Bad decisions sparked by anxiety are investor’s most dangerous nemesis.

Although most of our worst fears seldom come true, we attach ourselves to outcomes that don’t exist.

Evolution plays a role. Avoiding danger on the Steppes of Africa kept us from being devoured by fierce beasts and enabled the propagation of the species.

Biology is a factor, but it doesn’t explain our overemphasis on what can go wrong over what may go right.

Common sense and basic intelligence should keep us from occupying the majority of our days with dread.

What gives us our end-of-the-world obsession?

Eckhart Tolle thinks he may have discovered the answer in his best-selling book, The Power Of Now.

The psychological condition of fear is divorced from any concrete and actual immediate danger. It comes in many forms: unease, worry, anxiety, nervousness, tension, dread, phobia, and so on. This psychological fear is always of something that might happen, not something that is happening now.

Tolle continues:

You are in the here and now, while your mind is in the future. This creates an anxiety gap. And if you are identified with your mind and have lost touch with the power and simplicity of the Now, that anxiety gap will be your constant companion. You can always cope with the present moment, but you cannot cope with something that is only a mind projection—you cannot cope with the future.

It’s not difficult to comprehend why many investors’ emotions are in a perpetual state of shambles.

The markets are discounting mechanisms, constantly discounting the present and looking towards the future.

Future uncertainty explains why a company may announce terrific earnings but the stock tanks when its forward guidance fails to meet expectations.

It’s all about future mind projections that are easily spooked and run wild with fear at the slightest provocation.

Being able to distinguish between what is happening and the dystopian conjectures of your mind is an investing superpower with few peers.

We just passed the fifth anniversary of coronavirus-induced stock market blood-letting. I found this post on Facebook that I created to try to fill investors’ anxiety gaps during that turbulent period.

Those investors who could keep their wits about them and not let their minds extrapolate the terrifying present into the future made it to the promised land and then some. We currently face a multitude of market uncertainties. (I am not sure when this isnt the case, but whatever.)

Besides the usual suspects, inflation, recession, tariffs, trade wars, etc, a new contestant burst onto the scene – Asteroid Strike!

According to NASA, there is a 2.4% chance of Asteroid 2024 YR4 hitting our planet soon.

If we were to get struck by the space rock — which measures between 131 and 295 feet in diameter — the resultant energy blast would be equivalent to 8 megatons of TNT, roughly 500 times the power of the atomic bomb dropped on Hiroshima.

Like I said, it never ends.

We can curl up in the fetal position and wait to die or choose another pathway.

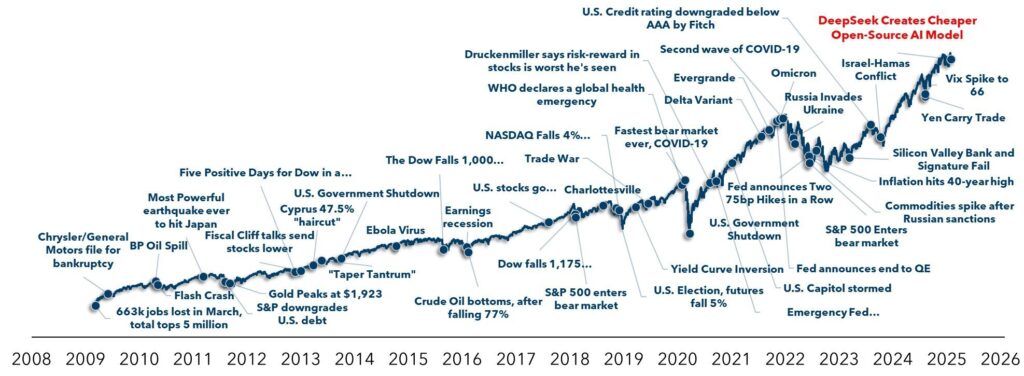

Back to my 2020 Covid FB post. Take a look at this updated Reasons to Sell Chart.

Taking action regarding something that might happen didn’t turn out very well. As usual, investors who focused on the simplicity of the now instead of the dread of the future were the big winners.

In the words of The Red Hot Chili Peppers, This Life is more than just a read-through.

Being anxious won’t add a single day to your life; being present just might.