ENOUGH

Thats it.

Ponder your life for a moment.

Your home, career, hobbies, family, and other possessions were all once distant desires.

At one point, your world revolved around acquiring these items.

At this moment, many reading this blog have them all and more.

Instead of focusing on having enough, moving the goalposts becomes the new focus.

More stuff, same result.

Imagine that instead of being a captive of the hedonic treadmill, another path emerged.

Try remembering what it was like twenty or thirty years ago to want all you now possess.

The exercise changes the narrative significantly.

Sam Harris recommends doing this practice for only an hour. It might be the most critical sixty minutes of your life.

Appreciating what you have instead of what you want maximizes current wealth without striving to increase it.

If you constantly work and grasp for things you don’t need, you’ll miss out on the good stuff.

Trading time for money isn’t the best strategy for people who don’t need to play the wealth game.

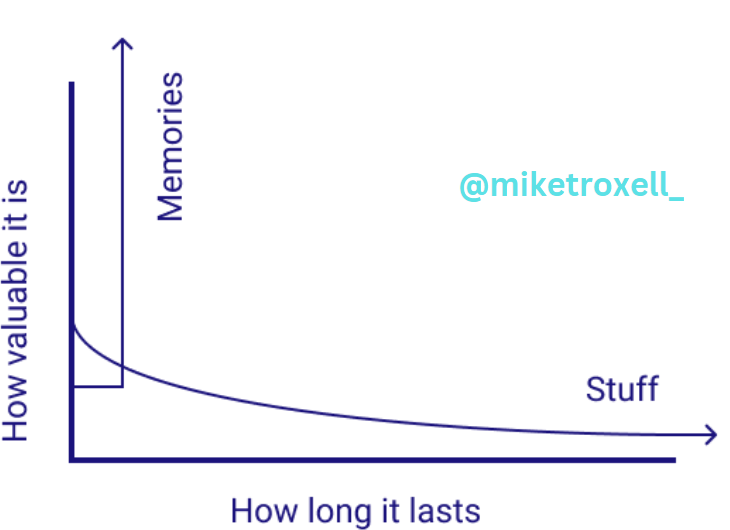

Consider memories. A good memory is priceless.

Even not-so-great memories have a positive net worth.

Mike Troxell points this out in this terrific blog post.

One study conducted by Dr. Thomas Gilovich, a psychology professor at Cornell University, showed that if people have an experience that they say negatively impacted their happiness, once they have the chance to talk about it, their assessment of that experience goes up.

Great experiences pack the most powerful punch.

Think of a concert or a game you attended with friends. The tickets might have seemed pricey then, but you would’ve gladly paid 10x or 20x as you get older to preserve their value. Compare this to someone with two million dollars and tons of good memories to a workaholic with 10 million and few memorable experiences with family, friends, or enjoying hobbies.

Who is wealthier?

Memory creation should be at the head of the list for people with enough.

Understanding the meaning of enough does something else that brings fulfillment to life- Gratitude.

Taking things for granted is a real buzz-kill.

Think of all the fantastic technology we possess that goes unappreciated because we want things to acquire additional stuff we don’t need quickly.

Seth Godin nails this point in his blog, The Half-Life of Magic.

He discusses our focus on the latest and greatest tech gadgets instead of marveling at what they can do.

It’s a sort of hedonic treadmill of tech, where we not only take a breakthrough for granted in a short time but also raise the bar for what counts as magic next time.

If we depend on outside forces to find wonder and awe, we will end up disappointed.

We don’t have to wait for a new technology to feel the magic. Instead, we have the chance to erase our expectations and simply notice it wherever we look.

It’s difficult to stop playing the only game you’ve ever known.

The good thing is it’s not the only sport in town.

We should all heed American Author Ann Patchett’s wise words: “Never be so focused on what you’re looking for that you overlook the thing you actually find.”