It’s straightforward to see what motivates people; peek at their incentives.

Sam Altman provided the title but didn’t create the destructive powers of wrong incentives. They’ve been around since the beginning of time and continue negatively affecting our lives.

Our Healthcare, Food, Social Media, and Finance industries are slingers of twisted enticements.

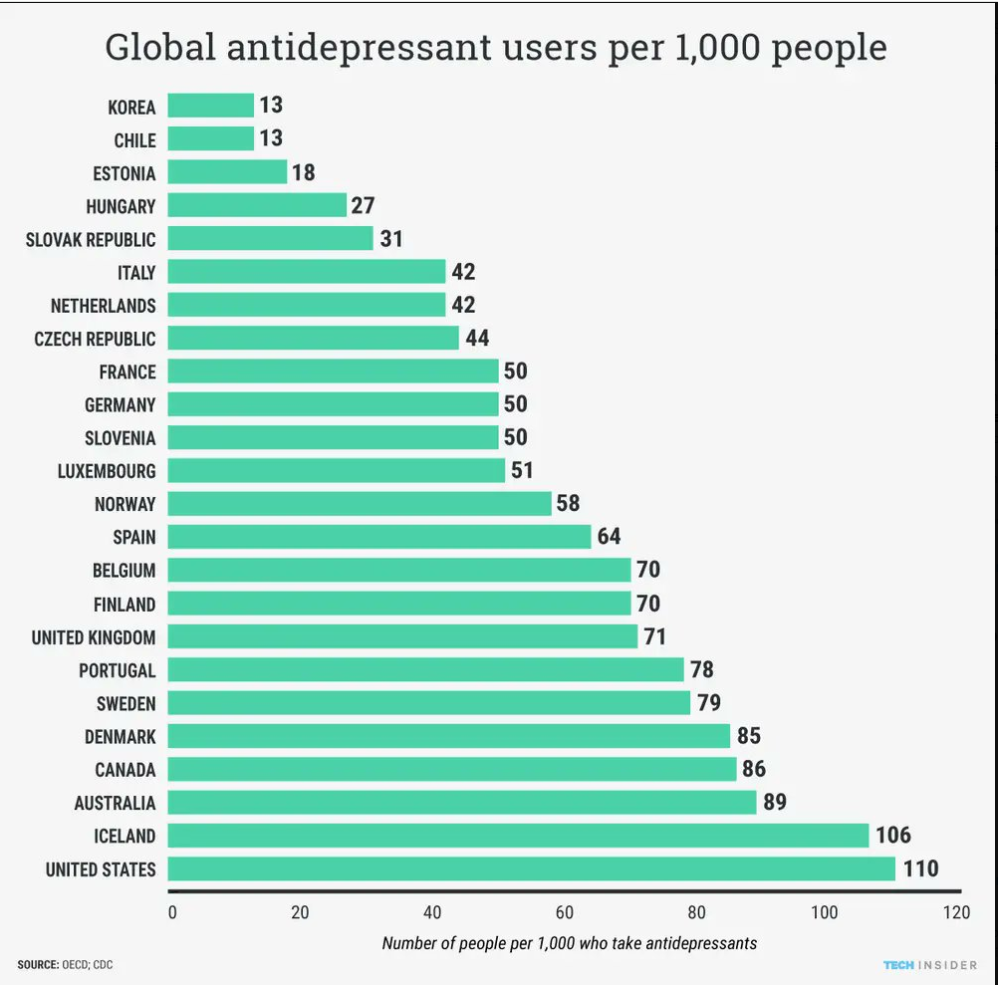

Treatment rather than curing chronic disease dominates the medical narrative.

Why?

Take a look at the incentives. Big Pharma is a dominant financier of medical school education. Drugs, devices, and surgeries make money for all stakeholders except the patient.

Preventative Care, not so much.

Dr. Robert Lustig points out the effects of perverse incentives in his groundbreaking book Metabolical.

Why would your doctor recommend a $0.10/day dietary supplement or a $0.50 vegetable/day that doesn’t need a prescription over a $10.00/day pharmaceutical that needs their signature and continued follow-ups?

Bad incentives created a business model in which large pharmaceutical companies grossly overspend on promotions and advertising over basic research, which is $19 to $1. The industry keeps a stranglehold on this model by contributing 2/3 of the money to the FDA budget and deploying a small army of 1,378 lobbyists.

