Don’t sleep on your Metabolism.

Metabolism is the process that transforms food into Energy. This Energy powers every single one of the 36 trillion cells in our bodies.

When Metabolism encounters adversity, our organs don’t function properly, and dozens of conditions like Dementia, Stroke, Migraines, and Depression are the result.

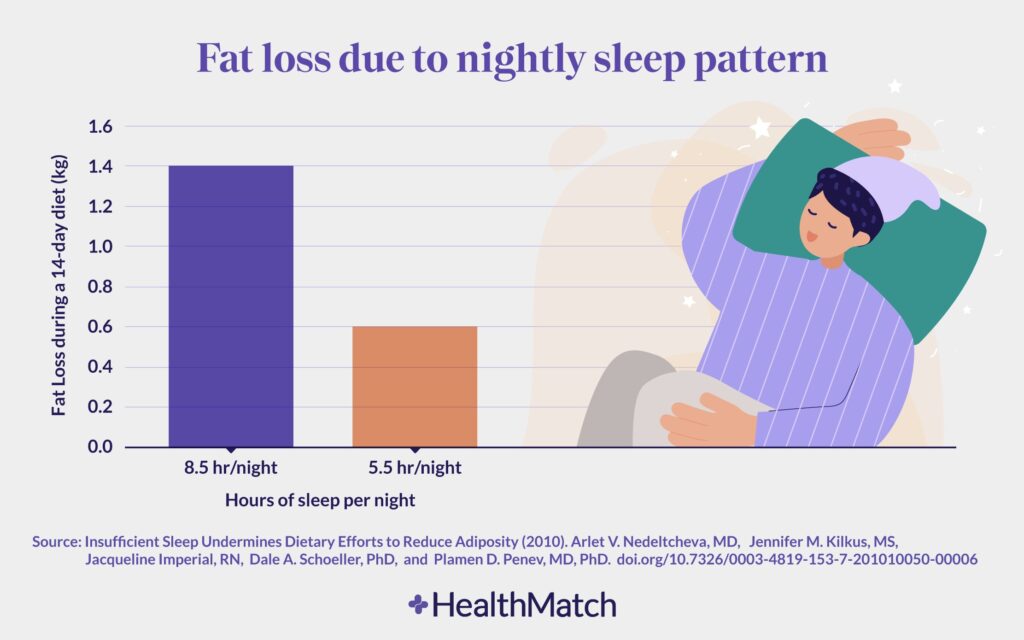

There are multiple causes for metabolic disorders. These include nutrient deficiencies, microbiome issues, sedentary lifestyles, chronic stress, medications and drugs, sleep deprivation, environmental toxins, and circadian disruption.

Chronic overnutrition is a prime origin of metabolic deficiencies. Our bodies cannot handle the copious amounts of food many consume.

According to Casy Means, M.D., we eat approximately 20 percent more calories and 700 to 3,000 percent more fructose than we did one hundred years ago, all of which the body must process. Imagine being asked to do 700 to 3,000 percent more work than you normally do daily—you’d collapse!

The system becomes gummed up, and cells become dysfunctional. Cells become filled with fat, and Mitochondria start producing dangerous free radicals in response to the intense taxation.

The Pancreas typically produces Insulin to cope with excess Energy or glucose. When this happens, a safety valve is triggered, and the body stops converting food into Energy. The process is called insulin resistance, and it leads to a plethora of chronic diseases like Type-2 Diabetes.

When cells lack proper nutrition, they send distress signals to our immune system, which mounts a full-on attack led by inflammation.

Our immune system thinks excess food intake is an outside invader, so it pours more resources into the battle. Numerous chronic diseases result from this miscommunication due to consuming highly caloric, nutrient-deficient processed foods.

Investors can learn much from how our bodies work. Similar results occur when we inject bad Energy into deploying Capital into our investments. Too much of the wrong types of Energy leads to disastrous investment results.

An overabundance of fear in your portfolio can be deadly. Selling at the worst possible time leads to the worst possible outcome- A permanent loss of Capital.

The same goes for the polar opposite—greed. Clogging the system with delusional thoughts of outsized investment returns without vetting the risks is an investment metabolic disaster waiting to happen. Pouring money into the top of a market bubble is a fantastic strategy, said no one ever. Just ask those poor souls who decided to plow money into the Hawk Tuah’s Meme Coin. What could go wrong?

FOMO is another example of gobbling up the works with bad Energy. The side effect of keeping up with the Joneses is overconsumption. Too much conspicuous consumption in the system activates an immunity response through maxed-out credit cards. Without constraint, this chronic financial disease ends in monetary death, AKA bankruptcy.

An overabundance of attentive Energy towards one’s investments blocks common sense flow. Micromanaging investments and reacting to every Crisis-Dujour diverts Energy from long-term compounding. Interrupting this process is a poisonous impediment to creating wealth.

Clogging the system with lousy Energy is never a good idea.

Less is more regarding your health and your finances.