Loyalty is King. Unbreakable bonds of human connection are all that matter.

Think of the scene from Good Will Hunting when the elitist college professor cluelessly asks Wil’s psychologist, Sean, why his prize math student continues to chill with his Southie Construction Worker/Mechanic pals.

Why does he hang out with those retarded gorillas, as you called them, because any one of them, if he asked them to, would take a f***ing bat to your head, okay? It’s called loyalty.

In my past life, teaching for five years in one of the most violent schools in NYC occupied my resume. The daily mayhem and carnage were standard protocols. There would be calls to bring in the National Guard in posh suburban schools if a fraction of these incidents exploded on their grounds.

The school was wired for AC and had no outside windows, but the final budget did not include money for the Air Conditioners.

Many of the teachers in the school were assigned there for disciplinary reasons or classroom incompetence. That is how this backward, incompetent system worked. The neediest students received the worst teachers instead of vice versa. The students knew this and behaved accordingly. When people don’t care, neither do you.

I was unaware of this inept system and walked into a minefield. The first year was rough, but I was determined to make things work. I made up for my lack of teaching experience with genuine concern for the student’s welfare. The students realized this, and there were some phenomenal results from those formerly deemed unreachable. I was far from perfect, but my intentions were well-meaning.

While there were many ups and downs, Amazing things happened.

A bunch of stuff made all the difference, including:

A Chess Club- One year, I used all my supply money to buy every student a chess set.

A Stock Market Club

An after-school sports program. The school had no organized sports teams!

Birthday Parties during lunch

Our legendary Know-Bowl Games

Scheduling as many trips outside this closed environment as possible. One excursion included taking over 200 students on the A Train to The Museum of Natural History. The true miracle was that we lost only two kids. (We Found Them.)

Bonds of steel forged. I remember a few incidents. Once, the attendance woman was collecting the daily folder, and the students deemed her response unacceptable. They thought she rudely grabbed it from my hand and began berating her. I had to step in before things escalated.

Another time, one of the students stole my lesson book. She was a legit kleptomaniac and would steal anything not nailed down. They proceeded to scan the school, searching for the book. Once they located it, the student presented a confession. Even though I offered complete amnesty in return for getting my plan book back, I had to physically get between the students and the enraged mob who were going to tear her limb from limb as punishment for the crime.

Halloween was another story. In this neighborhood, it was more like The Purge. I was pretty happy when it fell on the weekend, but that couldn’t happen every year. I was reassured by my students, “Don’t worry. We got your back.” I escaped unscathed every Halloween. I could go on, but you get the point.

How does this experience relate to your money?

Loyalty’s tentacles have a far reach.

Loyalty is a critical component of the wealth equation. I’m not discussing prolonging the relationship with your parent’s country club or golf buddy stockbroker. That’s more like codependency.

Strict loyalty to three investing principles separates the wheat from the chaff.

- As my colleague Nick Magiulli preaches, Just Keep Buying. Interrupting the miracle of compounding is an irreversible decision regarding time. Enhancing it with steady dollar cost averaging is the superfood of wealth creation. Don’t double-cross your financial future.

- Loyalty to your plan supersedes everything. Like NFL teams constantly changing coaches, this is a sure ticket to a bottom-dwelling financial future. You don’t have to be a genius to become a millionaire, but you do have to be consistent.

- Ignoring investment noise is simple but not easy. Doomsayers assault your senses daily, pounding into your brain like a Jackhammer. Eventually, something breaks. Shield yourself from Tic-Toc influencers and their like. Staying loyal to detachment and disengaging from the nonsense is an investment superpower.

