It’s impossible to manage something we can’t define.

We quantify what’s easily countable, not what matters most.

Investors with average I.Q.s have a clear path to a seven-figure portfolio.

Invest 10-20% of your salary in a basket of low-cost index funds. Place the process on auto-pilot through dollar-cost averaging and allow compounding to do the rest.

Remembering the market is brighter than you is critical. Some intelligent people tend to have an issue with self-awareness. To paraphrase Screenwriter David Mamet, the audience is brilliant, but individual viewers can be stupid. The same goes for the markets. Individual investors do many dumb things, but the market is a genius. Invest in the market.

My colleague Nick Maggiulli says it best: Just Keep Buying!

Wealth isn’t as easily defined. Many agree true wealth involves contentment, not dollar signs. Measuring something this nuanced, like individual happiness, is more complex than your retirement number. Pondering this isn’t time wasted.

Deciding to change my morning routine generated numerous dividends. #StockMarketCrash, #CivilWar, or #WorldWarlll is a nutrition-deficient start to the day. Empty calorie Angertainment is toxic for the body and mind. Instead of immediately checking social media and permitting sociopaths to set the day’s tone, there’s another way. It’s not checking your e-mail at 5 A.M.

How about conversing with the most intelligent individuals to ever pace the planet?

Despite what cancel culture says Greek and Roman Philosophers were pretty sharp dudes.

Taking some time shortly after waking up to read ancient philosophy is an eye-opening experience.

The more things change, the more they stay the same. Our problems are as old as the hills. The answers are right in front of us if we search in the right places.

Let’s take defining wealth as an example.

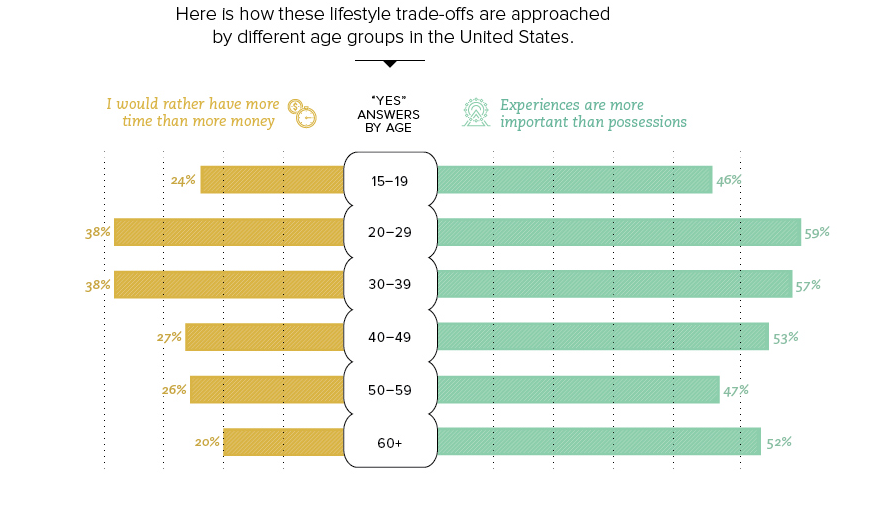

Too many of us possess conflicting definitions, valuing our time cheaply while running up the portfolio scoreboard.

I came across this gem regarding this human tendency from Seneca, the ancient Roman Stoic philosopher.

Men don’t allow anyone to take possession of their estates. If there is the slightest dispute about the limit of their property, they rush to pick up stones and weapons. Still, they allow others to make inroads into their lives, even extending personal invitations to those who will one day possess it. No one is found who would be willing to divide up his own money, but when it comes to his life, each one of us gives others a share, and how many others!

Men are tight-fisted in keeping control of their fortunes, but when it comes to the matter of wasting time, they are positively extravagant in one area where there is honor in being miserly.

That’s the kill shot. People only possess real wealth if they spend their days doing meaningful things. Busying yourself on fulfilling others’ goals and doing their bidding isn’t worth the tradeoff, no matter how highly compensated you may be.

Source: VisualCapitalist

Nothing moves faster than time, and selling it to the highest bidder isn’t advisable.

Why do we do this?

We think we will live forever. Newsflash- We won’t.

My colleague Michael Batnick has an expression that is an effective way of cutting to the chase: If it’s not an immediate yes, it’s a no.

To protect your time, you need to say no – a lot.

Our hubris is unlimited regarding time. “I’ll wait until I retire to do this or that” is a common expression.

Really? Who made you the time police? Will you even be around by the time this magical day arrives?

Reserving the remnants of your life for the best stuff makes no sense unless you consider yourself a time prophet.

Keep these words of Seneca in mind when you’re thinking of putting off what can be done today for tomorrow.

Life takes our plans and dashes them to pieces. We should never underestimate Fortune’s habit of beating just as she pleases. Just because we are showing promise and our path toward success is clear, it has no bearing on whether we will get what we want.

Saving and managing money is attainable if you bring home a decent income.

Defining and then managing wealth is an entirely separate animal.

Start by being a Scrooge with your most precious asset – Time.

Remember, this is your life, not a rehearsal.

Source: Seneca Dialogues and Essays A New Translation by John Davie