Polypharmacy. taking more than five prescriptions a day, is the result of a treatment rather than a cure-based model. Twenty percent of people over age 65 fall into this category.

The side effect of some wrong incentives is dying.

According to Dr. Lustig, The third most common cause of death today is a prescription medication. Over the past ten years, hospital admissions of the elderly due to medical side effects have tripled.

Pills treat symptoms, but they don’t cure diseases.

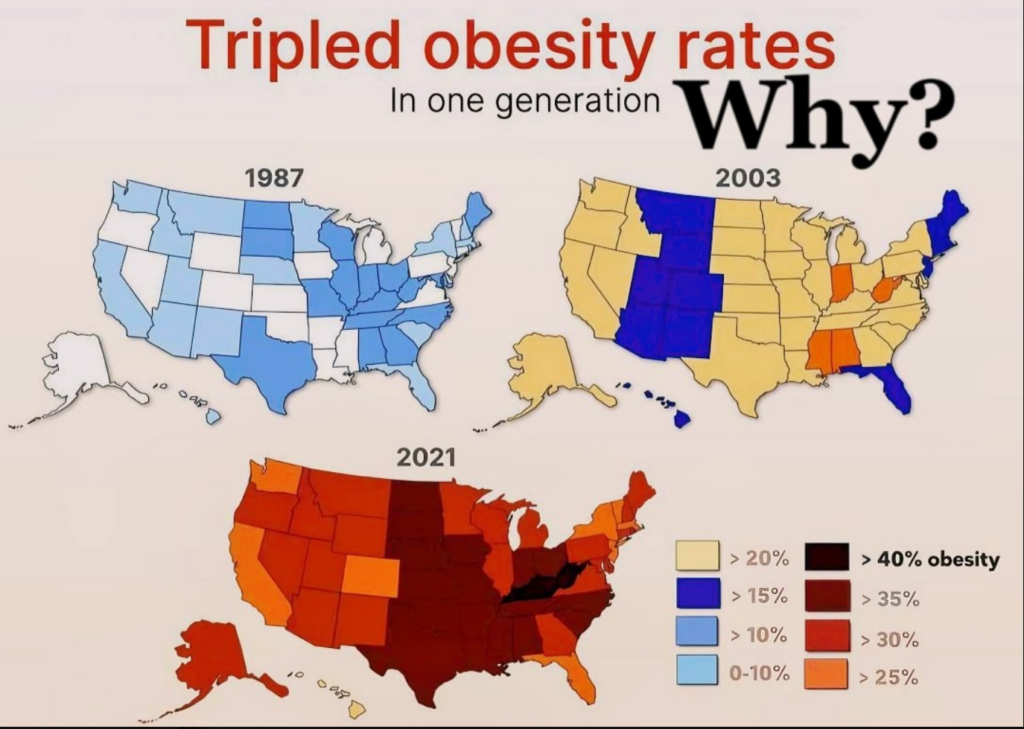

Food companies aren’t immune to pervasive incentives. The more food they sell, the more profit they make, and the less healthy we become.

There’s a reason why 37% of adults eat fast food daily. It’s highly processed. Almost all the fiber and nutrients are removed. They’re replaced by fats and sugars designed to trick your taste buds into thinking you’re still hungry. It’s no accident our nation is facing an obesity crisis.

Large food companies are aghast of a possible new highly processed food rating system. According to the Wall Street Journal:

Rather than focusing on salt, sugar, or other nutritional baddies, Nova groups foods based on how intensively processed they are. Some scientists think that industrial food processing might be harmful and encourage overeating.

As usual, bad incentives explain bad behavior.

Then, some reasons have nothing to do with consumers’ preferences, and cost is a dominant theme. Highly processed ingredients often save money for big food companies, boosting shareholder returns. “This is food designed to make profits for pension funds…and it has become the national diet,” says Chris Van Tulleken, the author of the bestselling book “Ultra Processed People. “

