Losing some battles to win the war sums up long-term investing.

Avoiding being powerless to fight another day is crucial for sustainable wealth creation.

The market seems to have an NDE (Near Death Experience) at least once every decade.

Recoiling from the white light is mission-critical.

About 10-20% of people experience clinical death experience, NDEs.

Inner feelings of peace and joy characterize these experiences. Many include being out of one’s body and watching events around them. A dark tunnel or white light is often part of the description. Some witness a full life review and a barrier they cannot breach.

People take comfort in these experiences of peace beyond this world; there’s a glitch. It turns out that those who reported these adventures didn’t fulfill the technical definition of death. Dying requires a brain shutdown. None of the reported cases of NDEs display proof this occurred.

According to Sam Harris, Those who have reported leaving their bodies during a true medical emergency after cardiac arrest, for instance-did not suffer a complete loss of brain activity. Even in cases where the brain is alleged to have shut down, its activity must return if the subject is to survive and describe the experience. In such cases, there is generally no way to establish that the NDE occurred while the brain was offline.

The brain also produces DMT, which is a short-term psychedelic similiar to longer-acting LSD. The brain may be releasing DMT during NDEs, which could account for the visions experienced by those near death.

While science doesn’t rule out heaven, hell, reincarnation, etc, it appears NDEs aren’t the secret door to a blissful afterlife. Nobody knows what happens when you die except those who die. Most of us would like to postpone death as long as possible before finding the ultimate spiritual truth serum.

At all costs, we must avoid letting our portfolios saunter to the afterlife.

Taking comfort in this morbid topic is an investing super-power.

In our firm, we create portfolios mimicking the global stock and bond markets. We overweight certain factors that have historically proven to produce a more optimal risk-reward portfolio, but make no mistake—we are invested in global capitalism. The only way a well-crafted diversified index fund representing global asset classes goes to zero is an Apocalypse-like event. In this case, the last thing on an investor’s mind would be their 401k balance. Running away from radiated cannibal zombies would take preference over YTD portfolio return concerns.

Despite what some Insurance Companies, Macro Hedge Funds, or Gold Bugs might sell you, Armaggadeon insurance is unavailable. Who would you collect from? Satan?

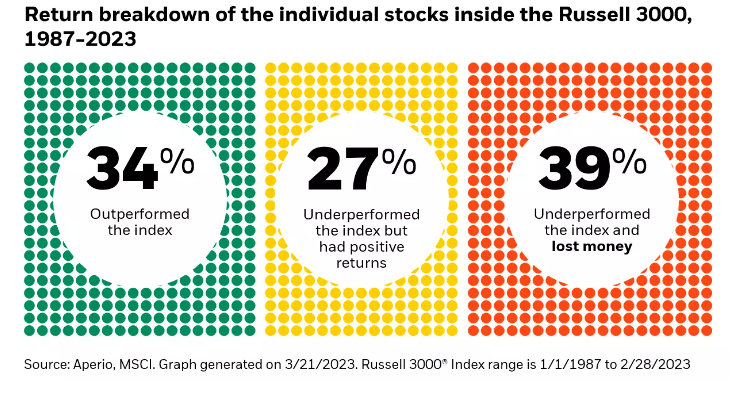

Stock picking provides its unique perils.

If an index like the S&P 500 went to zero, all banks and insurance companies would quickly follow suit. That’s why such calamities are aptly named extinction-level events.

While this topic is disturbing, one can take comfort in knowing that a global market-based investing strategy translates into “If this doesn’t work, nothing else will either.”

Though it doesn’t hurt, The good news is you don’t have to believe in an afterlife to build wealth.

Not watching your portfolio die due to over-concentration, irresponsible speculation, or leverage is 90% of the battle.

While we hope there’s something beyond this world, don’t allow your portfolio to journey to the Pearly Gates.

If it does, it won’t be coming back anytime soon.