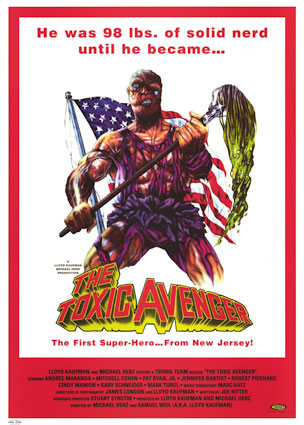

Investors need their own super hero to save them from making awful decisions during market me lt downs. The cult hero, The Toxic Avenger, exists only in fantasy. In reality, there are four ways the average investor can save himself from the stress created by financial bullies and hype men.

lt downs. The cult hero, The Toxic Avenger, exists only in fantasy. In reality, there are four ways the average investor can save himself from the stress created by financial bullies and hype men.

Stress can be a powerful force for good if channeled properly in moderate amounts. Unfortunately too much stress often leads to very bad decision making. This is especially true regarding investing.

According to Paul Tough’s article, “How Kids Learn Resilience” (The Atlantic, June 2016), “severe and chronic stress in childhood, what Doctors sometimes call toxic stress-leads to physiological and neurological adaptations in children that affect the way their minds and bodies developed and significantly the way they function in school.”

Children living in dangerous and unpredictable environments enhance their survival rate by being in a constant state of hyper-vigilance. This “fight or flight” instinct is the same way our prehistoric relatives kept themselves from becoming some larger mammal’s supper.

The problem for these children arises when they enter the” sometimes” safer school environment. The toxic stress from their home life has very adverse carry-over effects. According to Tough, this stress “produces patterns that are self-defeating in school: fighting, talking back, acting up and more subtly going through each day perpetually wary of connection with peers and teachers.”

These chronically elevated stress levels end up interfering with the higher order thinking regions of the brain. The fallout from this is these children often cannot handle interruptions, complicated directions, and distractions. The lack of higher order thinking formation also leads to volatile relationships with peers and especially adults in positions of authority.

What does this have to do with investing? Plenty, it turns out. Imagine yourself following every tick of an individual stock price during the course of the trading day and afterhours? How about clinging to the every words of hyperbole from a hysterical market pundit? Sound like anyone you might know?

Constant predictions of doom and gloom from “perma-bears” (and their like) will certainly raise the level of investor toxic stress to dangerous levels.

Focusing attention on items, such as these, greatly inhibits the development of the qualities needed to achieve investing success. This is similar to the inner-city student who is labeled a behavior problem due to a home life bubbling over with toxic stress. In both cases, these individuals cannot seem to get out of their own way. The prescribed solutions often lead to greater problems.

In the case of the stressed out investor, the qualities of patience, flexibility and focus (on process, instead of outcome) will never be given a chance to bloom.

Much like the child who grows up in violence-ridden environment, investors who allow toxic stress to dominate their financial environment will face an uncertain monetary future.

There is hope to change the fortunes of both the stressed youth and harried investor. The injection of four guiding principles can have miraculous effects for both troubled schools and investors afflicted with toxic stress.

These four principles to turn around troubled youths include:

- Developing a sense of belonging to an academic community.

- Having the means to grow one’s ability and competence with individual effort.

- Providing confidence in the chance of success.

- Partaking in valuable work.

If these four guiding principles are applied to the environment of students who suffer from this form of stress, remarkable social and academic progress has often been the result.

Toxic stressed investors could use these same guidelines to improve their outcomes. They need to be adapted to the financially-stressed environment.

Here are some guidelines for stressed out investors based on the academic research completed in various schools.

- Improve you financial community – This can be attained with ditching your high-pressure broker and replacing him with a fee-only financial planner. Read research and implement long-term strategies using low-cost index funds. Ditch the stock picking. These actions will improve your long-term investment results and greatly lower the stress level.

- Increase your investment acumen – Make a conscious effort to be very picky about your sources of financial information. Do not consider anything that is not evidence-based. Eliminate any sales brochures from your reading and focus on unbiased data. These actions will go a long way to building your level of competence.

- Improve your odds of success – This will be achieved by focusing solely on repeatable processes instead of hysterical emotion or random chance. Having a comprehensive financial plan (instead of using hope as a strategy) will lead to much-improved investment outcomes.

- Align your finances with your goals and values – This financial version of doing valuable work will keep you on track and help you understand the true value of money. An example would be the increased happiness from buying experiences or giving to others. Wasteful purchases to keep up with the Joneses are not considered valuable work under these guidelines.

Implementing these strategies will pull you away from shows like “Mad Money” and may considerably lower your financial blood pressure.

Disadvantaged youths in the worst of our urban schools drew some pretty bad cards in the poker game of life. Most investors have stable jobs, reliable incomes and supportive families.

Don’t let stress destroy the luck of the draw you may be blessed with. Follow these strategies and rid yourself of investor toxic stress. You might be surprised about what happens when you focus on things that are actually important.

Better yet, you won’t need to rely on a 98 lb. weakling who fell into a vat of toxic waste to save you!