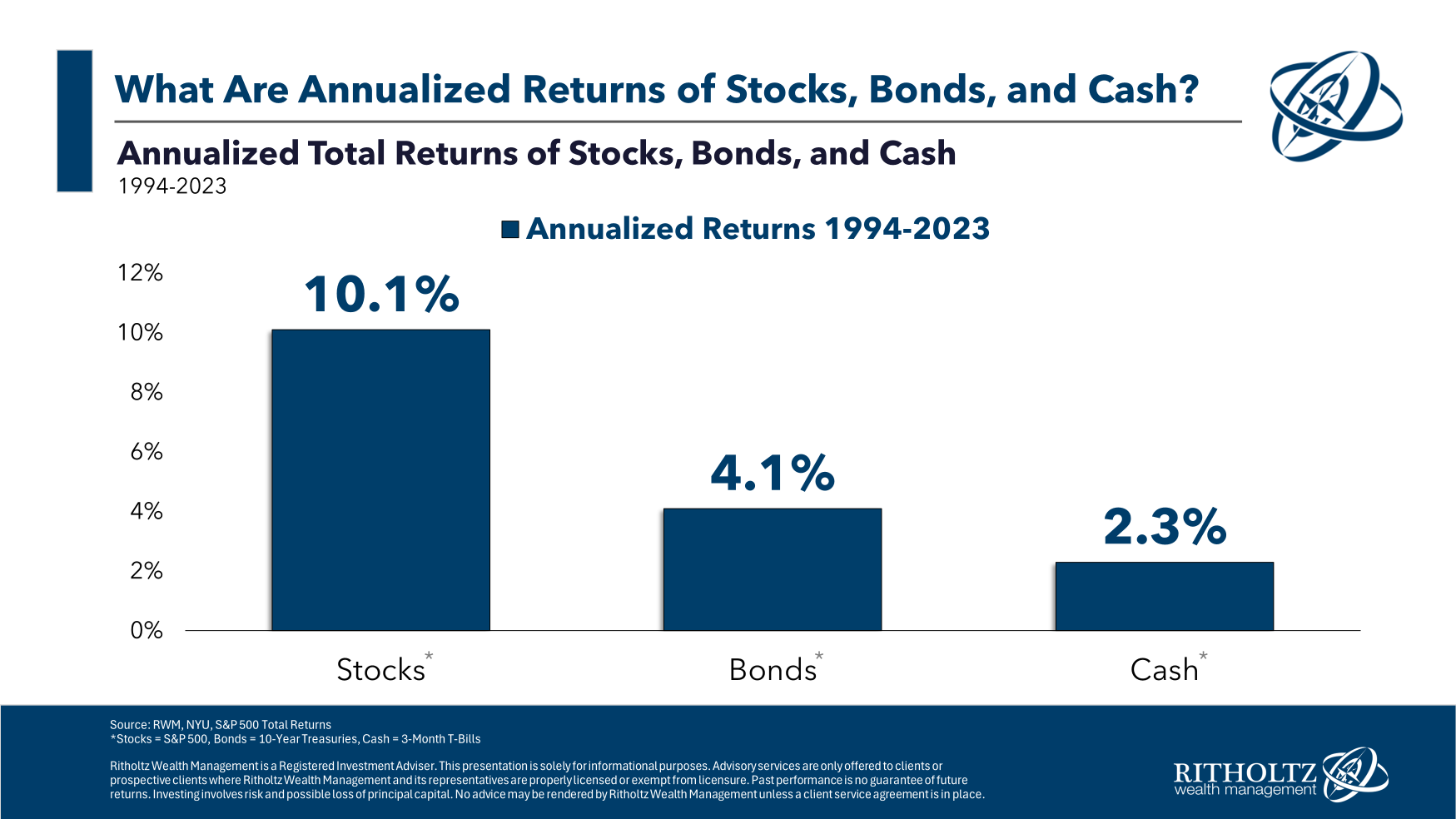

Stay true to these concepts, and good things happen over the long term. Ben Carlson created this chart of 30-year market returns. Allegiance to a simple index vanquished all the markets lobbed at it, including the complex strategies hawked by those who should know better.

Surround yourself with people of integrity, and stay faithful to your core principles.

It is not just your money that crashes and burns apart without it.