We can learn a lot about managing our money by studying nature.

Untouched Forests serve as prime examples.

The oldest tree, a Spruce in Sweden, is over 9,500 years old. Talk about a long-term plan!

Trees protect each other, share food, and communicate. Peter Wohlleben discusses these fascinating details in his BestSeller, The Hidden Life of Trees.

If a giraffe starts munching on its leaves, the African Acacia tree releases a chemical that drifts through the air and warns other trees of approaching predators. The tree also battles insects by sending chemical signals that attract bugs that feed on the leaf chewers.

It’s not by accident we use the Acacia tree as a symbol of The Preserve, a client segment dedicated to protecting the wealth of some of our more wealthy households with complex needs.

Trees need each other to provide the right environment for creating a microclimate suitable for tree growth and sustenance. Trees are known to interconnect roots to redistribute resources. Stronger trees nurse the sick ones back to health. The forest has its own version of Social Security.

Wohlleben explains how this process works:

A tree is not a forest. On its own, a tree cannot establish a consistent local climate. It is at the mercy of wind and weather. But together, many trees create an ecosystem that moderates extremes of heat and cold, stores a great deal of water, and generates a great deal of humidity. In this environment, trees can live to be very old. To get to this point, the community must stay intact no matter what. If every tree were looking out for itself, then quite a few would never reach old age. Regular fatalities would result in many gaps in the tree canopy, making it easier for storms to get inside the forest and uproot more trees. The summer heat would reach the forest floor and dry it out. Every tree would suffer.

Your retirement plan should behave similarly. Like a tree isn’t a forest, one asset class isn’t a portfolio. Stocks and bonds must work harmoniously to save your retirement from market storms. Diversification is the market canopy protecting your plan from scorching market volatility.

High-quality bonds are essential for your retirement portfolio growth and sustenance over the long term. They aren’t perfect. The old quote about diversification, It works, just not very year holds true.

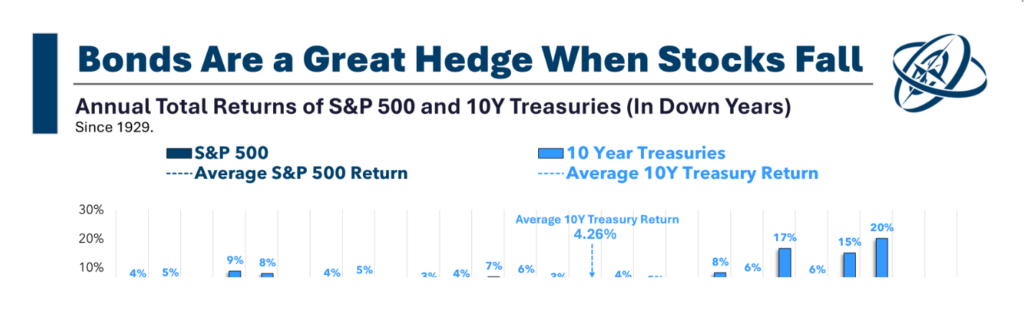

My Colleague, Ben Carlson, points this out in his excellent post, Bonds Are Still a Hedge Against Bad Times in the Stock Market.

The average down year for the U.S. stock market is a loss of almost 14%. In those same down years, Treasuries have averaged a gain of more than 4%. And that number includes the downright awful year that was 2022.

Most of the time, bonds act as a good hedge against bad years in the stock market, even if they’re not a good hedge against bad years in the stock market all the time.

Your retirement plan also leans on human connections. Loneliness is a gruesome asset class.

Social connections are invaluable for physical and mental health. Just like isolated trees, spending retirement withdrawing from the world contracts your chances of long-term survival.

We can learn much from species that can live to be 9.500 years old.

The question becomes, will we ask the right questions?