Many wounds are self-inflicted due to attitude rather than circumstances.

That’s not to say bad things don’t happen to good people, but playing the victim card is a lousy strategy.

Leaving your life to fate isn’t the solution. We have more power than we think.

Andrew Huberman recently hosted Dr. James Hollis on his podcast.

Dr. Hollis has a terrific life philosophy, divided into three sections: Shut Up, Suit Up, and Show Up.

The noted psychologist has seen it all, and his outlook provides important clues to a successful and happy life. This same attitude is ideal for fine-tuning your finances.

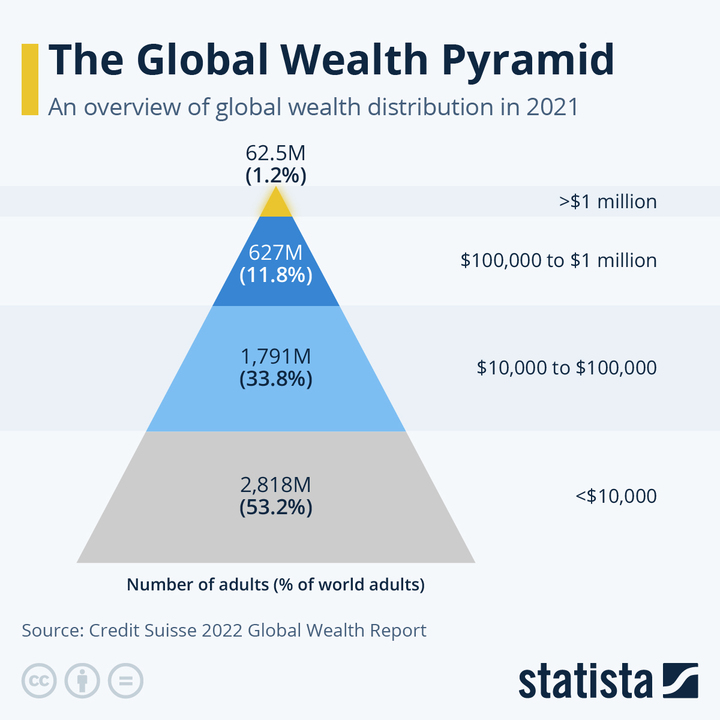

- Shut Up—Hollis’ doctrine is to stop whining. Besides annoying those around you, whining isn’t at the top of the problem-solvers’ toolbox. Focusing on what you have rather than what you want is a good start. The odds are that if you’re reading this blog post, you’re privileged compared to the rest of the world’s 8.1 billion (and counting) global citizens. Look no further than this Global Wealth Pyramid chart created by Credit Suisse.

If you have over $1 million in net worth, you are in the top 1.2% of Global Wealth. Net Worth includes your residence. For many living on the expensive East and West Coasts, home values are worth more than the possessions of almost 8 billion people!

According to Yahoo Finance, the median 401(k) for Americans aged 55-64 is $71,168. Putting things into proper perspective tends to lower the volume of whining.

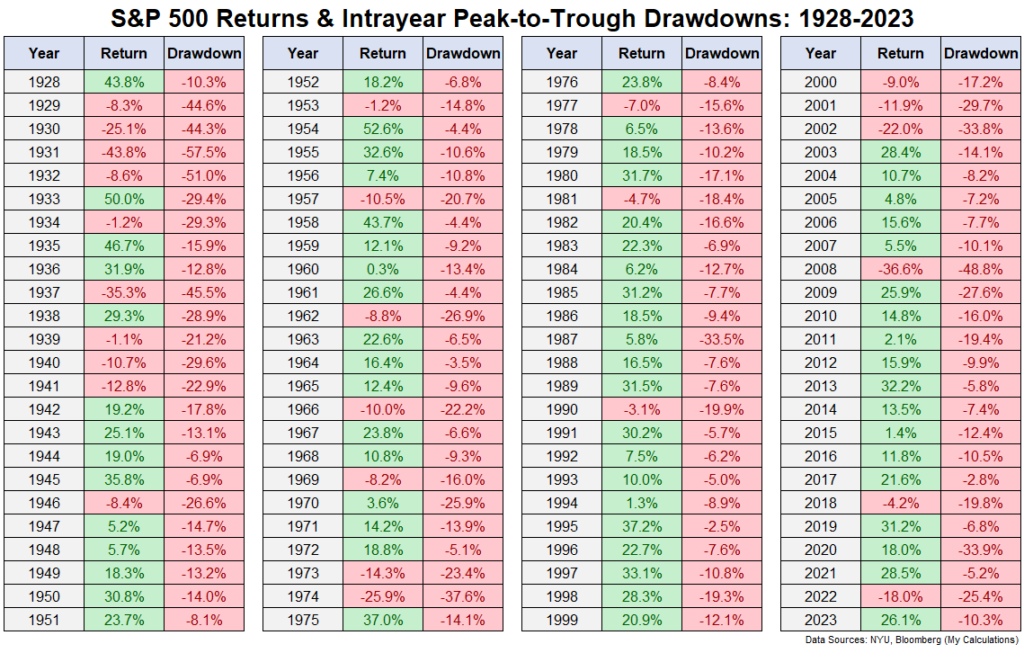

2. Suit Up—When Dr. Hollis discusses suiting up, it’s all about preparation and doing your homework. Bad things will happen. The question becomes, what is your plan to deal with life’s inevitable setbacks? The stock market is a good case in point. Stocks create great wealth over long periods, but there is a price to savor the benefits of compounding. Take a look at this chart by my colleague, Ben Carlson.

The market elevator isn’t a direct ride to the top. Understanding market history, owning a diversified portfolio, and possessing a long-term attitude all follow the definition of Hollis’ Suiting Up prep for worst-case scenarios.

3. Show Up—Hollis defines showing up as focusing on what matters most. Showing Up entails pinpointing what’s within rather than what others think. We all have one life, and death is the greatest democracy. Creating a financial plan based on a filtered social media influencer’s ideas of wealth is a one-way ticket to disaster. Driving a cybertruck might look cool, but social media likes won’t fund your retirement. A significant component of showing up is cultivating a razor-sharp BS detector. To quote comedian Bill Maher, Keeping you safe and sorting out the lies from the truth is not the job of Twitter or Facebook – it’s yours.

You are way ahead of the game by owning a life philosophy. Most people follow a weather vane credo: they blow in whatever direction the wind takes them.

Shut up, Suit Up, and Show Up. It’s no fun to be part of someone else’s grand plan.