“What’s bad for the hive is bad for the bee ” Marcus Aurelius

Financial sales incentives are the twinkies of human motivation.

Shelly The Machine Levine, notwithstanding, the financial sales incentive structure conflicts with the fundamental needs of human happiness, productivity, and creativity.

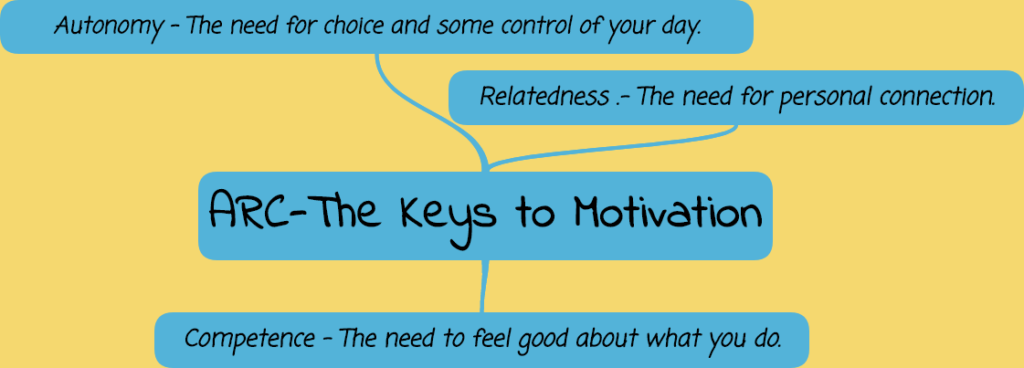

Susan Fowler points out the three intangibles that motivate all of us in her excellent book, Why Motivating People Doesn’t Work… and What Does.

Autonomy, relatedness, and competence are the ingredients of the secret sauce for work passion and fulfilment. They’re commonly known as ARC.

None of these three components is typically found in the cultures of broker-dealers and insurance companies slinging high-fee investment products.

Autonomy

Autonomy is the human need to perceive we have choices. It’s a belief that we are in control of our environment. It’s absolutely necessary for productive and engaged employees.

Top producers are bred to respond in a Pavlovian manner to external rather than internal motivation. These include things such as money, a big office, titles, status, shame, and fear.

All of these are controlled by external forces (The Sales Manager) and destroy feelings of autonomy. It’s no surprise many salespeople are highly compensated but hate their jobs and look outside their work for emotional fulfilment.

Relatedness

Relatedness is the want to care about and be cared for by others. We strive for connection. Being able to contribute to something bigger than ourselves is something we all strive for.

In financial sales organizations, many employees resent their managers. They view their all or nothing quest for results at all costs as self-serving behavior.

They consider their support as conditional to their standing on things like the leader board for monthly sales. Destroying all feelings of relatedness, this contributes to burning out and avoiding the real needs of clients.

Competence

Competence is the desire to feel good at meeting challenges and opportunities, igniting feelings of growth and flourishing.

In many financial sales cultures, there’s an atmosphere of pressure and intensity. In some cases, basic needs such as health care are withheld if certain sales objectives aren’t attained.

This culture inhibits creativity, leaving employees with ineffective coping mechanisms greatly undermining feelings of competence.

Month-end becomes a time of anything goes. It’s hard to feel good about yourself and your profession when saying just about anything to get a contract signed.

Why do many financial sales organizations violate ARC?

The short answer is, they are lazy. It’s much easier to throw around money than build meaningful relationships. Making true connections with their employees and serving the needs of all stakeholders is far more time consuming and difficult.

External rewards require little creativity or effort. Researching the next exotic locale of a top producers conference doesn’t count.

Not realizing there’s never enough money or trinkets to fill the critical ARC void.

These companies are ignoring the fact external rewards provide a distraction from what really makes their employees happy and productive.

Think of some of the most common business phrases found in these organizations.

It’s not personal, it’s just business

The only thing that matters is results.

If you cannot measure it, it doesn’t matter.

These all violate ARC.

Encouraging the prioritization of results over process leads to bad outcomes. Money and rewards cannot replace purpose-filled work. Decisions based on external motivations rather than a sense of purpose are ethical time-bombs waiting to explode.

Google the list of fines and law-breaking by the top brokers, banks, and insurers if you want proof of their disastrous effects.

External rewards serve as motivational junk food. Once started, there’s no satisfying the desire for bigger and bigger stimulation, no matter how they might be achieved.

This reward system is a distraction from what really makes people happy, productive and client-centred.

Last week, Our CEO Josh Brown told everyone they didn’t have to come into the office on Columbus Day. Our morning meeting was cancelled. Josh’s only request was we respond to client e-mails and phone calls.

What happened? Dina and I had several client/prospect meetings and worked past 6 P.M. We weren’t alone. Kris Venne our Director of Financial Planning noted, “You know something great? Today was optional – and it was a full house. Insane! What a place!

Stuff like happens when people believe they have control over their schedule, feel a deep sense connection to their co-workers and are a part of something bigger than themselves. ARC works as advertised.

Nobody needed the lure of an expense-paid top-producer trip to show up.

Shared values, intrinsic motivation, and a sense of purpose worked just fine.

Fowler states, “Money and rewards should be the products of purpose-filled work.”

Most financial firms have it backwards. Money and rewards don’t produce purpose

In 431 BC, the philosopher Pericles made this 2019-relevant observation:

“I am convinced that people are much better off when their whole city is flourishing than when certain citizens prosper but the community has gone off course. When a man is doing well for himself but his country is falling to pieces he goes to pieces along with it, but a struggling individual has much better hopes if his country is thriving.”

When the hive is contaminated, the bees die along with plants and flowers. We are seeing this happening in real-time with the noxious effects of global warming.

The lesson for investors, find an advisor who loves where they work and what they do.

Avoid being stung to death by the deadly swarm of financial Killer Bees.

They’re motivated by all the wrong reasons.

Source: Why Motivating People Doesn’t Work… and What Does by Susan Fowler.