- 80% of financial products would only be missed by salespeople who hawk them.

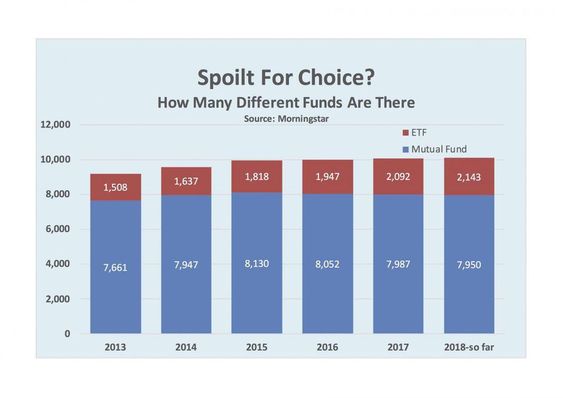

- There are more ETFs and mutual funds than individual stocks. Think about that before we add more.

- People don’t need new funds. They DO need advice about things that matter to them like college, estate, and social security planning.

- 70% of public school teachers’ 403(b) accounts are in annuities!! Advice about Bitcoin is not at the top of our list.

- Unnecessary fees prevent people from paying for their kid’s college, retiring sooner and giving money to charity. Clean this up and then we can start speaking about new products.

My friend and colleague Josh Brown understood I was not playing.

“Nobody f***s with Tony. He was explosive on stage when the subject of financial predators came up.”

https://twitter.com/CarolynGowen/status/1011648618460139520

Bob Seawright, one of the best bloggers out there (we all wish he would post more) also got it.

Here at the resort where #EBIWest is held, this hawk sits on his perch all day while his trainer sits under an umbrella. There’s not a pesky seagull to be seen. It’s much like the way @ATeachMoment sees his role re bad strategies and advisors. pic.twitter.com/Gr8gwhi0AM

— Bob Seawright (@RPSeawright) June 26, 2018

Several attendees came up to me later and expressed their desire to help clean up this enormous stain on the profession.

Maybe there’s hope. I can’t wait for next year to continue this discussion. (If they invite me back. LOL)

In the meantime, the team is working hard to do our part – though not at this moment.

Carolyn asked me, “Do you think regulators will change this?”

My response was: “No, investors need organic organization. Get in your salesperson’s face and scream: I am mad as hell and I am not going to take it anymore!”

In the words of Val Fishman, “If you are not at the table you are on the menu.”

If you need some help, you know where to find us.

Source Spoilt Rotten: Are There Too Many Mutual Funds & ETFs?, by Simon Constable, Forbes