The debate between nature and nurture is eternal.

Are good investors born or made?

Eddie Murphy famously became the object of a cruel experiment concocted by two greedy, entitled commodity moguls in the 1970s comedy Trading Places. Murphy was grabbed from the mean streets and placed in a country club environment with the idea he would become a successful commodity trader with the right nurturing. His privileged counterpart was thrown into the gutter due to a devious scheme to complete the experiment.

Mayhem ensues, including the most profitable Orange Juice trade ever executed.

https://youtu.be/I0swBR40_R8

Pseudo-Science aside, there’s scholarly debate regarding genetics’ role in human outcomes.

Canadian Physician Gabor Mate’ discusses genetic potential in his book, The Myth of Normal. In particular, the developing field of Epigenetics plays a role in fulfilling human potential.

Experience determines how our genetic potential expresses itself in the end. The field of epigenetics-meaning “on top of” genes, is all about this. Epigenetic processes act on chromosomes delivering and translating messages from the environment that “tell” genes what to do. …..Genes answer to their environment; without environmental signals, they cannot function.

Epigenetics cause us to look at evolution differently. It doesn’t deny Darwinism, as some detractors state. Epigenetics states circumstances determine how and when genes are expressed.

As Mate summarizes, “Said another way, our lives are what happens when life acts upon life.’

Think of a simple Acorn. Depending on the environmental conditions, it could grow into a stately Oak Tree or be eaten by a hungry squirrel. Its genetic potential never changed, but the conditions did.

Social changes aren’t too different from the chemical variety.

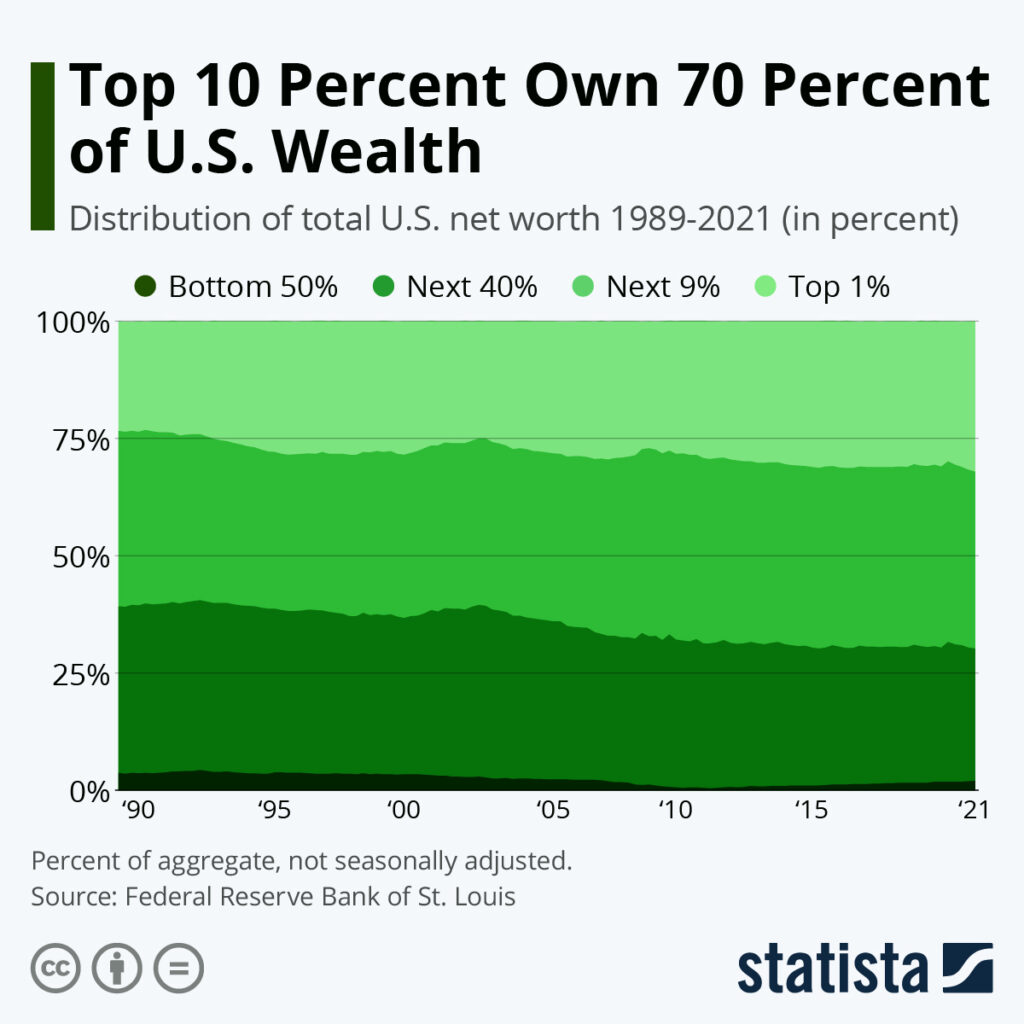

Investing is no different. I’m sure multitudes possess wealth-building genes, but their environmental constraints never let them bear fruit.

There’s a current debate about Baby Bonds.

The Wall Street Journal recently explored this topic.

The idea is for the government to deposit a few thousand dollars into a trust account for each infant born to parents below a designated income level. As adults, the beneficiaries can use the money—plus investment returns—to help pay for education or a home.

Will a government program unlock the hidden genes of wealth creation in low-income families?

Derrick Hamilton of The New School believes the answer is yes.“The most critical ingredient to generate wealth is wealth itself,” Mr. Hamilton said. “All the financial literacy in the world is useful and valuable, but limited if you have no finances to manage.”

Many foreign nations offer similar programs. These include Canada, Singapore, Israel, and The United Kingdom.

Some Conservatives worry about potential budget implications and favor the U.K.’s model of encouraging savings by freeing investment earnings from taxation. There are also valid concerns about personal responsibility and compliance issues that must be addressed.

This and other objections are why only Washington, D.C., Connecticut, and California have approved programs. Eight other states are discussing the proposal.

If Epigenetic theory holds up, Baby Bonds are a terrific idea, providing guardrails exist and ensuring the money is used to build wealth and not squander it.

Connecticut’s program might serve as a national prototype if (A big If) its implemented successfully.

Connecticut’s baby bonds program was meant to fund the creation of trust accounts with deposits of up to $3,200 per child for 12 years. At 18, beneficiaries who completed a financial literacy course could use the money to start or invest in a Connecticut business, buy a home in the state, pay for higher education, or save for retirement. A first-time family could qualify for eligibility under the state’s public health insurance with an income of $65,382.

Regardless of your views on Baby Bonds, one fact holds. Epigenetics or not, wealth creation requires the right conditions to sprout from the human genome.

Source: The Myth of Normal: Trauma, Illness, and Healing in a Toxic Culture by Gabor Mate’