Busy work keeps you busy.

That’s fine if you believe running on a treadmill will enable you to fulfill your goals.

The goal is moving the needle in a positive direction, not running in circles.

Usually, the best way to get stuff done is to focus on the few activities that generate disproportionate returns.

Everyone should prioritize getting and staying healthy. In many cases, the focus is on all the wrong things.

Joining an exclusive gym, shopping for expensive running shoes and workout clothes, and aping the latest fad diet consume enormous amounts of time but often leave you floundering in unhealthy quicksand.

Instead of mindlessly chasing costly and flexing debatable solutions, focus on a few proven strategies that are the antithesis of busy work.

These include but are not limited to:

Staying hydrated

Exposing yourself to morning sunshine

Limiting sitting periods to no more than thirty minutes

Completing three resistance training sessions weekly

Establishing a consistent sleep and wake-up schedule

Cutting down your screen time and replacing it with walks in nature.

Replacing the busy work and concentrating your energy on practical, proven techniques will work wonders for your health.

The same strategy applies to your money.

The worst thing an investor can do is get busy with their money.

Doing less is doing more regarding wealth creation. Doing nothing is an underrated investment strategy.

Watching your portfolio’s daily fluctuations and, worse, incessantly meddling with its components is the most egregious example of destructive, busy work.

The same goes for taking ownership of global problems by addicting yourself to 24/7 cable news and social media alerts.

Getting busy analyzing monthly economic indicators is a waste of precious mitochondria. There’s an indirect correlation between focusing on financial minutia and building wealth over time.

Good luck with your stock-picking experiment; you’ll need it.

Like your health, a few tried-and-true concepts can meaningfully change the dial.

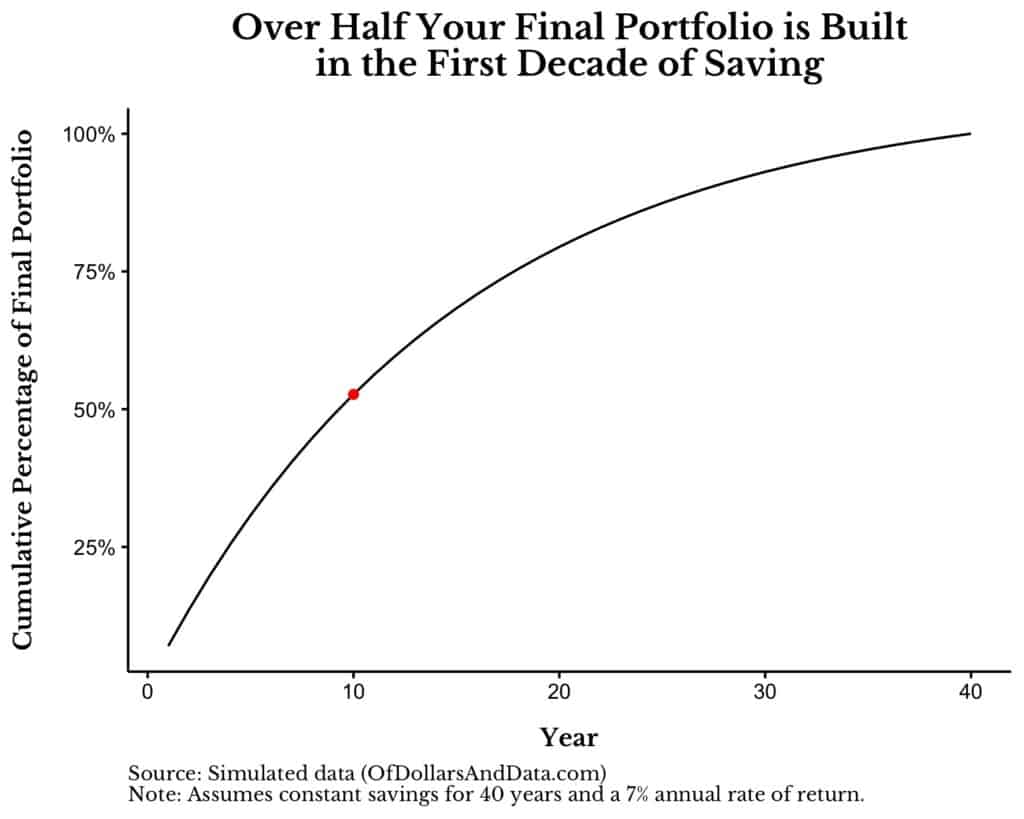

Prioritize letting compounding money compound. The best way to seed wealth over time is dollar-cost averaging a set amount of funds into a diversified portfolio of low-cost index funds over long periods. Weekly or bi-weekly contributions into an employer’s 4019k) or 403(b) plan is an excellent way to begin implementing this plan.

Take Ben Franklin’s approach of letting the early bird catch the compounding.

For the average investor, everything else is just busy noise.

Earning a higher salary is the superior method of funding this strategy, as you will have more money for DCA. Acquiring skills, especially when you’re young, turbocharges the process.

Focusing your energy on these two items to generate wealth over time puts you ahead of the pack of busybodies looking to get rich quickly. The same goes for those who insist on downsizing their portfolios by micromanaging their assets by overreacting to streams of useless information.

Meditation is all about doing nothing. The idea is to prevent distraction by noticing when it occurs. The same principle applies to your finances.

It’s not easy sticking to a few things that work and ignoring everyone else.

Never confuse effort with productivity.

Devoting a few hours per year to the right things laps the field of investing tryhards.