May you live in interesting times.

Some believe this quote is a Chinese curse. We are all under its spell.

Luckily, the U.S. military devised a method to cope with the lunacy.

Enter- VUCA.

This acronym stands for Volatile, Uncertain, Complex, and Ambiguous.

Ex-Congressman Steve Israel lays out a precise definition of VUCA.

VUCA is an environment where the fabric of society changes with each passing day. New regulations consume old rules. Long-established norms fall by the wayside, with some cheering their downfall and others terrified of what might come next. It’s a pervasive sense that the future is growing harder to predict. Even more worrying, there’s less to bring us together in the present.

What is a sane way to deal with this new environment, which recently added Alien Drones to the menu?

Former Joint Chiefs of Staff Chairman General Joseph Danford advised subordinates to be proactive in mindfulness and meditation.

Embracing impermanence and non-attachment makes perfect sense. Nothing lasts forever, no matter how crazy it seems at the moment.

Eckhart Tolle expands upon this concept.

Physicists tell us that the solidity of matter is an illusion. Even seemingly solid matter, including your physical body, is nearly 100 percent space- so vast are the distances between atoms compared to their size. Moreover, even inside every atom, there is mostly space. What is left is more like a vibrational frequency than particles of solid matter, more like a musical note. Buddhists have known that for over 2,500 years. ……The essence of all things is emptiness.

VUCA is a fantastic description of the financial markets. The parallels are fascinating.

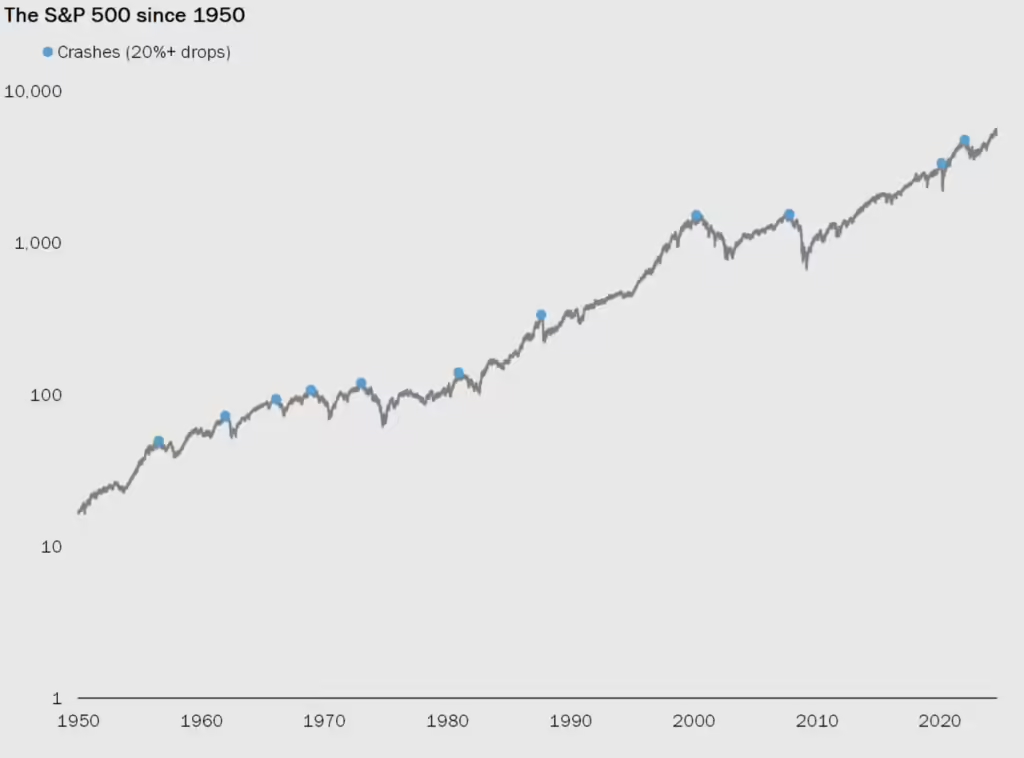

Source: OptmistiCallie

Instead of society, substitute the stock market in regards to changing every day. While at it, throw in new regulations to replace old rules. Bitcoin is the poster child for this revolution. Norms collapsing is an ideal description of how the advice business is in the process of a seismic shift from the Old Broker-Dealer model into a new client-centered RIA configuration. Finally, we don’t need to discuss how the future is becoming more difficult to predict. (As if it ever was possible in the first place.)

Markets are the epicenter of VUCA. How an investor deals with his irrefutable fact will determine their survival rate.

My colleague Blair DuQuesnay provides an ideal antidote to VUCA in her terrific post-Aparigraha.

I’m old enough to remember the bankruptcies of Enron and Worldcom. I still have battle scars from Lehman, AIG, Bear Stearns, and other casualties of the Great Financial Crisis. I have lived through a period where HODLing stock market winners have produced life-changing results. But headlines about a new administration rolling back financial regulations and abolishing the FDIC give me pause. It was benign deregulation from the Clinton era that created the environment for the GFC.

Reading Stoic or Buddhist philosophy gives one the courage to practice not worrying about things beyond one’s control. Who would have believed Marcus Aurelius or the Buddha to be the ultimate source of portfolio alpha?

My advice for 2025 is to lean into these wise words from Duncan Trussell.

Some poor, phoneless fool is probably sitting next to a waterfall somewhere, totally unaware of how angry and scared he’s supposed to be.