Applying to college is a confusing maze of non-transparency.

Imagine signing a contract to purchase your home without knowing the final price.

Scores of parents do this annually when paying for college with garish results.

Unmanageable debt and school transfers leading to five years plus of tuition payments top the list of unintended consequences.

How could things get worse?

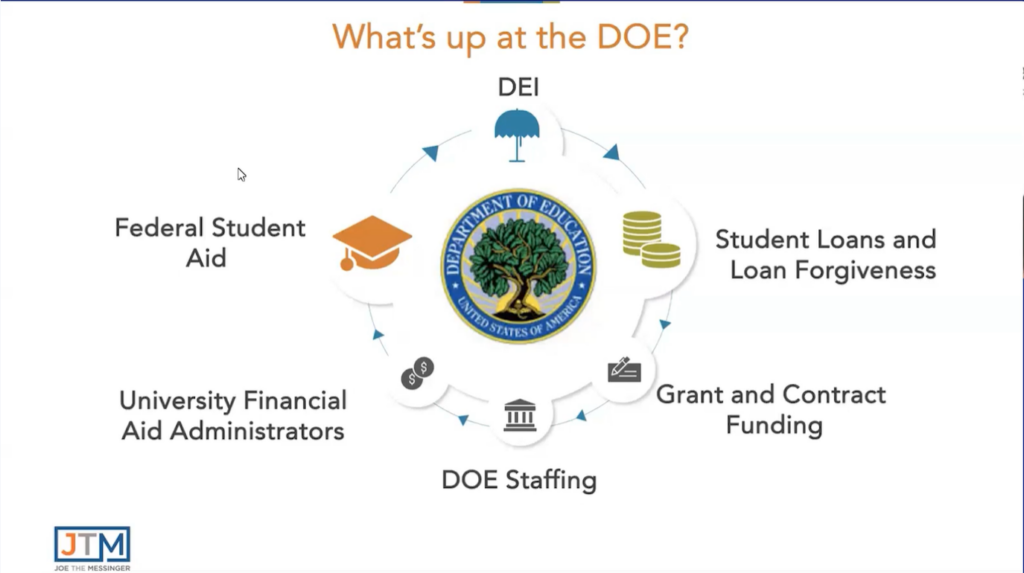

The Department of Education laid off half of its employees. Whether you believe this is a good idea or not, based on your political views, these actions profoundly impact the college application process.

Worse, students from low-income and first-generation college families will bear the brunt of the storm.

The Department of Education is responsible for many aspects of the application process. Responsibilities include the FAFSA’s daily operations and the distribution of its database to schools. The last couple of years have been a debacle concerning FASFA filings, with months of delays and confusion. While reform is much needed, removing a significant component of the helpline won’t make this tedious process more user-friendly.

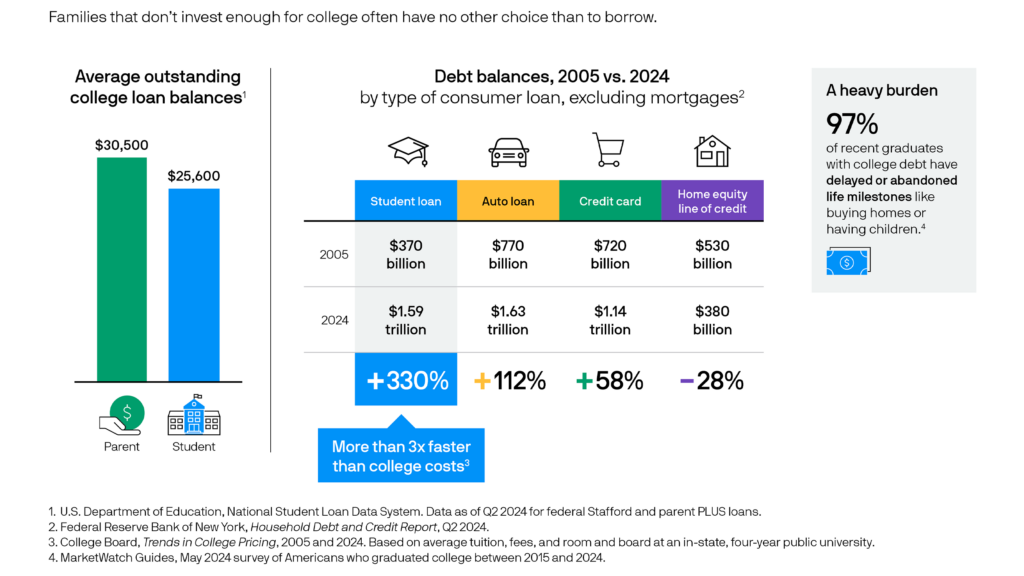

The Education Department is responsible for disbursing student loans. While some have floated the not-crazy idea of moving this task to the Treasury Department, the immediate effects of staff reductions will negatively impact Pell Grants (Aid to low-income households), Student loans, and Parent Plus Loans. Even though Student Loans are a huge money-maker for the government, the system needs a major overhaul due to the debt burdens on students and parents alike. Just slashing employees without an adequate replacement plan isn’t optimal.

Another side effect of the slash-and-burn policy is an increased risk of school malfeasance.

Ann Garcia mentions some items in her popular How to Pay For College blog.

-

The School Participation Division, which has regional offices that provide oversight of colleges and financial aid, also lost significant staff, with eight of 10 regional offices being effectively closed. This group investigated waste and fraud, provided oversight to ensure that colleges didn’t defraud students, and managed eligibility for federal grants, among other responsibilities.

-

The Institute of Education Sciences, which tracks educational outcomes and provides research support for education policy, lost about 3/4 of its employees. Among other things, the IPEDS data system is part of IES. IPEDS is a mandatory data survey that provides public information about college costs, financial aid, completion rates, and other metrics. That data is available to the public through College Navigator and the College Scorecard.

Choosing the right college just got more demanding. Creating a diversified list of schools focusing on affordability factors like merit aid is more important than ever. Putting all your eggs in one basket is a poor risk management tool for most aspects of life, and choosing the right college isn’t exempt from this, as many of the traditional financing factors are in a state of flux.

Preparing ahead by setting reasonable expectations and lining up reliable financing through 529 plans, employment income, and outside scholarships is a way to control the controllable.

One thing is sure: this isn’t the last you will hear about upheaval regarding financing a college education.

“If you get in, we will figure it out”—is a strategy to avoid at all costs.