Is divorce worse for your retirement than a bruising bear market?

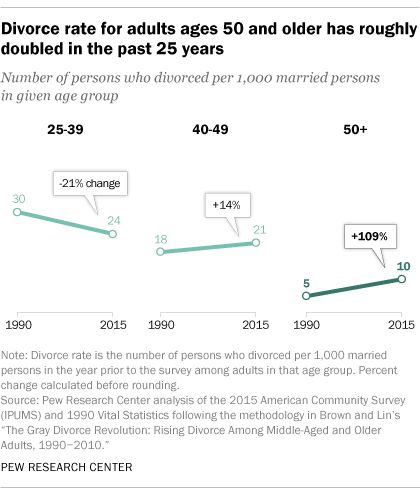

While divorce is declining among younger people, the rate for those 50 and over doubled since the 1990s.

“Gray divorce” is spreading like wildfire during the Battle of the Blackwater.

According to Lili Vasileff, a divorce financial expert,” For adults 65 and older, the rate has tripled. 55% of that group, also known as silver splitters, are leaving their first marriages-long-term unions that had lasted more than 20 years.”

What’s causing this?

Divorce stigma is gone.

48% of first marriages are ending in divorce.

60% of second marriage reach the same fate.

73% of third marriages call it quits according to Psychology Today.

Intuitively this makes sense. The more marriages one has, the fewer ties that typically bind couples together exist. Splitting up is less traumatic.

With people living longer, spending another 30 years in a bad marriage isn’t appealing for the 55 is the new 65 crowd.

It wouldn’t be surprising if these numbers rocketed higher due to the stresses of extended co-habitation during the COVID-19 Crisis.

I’m not worried, being happily married for 27 years. Also, I go to bed at 9:30, don’t like going out at night, place empty boxes back into the pantry, and hate getting dressed up for any occasion. There probably wouldn’t be too long a line of suitors if I suddenly entered the dating scene, but I digress.

Why is grey divorce such a menace?

Few have prenuptial agreements. Only around 3% of married couples use them—those 60 and over own 80% of the net worth in the U.S. Houston. We have a problem.

I reached out to our divorce expert, Emily Johnson, for tips on navigating silver splitting. Here’s her advice:

- Maximize survivor benefits: Make sure you’ve selected an option and understand the consequences of any reductions in benefits will bring,

- Liquidity is king: Know what’s liquid now vs. future assets or cash flow. Pensions, annuities, private equity, and non-traded REITs fall under this category They’re subject to specific rules – You better know them.

- Understand the real value of insurance-based assets: These assets can be a source of “found money.” Cash-value life insurance with little gains and future income from annuities fall under this category. Long Term Care insurance rules may allow the policy to split into two separate parts without having to submit health information.

- Health Insurance: Divorce before Medicare eligibility makes this is a priority. Health insurance is a substantial fixed retirement cost. Besides looking into COBRA, pay attention to military benefits, which may terminate upon divorce.

- Social Security: You MUST incorporate future benefits into any settlement. Divorced individuals are entitled to 50% of the spouse’s benefit if their payout is lower.

- Liabilities: Debt holders don’t care about your divorce. Understanding what you’re on the hook for isn’t something to take lightly.

- New Trusted Contacts: Update all your beneficiaries and estate plan. Listed beneficiaries serve as will substitutes.

While stressful, use this is an opportunity to reinvent yourself. There’s always a silver lining. (No pun intended)

They’re many other complexities involved in a grey divorce. Use this as a starting point.

You could end up losing more than your marriage.

Special thanks to Emily Johson. Reach out to her if you have further questions.