There is nothing so disturbing to one’s well-being and judgment as to see a friend get rich. – Charles Kindleberger

Comparison is the thief of joy.

Rising wealth is both a blessing and a curse. Soaring expectations distract us from happiness. Often, circumstances don’t matter. What’s important is how much stuff the other guy possesses.

America is teeming with exclusivity that previously was unthinkable.

We have become a tiered society on steroids.

Frank Bruni adds color to this discussion in his terrific book, The Age of Grievance.

He reflects on the past when social comparison didn’t preoccupy our lives.

Think of concert tickets. Decades ago, being first in line and contending with the hardships of sleeping on the sidewalk were the prime determinants of how close you got to the stage. Today, money handles that issue.

School used to be pretty straightforward—public or private. In 2024, the add-ons are what matters. Exceptional academic and athletic tutors have become the norm, and college admissions consultants command thousands of dollars in fees. It’s easy to extrapolate why our record affluence hasn’t had a similar effect on our psyches.

Everything is tiered, providing countless ammo for bragging rights.

Nothing escapes the claws of envy.

Years ago, your workout choices were simple: the YMCA or a private gym.

In 2024, private gyms are the new caste system.

The chasm between the Equinoxes of the world and Planet Fitness couldn’t be more expansive.

Compounding our self-inflicted misery is the endless bandwidth of social media.

Bruni brilliantly comments: Social media platforms present a nonstop stream of braggart postcards from other people’s lives. Just as there are new echelons of coddling, there are new portals and peepholes, and they present a warped view. On Facebook and Instagram, somebody is always raising a glass of champagne at a wedding in a tropical locale while the sun is setting in a gorgeous mosaic of colors. Somebody just bought an amazing pair of impossible-to-find shoes. Somebody got a promotion. Somebody got into Yale.

We look to share experiences on social media rather than sitting back and enjoying them.

The Money with Katie Blog provides an interesting perspective on this phenomenon: Social media encourages us to buy experiences as though they are possessions—digital trinkets with which we’ll adorn our algorithmic front yards and, in the process, sell our claim to our memories for the low, low price of “free.”

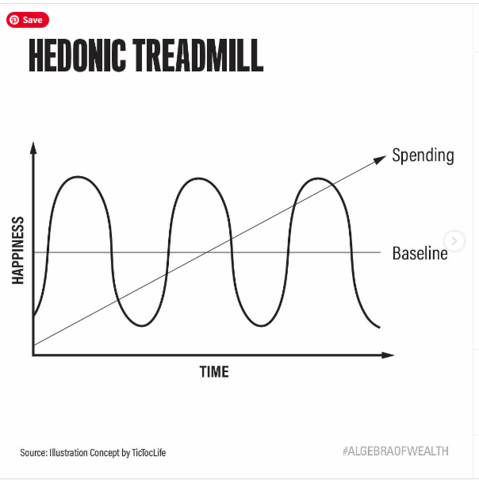

Is it that difficult to imagine how millionaires and even billionaires entangle themselves on an unending journey on the hedonic treadmill?

The simple but not easy solution to our comparison epidemic is appreciating what you have, not what you want, and forcing on generosity.

Billionaire Philanthropist Rob Hale is working towards changing our culture of looking at me.

He recently spoke at the University of Massachusetts commencement ceremony. As the graduates collected their diplomas, Hale returned to the stage and handed each an envelope with $1,000. The catch was they could keep $500 but had to donate the rest to a cause of their choice.

Hale commented: “If they get to feel that joy themselves, then maybe it becomes something they want to do again and make part of their own lives; in America and the world, these are times of turmoil, and the more we help each other, the better off we’ll be.”

Wealth is about purchasing a freedom ticket.

Liberating yourself from the addiction of comparison should be the centerpiece of your financial plan.

Envy is not an asset class.