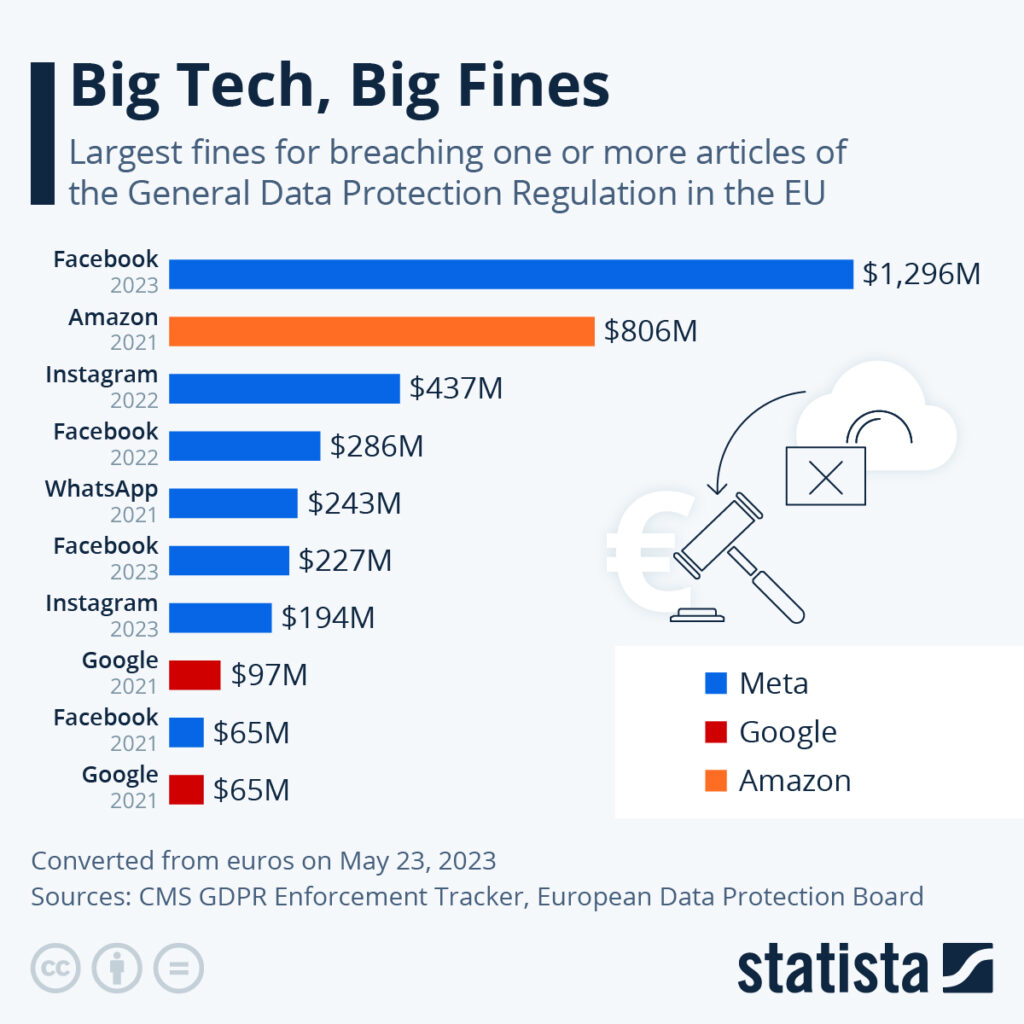

The incentives for social media companies are warped. They aim to keep you staring at screens to pry personal information to sell to advertisers. Their unsavory methods result in screen addictions, depression, and sometimes suicide.

While not putting our health in danger, the financial services industry is ripe with egregious conflicts of interest and toxic incentives.

It’s no accident that when you speak to many insurance agents, their answer to all of your financial concerns is ……Drumroll – More Insurance!

Many brokerages push their expensive proprietary funds over low-cost index products because this helps them finance their retirements. Not yours.

No model is immune from bad incentives. While an AUM fee structure helps avoid the above issues, it’s far from perfect.

There are cases of advisors giving advice that unnecessarily keeps client funds in their portfolios because that’s how their firms make money.

For example, paying off a high-interest loan may make financial sense. Still, some advisors may caution against withdrawing funds from their managed accounts to keep a steady revenue stream flowing. Advisors can scare clients with unlikely doomsday market scenarios into not spending their hard-earned funds and enjoying their lives.

It’s not the case everywhere. This type of behavior is the antithesis of our firm’s philosophy. I spend most of my time pleading with my clients to spend MORE money before it’s too late. When they object, I tell them Why would I tell you this when depleting your account brings less revenue to my company?? My colleagues do the same.

The right incentives mean everything; unfortunately, they’re rare.

The bottom line is to carefully read the ingredient labels for your health, food, social media, and money.

Most people working in these industries are good and decent, with one caveat.

NEVER underestimate the power of bad incentives to make good people do awful things.