Creating time isn’t what it’s cracked up to be.

It all starts with how you define time.

If you think about it, there is only one time – Right Now.

Everything else is a mind creation.

Your mind is a control freak. Its main objective is to obscure the present moment with the past and future.

Creating time is, in effect, saying no to the present moment in exchange for a world that exists only in your mind.

It makes zero sense to refuse what is already there. Everyone needs to briefly engage with the past and future to deal with essential moments of daily living.

Anything more than this creates time at the expense of enjoying the here and now.

Eckhart Tolle explains the obvious in his best-selling book, The Power Of Now.

Imagine the Earth devoid of human life, inhabited only by plants and animals. Would it still have a past and a future? Could we still speak of time in any meaningful way? The question “What time is it?” or “What’s the date today?” – if anybody were there to ask it – would be pretty meaningless’ The oak tree or the eagle would be bemused by such a question. “What time?” they would ask. “Well, of course, it’s now. The time is now. What else is there?”

Retirement spending isn’t immune from the laws of nature.

Many retirees don’t spend enough during retirement. Talk about a first-world problem!

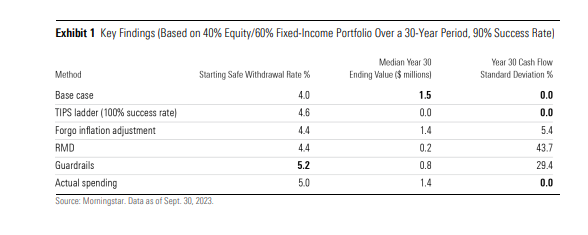

Morningstar’s Christine Benz, in her post “We Need To Talk About Your Retirement Spending,” explores this topic in depth.

The research behind spending in retirement leads to some surprising conclusions.

Even the retirees who spend in line with our “base case,” which in 2023 meant taking 4% initially and inflation-adjusting withdrawals each year thereafter, will tend to have significant remaining balances after 30 years of withdrawals. For example, for people starting retirement with $1 million, withdrawing $40,000 initially (4% of the balance), and inflation-adjusting that dollar amount for the next 30 years, the median ending balance was $1.5 million for balanced portfolios and even higher for more equity-heavy portfolios.

In other words, too many retirees are too busy creating time rather than living in it.

We see this constantly in our practice. Clients put off spending money in the here and now, even though they have the means. In exchange, they bet on an imaginary, uncertain, mind-created future to disburse funds, thinking this will provide more satisfaction and safety than living in the present.

If you ask me, leaving a ton of money to people when you are dead is a major buzzkill.

The average age of inheriting money is 51. According to research by Mike Piper, more than one in four beneficiaries receive their inheritances over the age of 61.

Creating time cancels funding student loan repayments, financing someone’s first home, or possibly forever delaying that dream family vacation.

The price of delay is enormous on many fronts.

Conventional wisdom decrees time is your most valuable asset.

That’s true only if your preferred method of measurement is accurate.

The only time that exists is right now. Make sure you fund it accordingly.