There is no Plan B; is a dangerous game to play.

This advice goes for your financial portfolio and NFL Quarterbacks.

A couple of weeks ago, the NFL draft threw the sports world into a frenzy.

Shadeur Sanders, the Colorado quarterback, was rumoured to be the third pick in the entire draft. Indeed, it was considered a certainty that some team would call his name in the first round.

In a jaw-dropping plummet, Sanders fell to the fifth round before being chosen by league also-ran, the Cleveland Browns.

What transpired during those fateful 24 hours that caused Sanders’ stock to tumble precipitously?

There are copious theories explaining his epic collapse in value.

Starting with Sander’s average arm strength and mediocre athleticism compared to his counterparts.

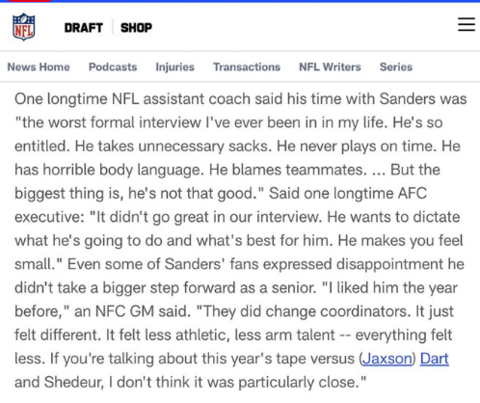

Others mentioned his poor performance regarding team interviews. Some insiders questioned Sanders’ loyalty to his teammates and implied he was more concerned about his brand than winning games.

This damning assessment came from an anonymous long time NFL assistant coach. I don’t know if all this is true, but it’s not exactly a rave review.

The honest answer might involve Sander’s ability to adapt to the vital role of backup quarterback.

NFL coaches want this position to be drama-free. The number two quarterback isn’t necessarily the second-most-talented quarterback in the room. What’s cherished most is loyalty and unmatched devotion to helping the starter prepare for the grueling NFL season.

These attributes help explain why players like Tim Tebow and Colin Kaepernick, for very different reasons, never found permanent jobs as understudies. Management felt they brought too many distractions to a role prized for anonymity.

Sanders, His Dad, Deion, and his entourage’s outsized personalities were too much for a position in which boredom is a prized attribute.

We may never know what caused Sanders’ demise in the eyes of NFL GMs, but I wish him the best as he embarks on his NFL career.

Regarding the investor’s wealth management plan, the answers are crystal clear.

Investors need a drama-free backup plan; the less sizzle, the better.

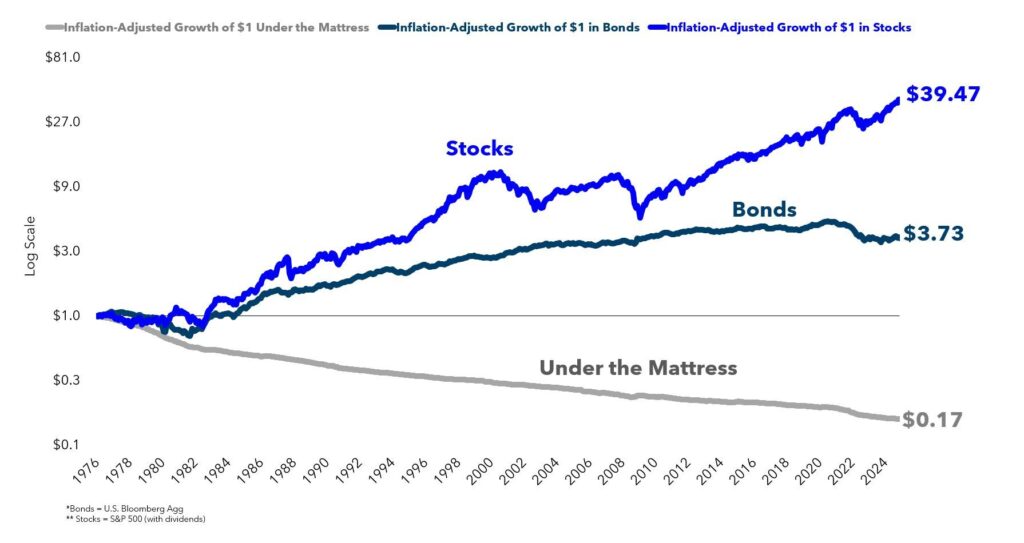

Stocks generate tremendous value over long periods because sometimes they go down and stay there for a while.

Backing up your stock portfolio with more stocks is an atrocious plan B.

High-quality bonds like U.S. Treasuries help negate some of the stock market volatility and are essential to a balanced portfolio. Not every asset needs to be a gamebreaker.

- Cash Reserve: Depending on your income fluctuation, this should cover at least three and possibly two years’ worth of living expenses. Park these funds in an FDIC-insured high-yield savings account. The return on this capital is more important than the return on it.

- Proper Insurance: Protecting your assets with the correct home, life, and auto insurance amounts should be integral to all investors’ wealth creation playbook.

- Diverse Income Sources: Relying on a single salary is a poor risk management strategy. Cash Bonds and Real Estate provide a diverse cash flow stream to help soften the interruption of your paycheck.

- A Side Hustle: A skillset that leverages potential for increased income is invaluable—young and not-so-young need to upgrade their certification portfolio to maximize their employment flexibility constantly.

Like second-string NFL Quarterbacks, your backup financial plans should be steady, reliable, and consistent. This area of your finances needs to be a drama-free zone.

If you don’t believe me, ask NFL GMs about Shadeur Sanders.

Sometimes choosing boring and reliable is the best decision you’ll ever make.