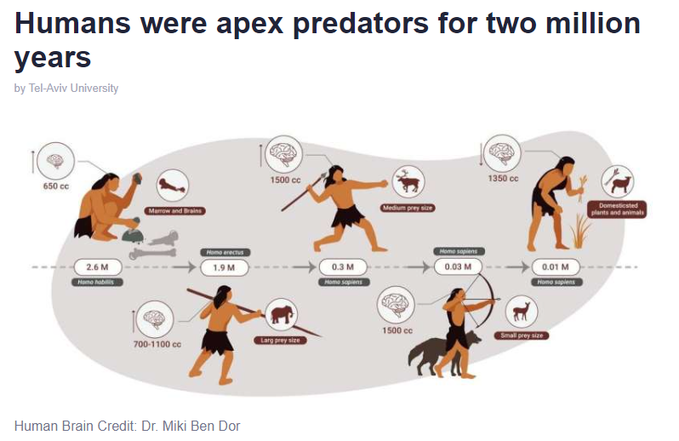

Humans are Apex Predators.

For two million years, they focused their energies on hunting plus-sized prey. HyperCarnivore is an excellent way to describe this prehistoric lifestyle.

Humans are responsible for the extinction of thousands of species in their quest for meat. The list ranges from various large Mammals to numerous Birds and Marine life.

These large extinctions paved the way toward consuming more plants and eventually led to farming. Plants weren’t our first choice.

It’s in our DNA to hunt and kill things.

Unsurprisingly, this predatory favor displays its fangs in an area other than driving Buffalo over cliffs.

The financial services industry serves as a rallying point to channel these biological impulses to suit modern times.

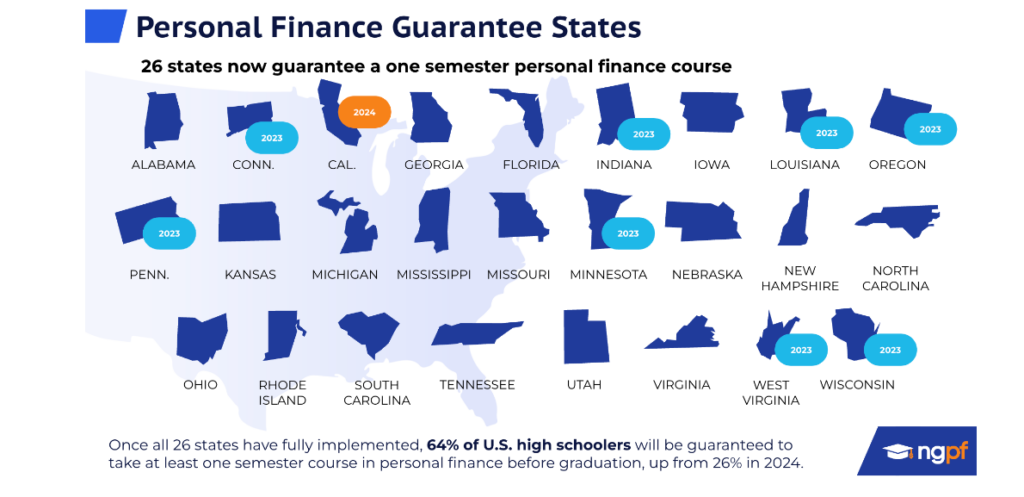

The other night, Dina and I spoke to around 100 teachers at a web event hosted by our friend, Tim Ranzetta. Tim founded the wonderful Non-Profit NGPF.

Next Gen Peronal Finance provides teachers with a free personal finance curriculum, reaching over 3 million students. It is partially responsible for legislation mandating passing a high school personal finance course, which is mandatory in several states.

The event mainly focused on preparing public school teachers for retirement. Teachers’ pensions don’t index for inflation; many leave the job before they become fully vested. They can supplement their retirement with 403(b) contributions.

Public School Teacher plans are Non-Erisa and are fertile grounds for the worst financial predators.

Insurance agents flood your schools, peddling expensive and inappropriate variable annuities that have no place in an already tax-deferred 403(b). These individuals are Apex predators trained to prey on your lack of financial literacy and inclination to trust your fellow man. They are motivated by perverse incentives, which direct them to sell you their most expensive insurance products because that brings them higher compensation. Your only defense mechanism is financial education.

This disclosure shocked many teachers, but only the truth will set you free.

Teacher 403(b) plans aren’t the only area where beasts of prey stalk their unarmed victims in the financial services sector.

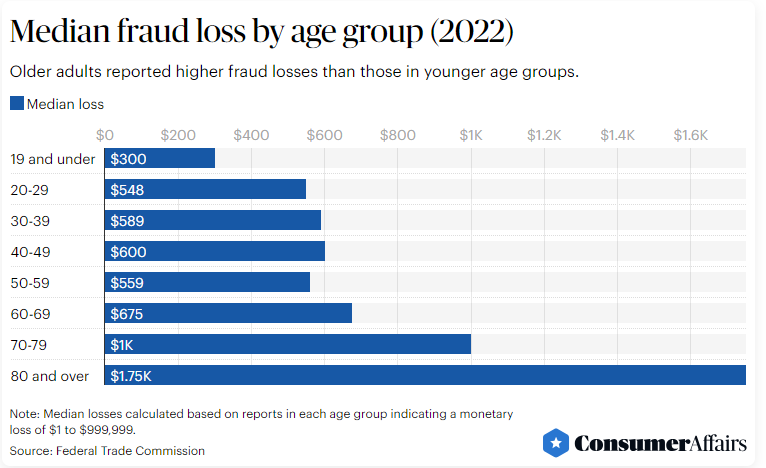

The data on financial elder abuse is shocking.

According to Consumer Affairs:

Almost 37% of seniors in the U.S. are affected by financial abuse in a given five-year period, and economic abuse costs elderly Americans $36.48 billion per year, according to a 2015 study by True Link Financial.

By 2050 people aged 65 and over will comprise 23% of the nation by 2050, a significant increase from the current level of 16.5%

Financial predatory behavior has the potential to expand over the following decades.

Unfortunately, these perverse incentives contaminate most financial services sectors. The people aren’t bad, but the incentives created by upper management are abhorrent.

RWM is a fiduciary. Our client’s best interests are the center of all interactions. It’s difficult for young people to see the forest through the trees. We recently hired a college graduate with no prior experience.

In speaking with her, I conveyed an important message.

Always remember you’re working in an oasis in a desert of perverse conflicts of interest. Putting clients first isn’t the norm in our industry. Don’t ever take this for granted; realize your job is more than just a job.

It doesn’t have to be this way, but human nature is what it is.

Remember that your best weapon for defending yourself against the Barbarians At The Gates is arming yourself with knowledge and the courage to say no.

The Lions Den is dark and filled with terrors, but there is good news: there’s an escape room.

Homans are Alpha Predators. Never assume this trait doesn’t apply to your investment portfolio.