Giving while living makes a ton of sense.

Why wait? Father Time is undefeated.

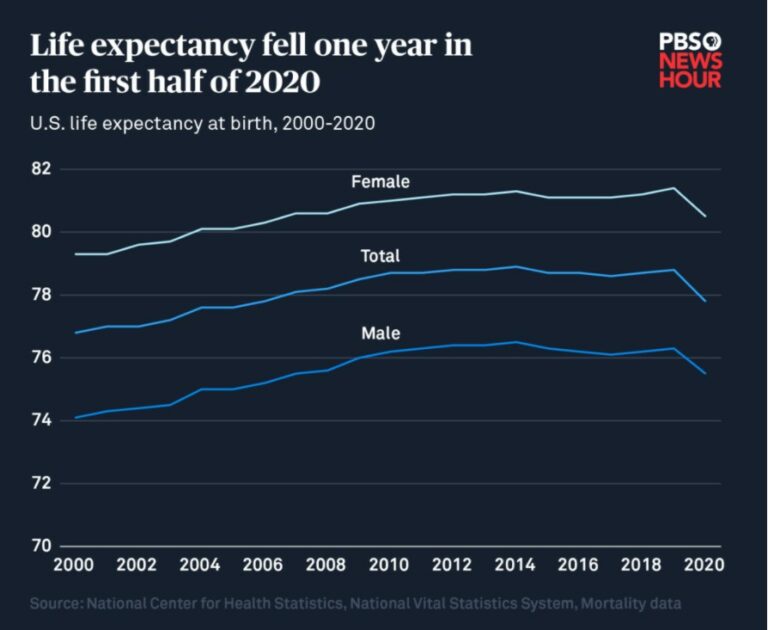

Due to Covid, life expectancy fell in the first half of 2020.

Impactful giving has no match for its effectiveness.

Waiting until death is a poor method for dispersing money to your kids or a favorite charity.

What makes you so sure your children will be alive when you die?

Charities needed money yesterday.

Data shows the age of inheritance receipt peaks at about sixty.

Most die around eighty, and the age gap between parent and child is close to twenty.

Giving upon death leaves too much of the outcome determined by chance.

Relying on fate for the greatest giving impact is a terrible plan.

Bill Perkins, the author of the terrific book, Die With Zero, has a great take on this.

He calls it The Three R’s.

Giving random amounts of money at random times to random people.

Does relying on randomness optimize caring?

Much of the money arrives too late to impact your children’s lives meaningfully. This is the natural result of receiving inheritance at age sixty or greater.

There is a better way.

The peak utility of money occurs at about age 30. When every dollar buys an equal amount of enjoyment. By the time someone turns 50, the utility level of money drops precipitously.

Perkins states: “The 26-to-35 age range combines the best of all these considerations. -old enough to be trusted with money, yet young enough to fully enjoy its benefits.”

The sweet spot of giving.

Don’t make the mistake of trying to maximize the dollar amount of giving. Change your mindset. Maximizing the impact of a gift is what’s important.

Reasonable people can quibble about the right age to give money to their children. The fact is the least optimal time is upon death.

Giving while living maximizes generosity.

Perkins reinforces this concept. “Your money is taken no matter what-so; how can that be generous? The dead don’t pay taxes- only the recipients of their bequests do. So you can be generous only when you’re alive. when you have actual choices and their consequences.”

Giving generously while you’re still above ground is a true act of selfishness.

We aren’t saying to liquidate your portfolio and empty your bank account recklessly.

Make sure you’ve covered your bases before implementing this strategy.

Consult with your financial advisor and estate attorney, ensuring your retirement needs won’t be jeopardized.

This may include purchasing Long Term Care or Whole Life Insurance with an LTC rider. These aren’t investments but provide needed assurance when utilizing a giving while living strategy.

Caveat Emptor when shopping. These products are a breeding ground for conflicted salespeople posing as financial advisors.

Optimizing giving doesn’t need to include your death.

It’s a shame to waste a great opportunity to provide the greatest impact with your hard-earned money.

There are no awards for being voted the richest person in the graveyard.

The clock is ticking.

Source: Die With Zero by Bill Perkins