America is filled with broken, antiquated systems indifferent to the modern world.

Our education monopoly was designed to prepare children to toil on an assembly line. In many ways, things haven’t changed much. A nine-period day, few options for practical skills, and judging students by the lowest common denominator, a standardized test grade still rules the process.

Crony capitalism is besieged by deep-pocketed lobbyists guaranteeing the few get rich at the expense of many. Children are burnt-addicted offerings to the altar of the profit Gods of social media. Prescription drugs are handed out like candy regardless of their side effects, and processed junk food has become a staple of our diets. All of this didnt occur by accident.

Politics is replacing religion. Wokism. Trumpism and QAnon have millions of disciples. There’s a possibility our next sitting president may commence his term under house arrest.

Faith in every established institution is at or approaching an all-time low.

Krista Tippet responds to these Macro-Toxins on The Ten Percent Happier Podcast with Dan Harris.

Her retort is simultaneously simple and beautiful.

Yes, and…..

It’s all about agency. We tend to rush to actions because we desire answers – yesterday.

It’s almost impossible to let go of our illusions of control.

Yes, and…. takes a different perspective.

We need to look for the light we can see and touch. Focusing on the little things we control can help keep us calm, safe, and open in a chaotic world. Macro issues are challenging to solve, but they become an impossible undertaking if you can’t fix yourself first.

While there are real problems out there, we choose the wrong messengers when trying to understand their gravity.

Media Overlords use our Amygdala as the determining factor for what news stories will reach our phones and TVs. If it bleeds, it leads is not an old wives tale. Fight or flight is weaponized and prevents us from seeing any good in the world.

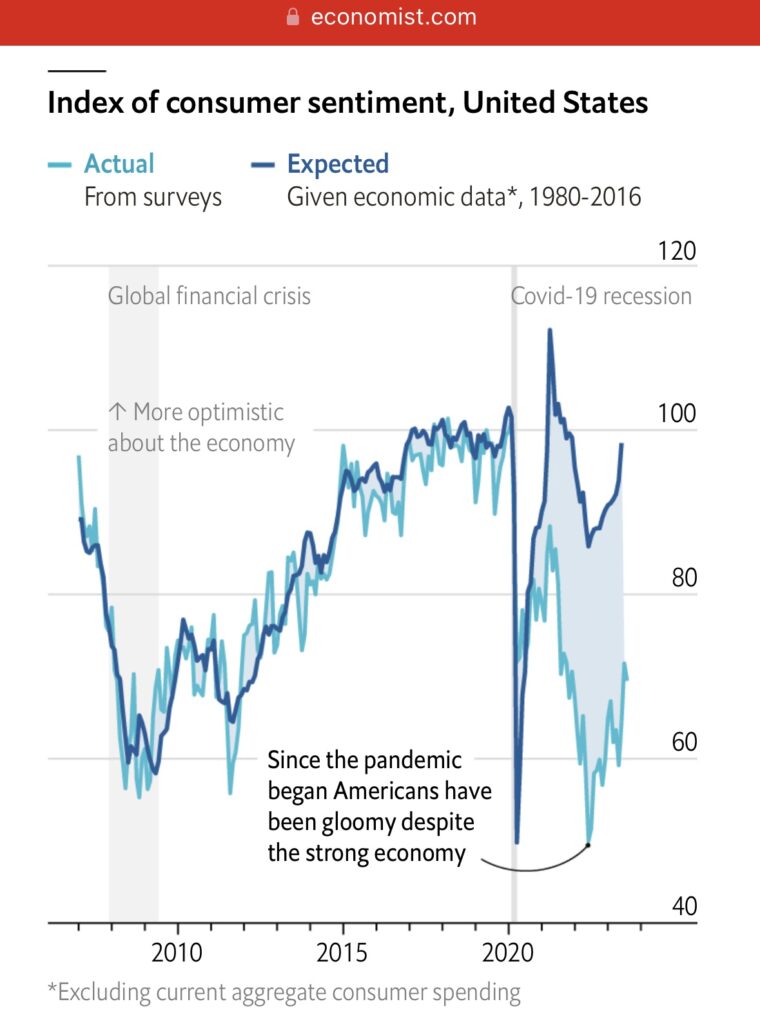

This helps explain the massive divergence between consumer sentiment and economic reality.

My colleague, Michael Batnick, brilliantly states:

Nobody watches the weather channel when it’s 70 and sunny.

News and social media are a drag on happiness. If I had to describe the economy using one word, I would use “strong.” If I had to describe the consumer in one word, I would use “anxious.”

The good news is we don’t have to let others determine the state of our world.

Yes, and…..

What are you going to let fuel your financial aspirations?

Living in fear of World War III arising in the deserts of the Middle East is an option. Preparing for a second American Civil War starting in November 2024 is on the agenda. Never-ending inflation accompanied by even higher interest rates is a third area of focus to let your imagination run wild.

There is a better way. Our reaction to the shitty things going on in the world isn’t predetermined.

Yes, and…..

We can fuel our minds with attainable retirement dreams. Paying for a grandchild’s college education or funding a cause close to your heart are anti-armageddon strategies. We shouldn’t ignore the imminent threat besieging us, but letting them overwhelm us does no good.

We need patience and curiosity rather than fear and reactivity.

Coming to peace with the fact it might take multiple generations to address some of our core issues is an excellent coping mechanism.

You may not see the day when the tide turns for the better, but it is, in many ways, comforting. Spending time and energy helping, funding, and observing the next generation plan and implement a battle strategy is something you don’t have to believe in reincarnation to take refuge in.

The next time the media, your friends, or colleagues bring up their fatalistic viewpoints, there is another choice rather than arguing or cowering before their facts.

There’s a way out.

Yes, and…..