There are few certainties in life. 100% probabilities are a work of fiction.

There is one thing I’m 99% certain of: the stock market will recover from its periodic spasms of mayhem.

I’m no Nostradamus, claiming to possess clairvoyance over the future. My track record regarding many aspects of life is laughable at best.

Let’s stroll down memory lane and observe some recent and not-so-recent prognostications that didn’t end well.

Getting excited the last decade over every NY Football Giants off-season and seeing my hopes dashed by a 1-7 record before Halloween.

Hiding my precious baseball cards so well that I can’t find them.

Sprinkling red pepper around my Hosta plants believing this would dissuade deer from turning them into an all-you-can-eat buffet.

Investing in a start-up Nano-Technology company thinking it would be a 100-bagger (It wasn’t)

Placing aggressive Jack Dempsey Cichlids in my community fish tank and expecting peace instead of a bloody massacre.

Attempting to bench 200lbs in my garage with full confidence a spotter was unnecessary. (Thank God I didnt use the collars)

Cooking my 7-year-old son’s hot dogs and ignoring their verbal cues that Sauerkraut needs to be warmed before being eaten.

Believing trading FX on a spot desk would be a fun and exciting career choice.

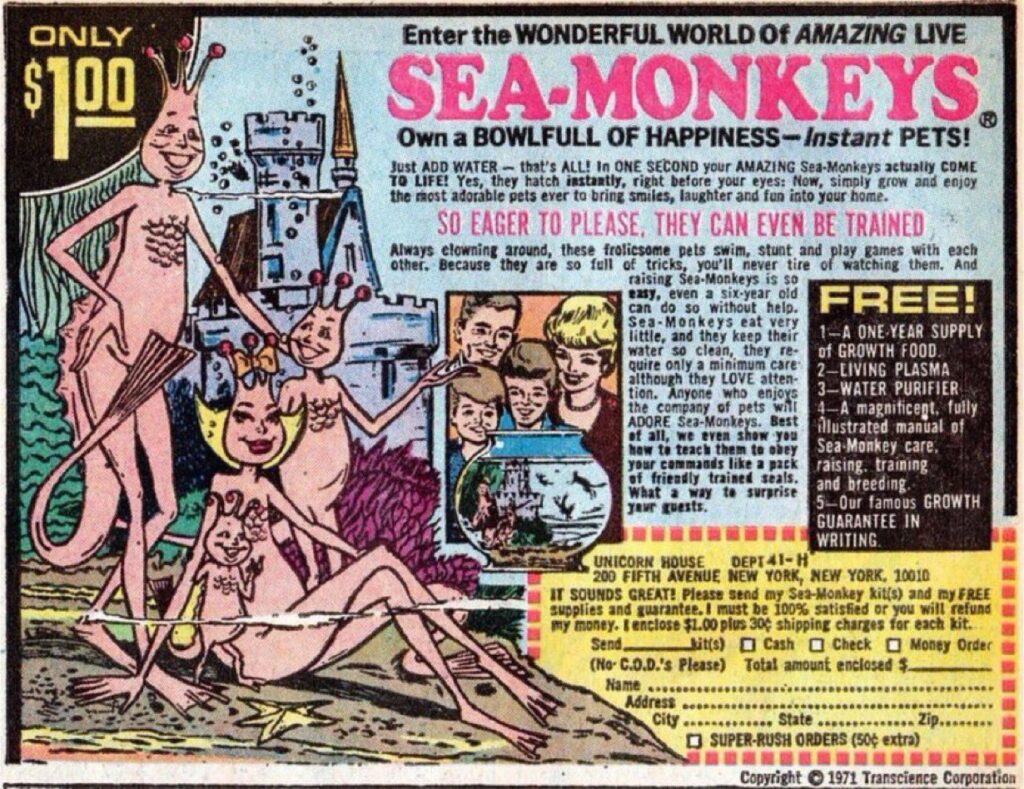

Wait. The Sea- Monkeys, which I just ordered from my comic book, aren’t real monkeys?

Despite this laughable pattern of predictive follies, I have a foolproof track record on one particular topic.

Every time, and I mean every time, a client has reached out asking for guidance on their portfolio during puking markets, I’ve held my ground.

“Stay the course, and this storm will pass like all the others. Spring will bloom again.”

I have NEVER been wrong, and their apocalyptic predictions have never been correct.

There are caveats and disclaimers.

First, this advice only applies to a well-constructed, diversified portfolio designed to navigate the incessant ebbs and flows of the financial markets.

Second, the time frame of recovery is unpredictable. Barring unforeseen events like meteor crashes and runaway buses, it will arrive during your lifetime.

Third, all bets are off if you bail out at the worst possible moments. Vaya con Dios.

Finally, if I’m wrong, who will you collect from if the worst outcome emerges? Bankrupt companies and Government Bond defaults do not provide a reliable stream of returning investors’ capital.

Good luck with the buried Gold. Unless you have a private army to protect you from roaming packs of marauders eager to feast on you and your precious commodity.

My colleague Ben Carlson puts an exclamation point on the doomsday scenario with a classic tale about the great Art Cashin and his interactions with a young trader during the Cuban Missile Crisis.

Professor Jack was already in the bar, and I came bursting through the doors as only a 19- or 20-year-old could. And I said, ‘Jack, Jack. The rumors are that the missiles are flying.’

And he said, ‘Kid, sit down and buy me a drink.’

And I sat down and he said, ‘Listen carefully. When you hear the missiles are flying, you buy them, you don’t sell them.’

And I looked at him, and I said, ‘You buy them, you don’t sell them?’

He said, ‘Of course, because if you’re wrong the trade will never clear. We’ll all be dead.’”

Being self-aware during times like these is a superpower.

Hang in there; I’m 99% certain things will get better.