It’s easy to get stuck in the mire of the game of life.

Change rarely occurs when things are good enough.

Many people keep working at jobs that function as acid to their souls.

Why?

They make enough money to pay the bills. With some left over to participate in various escapisms like gambling, alcohol, and drugs. Their boss isn’t a complete A-hole, and their co-workers are OK. You can see why the motivation to change is running on empty.

The same applies to those cemented to mediocre relationships. The misery factor isn’t strong enough to activate mitochondria, and looking for someone else is too overbearing to ponder.

The same issues sabotage personal finance. Adam Mastroianni wrote a thought-provoking post titled “So you wanna de-bog yourself.”

Mastroianni discusses why people get stuck in a rut and various ways to escape mediocrity.

One standard method is Waiting for the Jackpot. Waiting for the perfect option is the default modus operandi; investors always do this, depriving themselves of years of compound interest. A common refrain is waiting for market uncertainty to clear or the dust to settle before committing one’s precious capital.

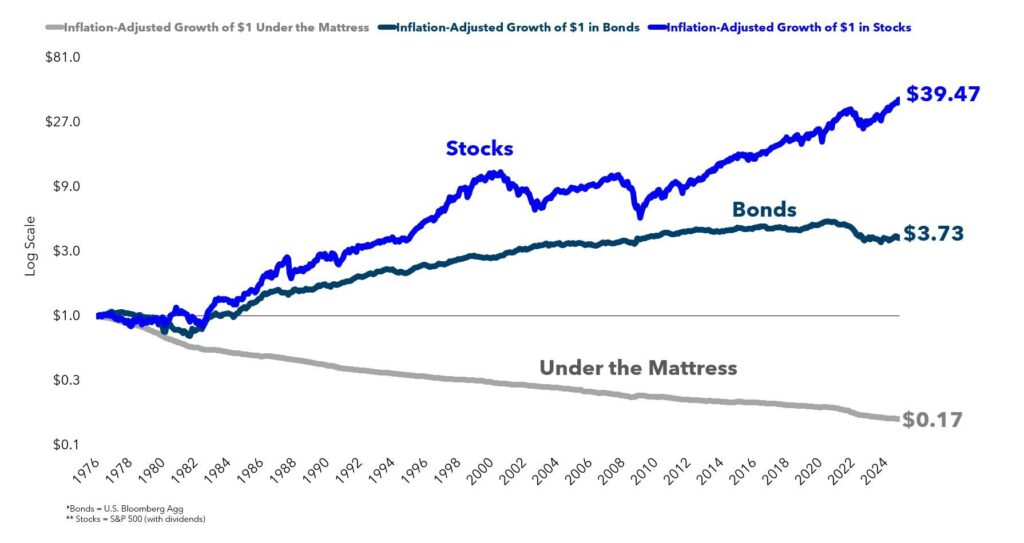

Newsflash: The market is always brimming with uncertainty. Stocks have trounced the long-term returns of bonds and cash due to the uncertainty premium.

Chart Credit: Matt Cerminaro

This perfect moment will never arrive, as Mastroianni explains:

Often, I’m waiting for the biggest Jackpot of all: the spontaneous remission of all my problems without any required effort. Someone suggests a way out of my predicament and I go, “Hmm, I dunno, do you have any solutions that involve me doing everything 100% exactly like I’m doing it right now, and getting better outcomes?”

Plans often fail even when investors activate their energy to pull themselves out of the swamp.

Financial torpor is due to The try-harder fallacy. It’s about doing the same thing repeatedly and expecting different results, more commonly known as the definition of insanity. Examples include thinking you are a talented day trader or market timer. Despite repeatedly buying high and selling low, you somehow believe this is your ticket to wealth creation.

Mastroianni puts this eloquently into its proper perspective.

This is the try-harder fallacy. I behold my situation and conclude that, somehow, I will improve it in the future by just sort of wishing it to be different, and then I get indignant that nothing happens. Like, “Um, excuse me! I’ve been doing all of this very diligent desiring for things to be different, and yet they remain the same, could someone please look into this?”

Too many investors get bogged down in the world’s problems, aptly named Super Surveillance.

By trying to fix all of the world’s economic troubles, such as inflation, tariffs, monetary policy, debt, and deficits, you’re guaranteed a seat on the express train to financial mediocrity or worse.

Mastroianni compares this to a Clockwork Orange style of torture.

I know some people think that super surveillance is virtuous, but they mainly seem to spend their time looking at screens and feeling bad, and this doesn’t seem to solve any of the problems that they’re monitoring. To them, I suppose, the most saintly life possible is one spent sitting in front of a hundred screens, eyelids held open with surgical instruments.

It’s not easy to pull yourself out of financial quicksand. The most critical first step is knowing what not to do regarding increasing the monetary undertow.

No matter how hard you try, running in place gets you nowhere.