Age makes some things better, others worse.

The trick is to understand how to discern between the two.

Athletes peak early—swimmers in their twenties and powerlifters in their thirties.

Competitors in sports that require speed and power reach their full potential rapidly, while endurance-based participants possess a later date.

The ages for both types of peak performances are on an upward slope due to advances in training, equipment, and sports science.

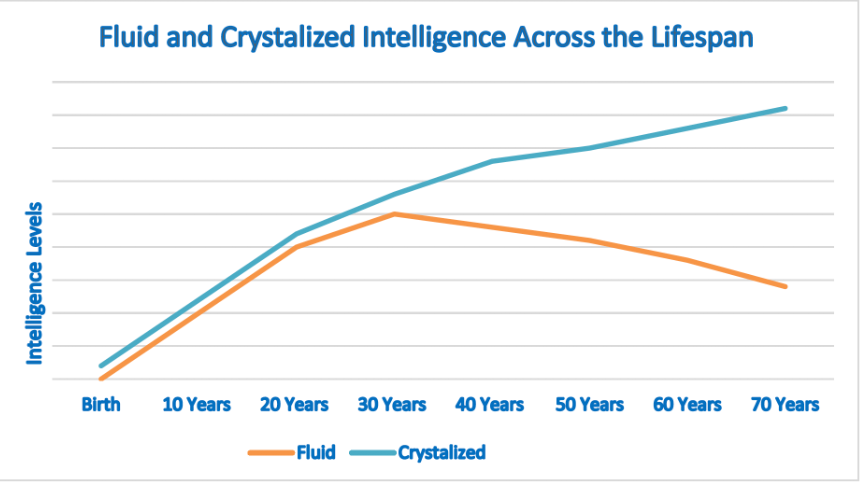

Peaks differ for mental activities. Conceptual thinking is similar to speed and power athletics. This thinking crests sooner due to different approaches to problem-solving. Fluid thinkers challenge the status quo and think more abstractly. This trait favors younger people,

Experimental thinkers rely on accumulated knowledge and experience. Older people fall into this category. This is referred to as crystallized intelligence.

Source: SimplyPsychology

There’s good news regarding when and how people attain peak performance.

The Wall Street Journal explains:

The good news is that while we may have peaked in one endeavor, we are likely improving in another.

“At every age, you are getting better at some things and worse at others,” says Joshua Hartshorne, an assistant professor of psychology at Boston College, who researches how various cognitive functions change with age.

Understanding the peaks and valleys of mental and physical skill sets is essential for retirees.

Focusing energy on experimental thinking and crystallized intelligence reduces frustration and maximizes peak skill potential. There are many activities where older Americans are at an advantage. Unfortunately, too many people are running out the clock in retirement rather than applying their hard-earned life skills to benefit themselves and those in their community.

Here’s some food for thought.

- Mentoring and Teaching: Share your knowledge and skills by becoming a mentor or volunteer instructor. You can offer guidance and support to younger generations by sharing your insights in your area of expertise.

- Consulting and Freelancing: Many organizations value the wisdom and experience of retirees and are willing to pay for your insights and advice.

- Writing and Blogging: Start a blog, write articles, or even publish a book to share your knowledge and experience.

- Volunteering: Offer your skills and knowledge as a volunteer in non-profits, community groups, or social initiatives.

- Personal Growth And Lifelong Learning: Continue expanding your knowledge and skills. Take courses, attend workshops, participate in seminars, or engage in intellectual hobbies. Crystallized intelligence allows you to build upon existing knowledge and explore new areas of interest.

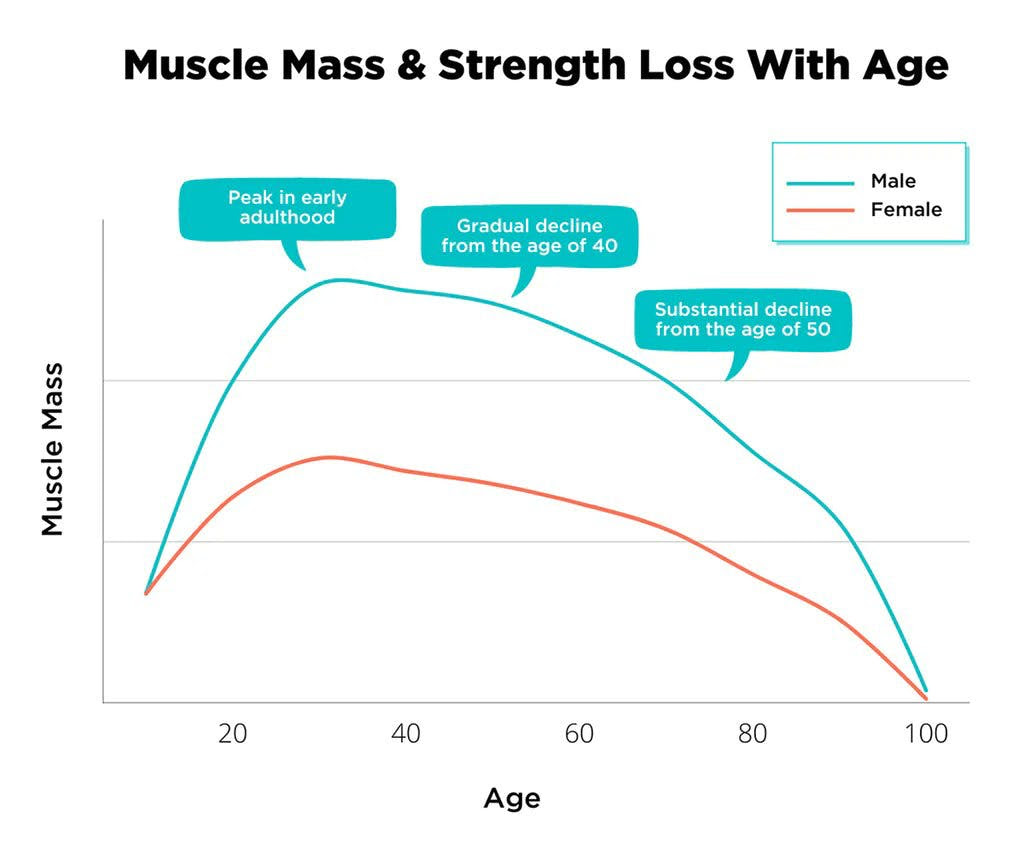

As we age, we lose muscle, strength, and stability. It’s critical to counteract these effects for optimal lifespan. Unlike mental activities, which we play to our strengths, we must do the opposite regarding our bodies.

Research suggests muscle strength decreases by about 1-2% a year after age forty.

Source: DG

Fast twitch muscles keep us strong, but unfortunately, these muscles atrophy when things like walking become our only form of exercise. Slow twitch muscles activate during less dynamic movement.

As we age, we must incorporate activities like box jumps, sprints, weight lifting, HIIT workouts, Sports, and Jumping Rope to roll back Mother Nature. Explosive and high-intensity movements are deemed too dangerous for older individuals, but they’re exactly what the body needs.

Balancing playing to strengths and working on weaknesses is vital for a healthy and wealthy retirement.

What game are you playing?