What do you want to last longer, your money or your life?

It turns out that spending more money on certain items in retirement may add years to your longevity.

Research proves those with larger salaries and increased net worth live longer than average.

The Wall Street Journal discusses the details in Money Can Buy a Longer Life – to a point.

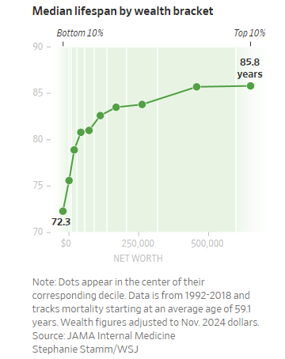

Once Americans make it to their late 50s, the wealthiest 10% live to a median age of around 86 years, roughly 14 years longer than the least wealthy 10%, according to a study published earlier this year in JAMA Internal Medicine.

People with more money can afford healthier food, more healthcare, and homes in safer, less-polluted neighborhoods, says Kathryn Himmelstein, a study co-author and medical director at the Boston Public Health Commission.

There’s a limit to the gains. The research group Opportunity Insights determined that an individual making $14,000 lives about ten fewer months than another person making $20.000. The same gap exists between household incomes of about $160,000 and $225,000 and those earning between $225,00 and $1.95 million.

These numbers make sense. Poor people do not have the luxury of buying time to reduce stress. Living in a safe neighborhood and not having anxiety over where your next meal will come from adds years to your life.

In addition, many lower-income earners work jobs that are taxing on their bodies and contribute to reduced longevity.

Where does increasing spending kick in to extend longevity?

The answer lies in excess disposable income allocated to decreasing the friction preventing people from establishing healthy routines.

An example is setting up a home gym by purchasing easily accessible exercise equipment. Another is spending money on pre-cooked meals from whole foods containing the right protein and other nutrients.

Wealthier people tend to track their health in real-time using expensive technology.

Devices such as the Apple Watch and Oura Ring can instill healthy habits and catch worrying patterns that might emerge between annual checkups, says Joe Coughlin, the director of the MIT AgeLab.

“It’s in front of you all the time,” he says. “It prompts awareness and therefore prompts action.”

Coughlin says he once went to the emergency room because his Apple Watch detected a spike in his heart rate that he hadn’t noticed.

I use a Garmin Watch to keep track of my vitals. Monitoring things like resting heart rate, HRV, and sleep patterns provides an early warning system for detecting potential health issues,

Before I contracted COVID, my HRV dropped from an average of around 54 to 19. HRV is a measure of stress in your body. I knew something was drastically out of whack before taking any tests.

Money doesn’t protect you from dropping dead tomorrow, but it certainly increases the probability you will have a longer lifespan than someone in a lower tax bracket.

Creating a significant health budget as one of your retirement goals will likely increase your health and lifespan.

Sometimes, you need to spend money to make money. The same goes for your retirement health, even if it violates the 4% rule.