If you can’t find the reasons for change, reconsider.

Gardening is a case in point.

Agatha, equipped with a degree in Conservation Biology, came here from Brazil and started her Organic Gardening Company, More Than Gardens. Their mission is to reconnect people with nature through regenerative landscaping practices. They’re terrific, utilizing no pesticides or carbon-spewing machinery. Her crew completed a project in my garden the other day for six hours; you barely hear a peep.

Their North Star is hand-weeding, planting native species, nourishing the ecosystem, and removing invasive plants while respecting nature’s cycles. Competing with get-it-done-quick landscapers who give little thought to biodiversity or the long-term health of our air, soil, and water supply isn’t easy, but Agatha is on the right side of history.

Agatha loves what she does, and it shows.

She told me a disturbing story about one of her customers. The client recalled how her former landscaper remarked, “ You need to change your plants every seven years.”

Trees, shrubs, and plants aren’t living room furniture. Besides the fact that disposing of living things every seven years solely for the sake of change is morally reprehensible, there’s more to the story.

There is zero scientific proof that this benefits anyone except for the landscaper. Getting paid twice for removal and replanting is the basis for this “design.”

Did you ever wonder why Landscapers continue to cut and fertilize your grass during the sweltering months of July and August, though the grass switches to dormant mode as a defense mechanism against the heat? Though it’s the best practice, leaving things alone doesn’t make them any money.

Landscapers are decent, hard-working people, but perverse incentives can lead to destructive behaviors. Understanding conflicts like these provides evergreen knowledge for gardeners and investors alike.

My colleague, Ben Carlson, recently wrote an invaluable post entitled The Biggest Winners in the Stock Market.

The post focused on uncovering the long-term drivers of Stock Market performance.

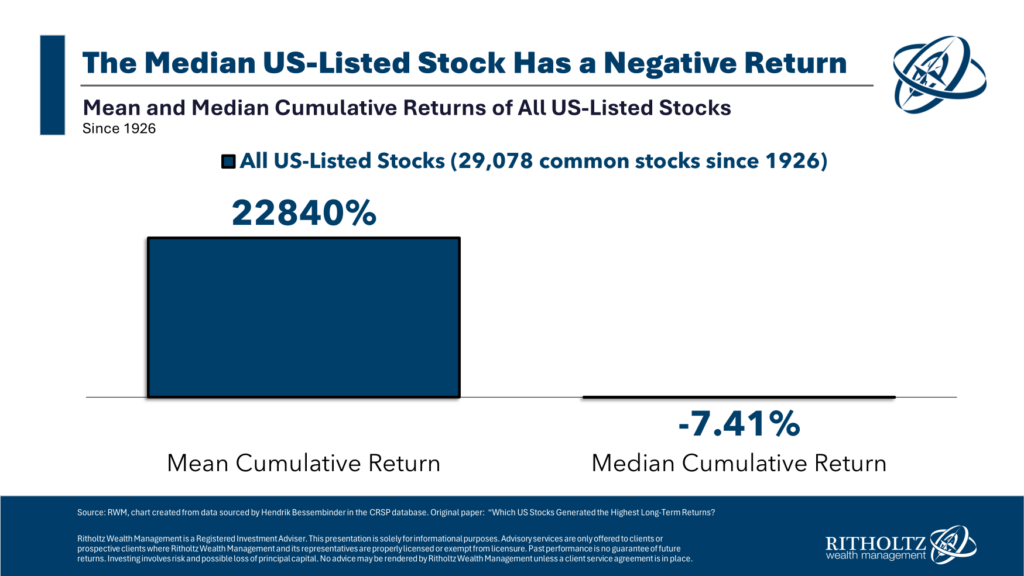

Bessembinder discovered that four out of every seven stocks in the U.S. had underperformed cash (one-month T-bills) since 1926. And just 4% of companies accounted for all the wealth gains for the entire stock market then.

The average cumulative return to 1926 was nearly 23,000%, just a gargantuan number. But the median stock then experienced a cumulative return of -7.4%.

Translation, if you don’t own the tiny sliver of winners over the long haul, you’re screwed.

There’s never been a more powerful argument for owning a diversified total market index fund.

Suppose you heeded the fee-thirsty landscapers’ advice about changing plantings every seven years. You’d never live to see that towering Oak or White Pine. The same goes for your money; change for the sake of change is a more potent wealth destroyer than the worst Bear Market.

Owning all the stocks in the market is the only guarantee of attaining their historical returns over long periods.

Numerous investors fall into change for the sake of change quagmire by:

- Reallocating portfolios centered on excitement.

- Placing heavily concentrated sector bets.

- Constantly flip-flop investment styles.

- Allowing emotions to determine long-term decisions.

- Implementing market timing as the basis of investment policy.

In reality, every seven years would be a godsend to many investors because too many change their portfolios every seven days!

The bottom line is that most businesses have the perverse incentive to make their profits by forcing their clients to take action when none is necessary, needlessly complicating things to boost their bottom lines. These moves directly contradict clients’ long-term goals.

Landscaping services and financial companies aren’t immune from this affliction.

Shut Up and Wait isn’t a profitable business model – For Them.