Everything changes, and you can’t be 100% sure of anything.

I am a spoiled New York Football Giants fan. From 1976 to 2011, I saw them appear in five Super Bowls and win four.

Things went south from 2012. Over the last decade, Co-Owner John Mara hired six head coaches and three General managers, which is heresy for a franchise formerly known for its stability.

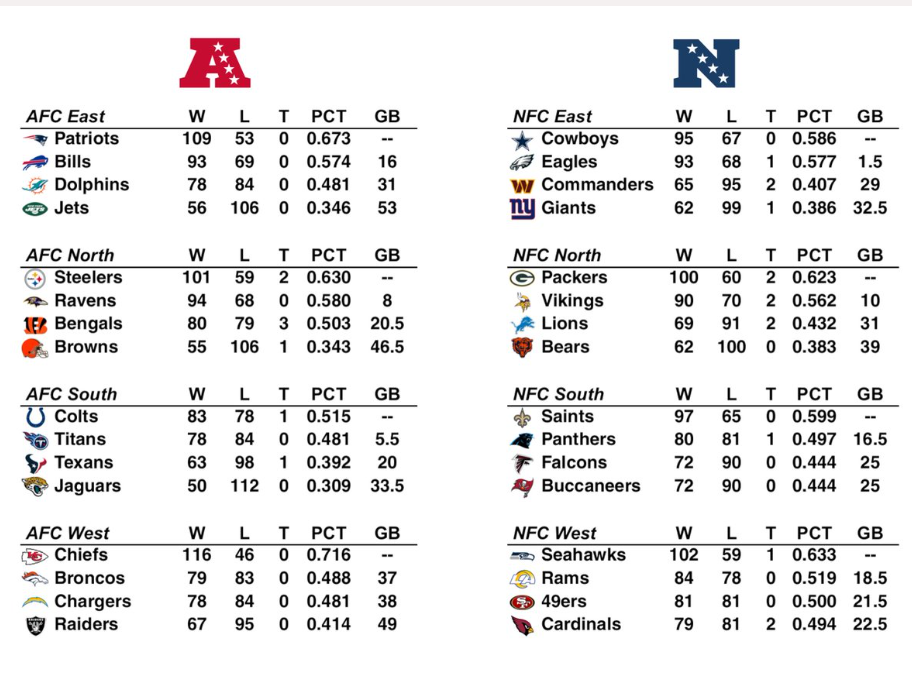

Predictable results followed the dysfunction.

The Giants won only 38% of their games over this period, which is suitable for the fifth-worst team in the league.

Like investing, Sports fans need to diversify. Rooting for a hapless team forces fans to divert their attention from the dumpster fire.

Strategies include

- Watching more college football and appreciating the enthusiasm of their yet-to-be-imbittered fans: Yes, they are primarily drunken college kids, but that is a minor point. It’s refreshing to watch fans that don’t default to booing at the slightest provocation, like some city that will remain nameless.

- Rooting for the underdog: Every year, the NFL has a surprise team that comes out of nowhere to shock the league. Last year, the Detroit Lions filled that role, and it was fun watching their long-suffering fans enjoy the ride to the NFC championship game.

- Hating the dominant teams: Teams like the Eagles, Chiefs, and Cowboys seem never to have a losing season. Watching first-place teams get upset and their smug fans and owners go home with their tails between their legs made the Giants’ plight a little easier. Few things give me greater pleasure during these dark times than watching Cowboy’s owner, Jerry Jones, react to the Boy’s latest playoff debacle.

- Looking forward to next year’s College Draft: Hope springs eternal, and you know your team is terrible when you start paying attention to next year’s mock drafts by the season’s third game.

- Getting away from it all. Scheduling Sunday plans that don’t involve football is difficult but necessary for one’s mental health. Escaping another doomed game and the accompanying Twitter toxicity is sometimes the best solution during desperate times.

What does the Gridiron have to do with investing?

The market is not immune to their lost decades. The stakes for not having a backup plan for your retirement portfolio are much higher than another ruined Sunday.

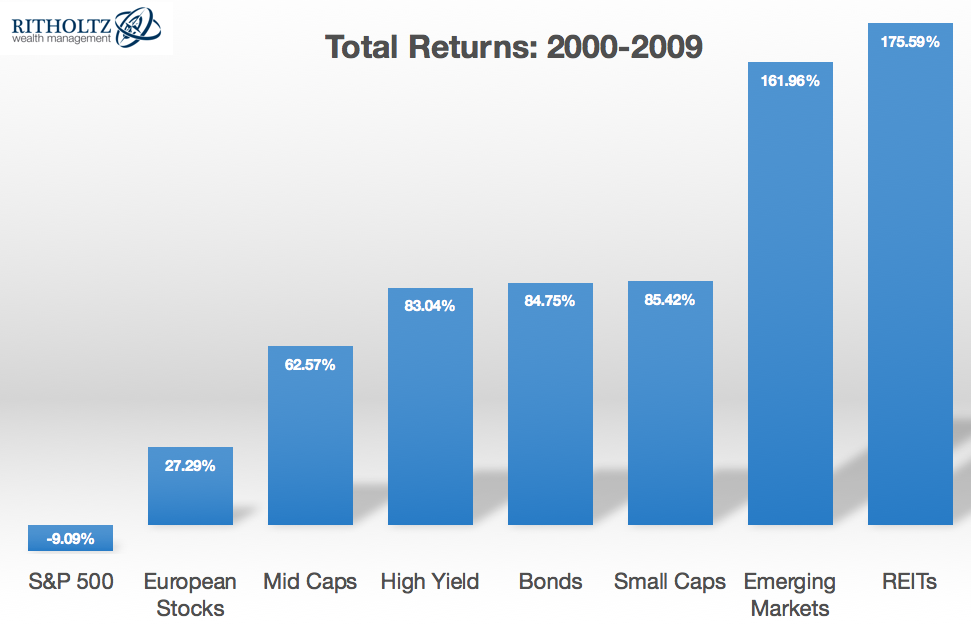

From 2000 to 2009, the S&P 500 generated a negative return. For some, this is hard to imagine, with large-cap tech Stocks like AAPL, NVDA, and MSFT dominating the indices for what seems like forever, but for quite a while, they brought up the rear in the market.

The good news for this significant U.S. large-cap underperformance period was that diversification worked beautifully. If an investor owned a diversified portfolio that included bonds, smaller U.S. companies, and foreign stocks, they did just fine.

The only sane strategy if one admits they can’t predict the future is diversification.

The same advice goes for sports, your career, and especially your portfolio.

The market couldn’t care less if you are a super fan of one asset class.

Never let loyalty, ideology, or just plain stuborness precede common sense.

The good times never last forever.

Plan accordingly.

One footnote- The Giants staged a dramatic 29-20 win last week over the heavily favored Seattle Seahawks. I’m back in like Charlie Brown falling for Lucy’s football trick! It shows you it’s much easier writing these posts than following common sense advice. Go, Giants!!