Making money doesn’t create success; what you do with it does.

The Go-Giver sold millions of copies based on the application of this premise.

The book answered the eternal money question – How do we delineate true wealth?

Your true wealth is determined by how much more you give in value than you take in payment.

By that definition, making oneself rich should be interpreted by applying this concept.

Kicking off with low-hanging fruit is the best protocol in your chosen pursuits.

Giving highly appreciated stock to your favorite charities checks all the boxes.

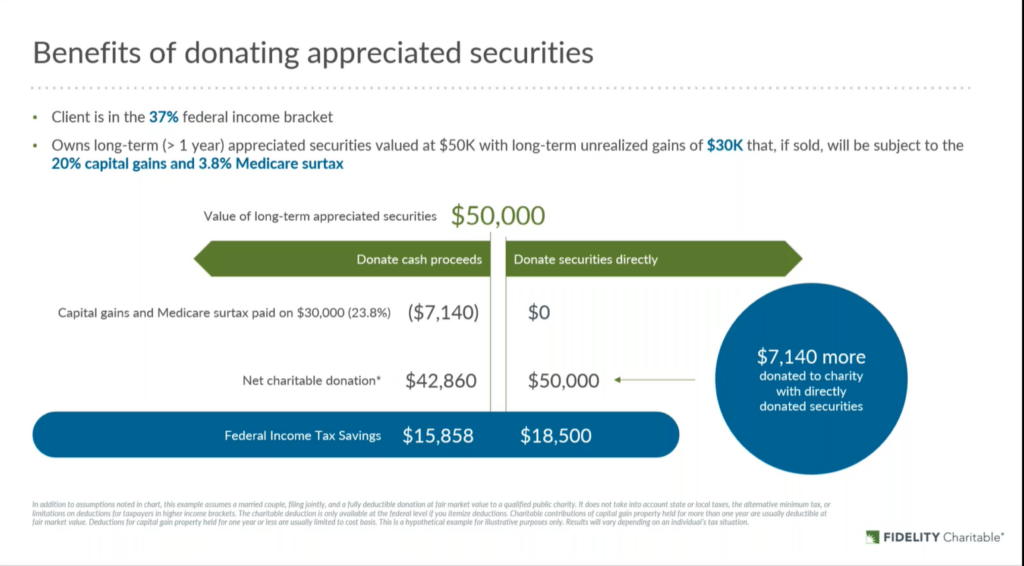

For the uninitiated, many investors embrace donating cash when practicing philanthropy. Though well-meaning, they could receive more bang for their buck if they switched to highly appreciated stock instead.

They will receive a charitable deduction if their contributions exceed certain thresholds and eliminate up to a 23.8% federal tax on appreciated securities. This break also applies to individual state taxes.

Why do so many people donate cash to charity and sell stock (paying capital gains taxes) to fund expenditures?

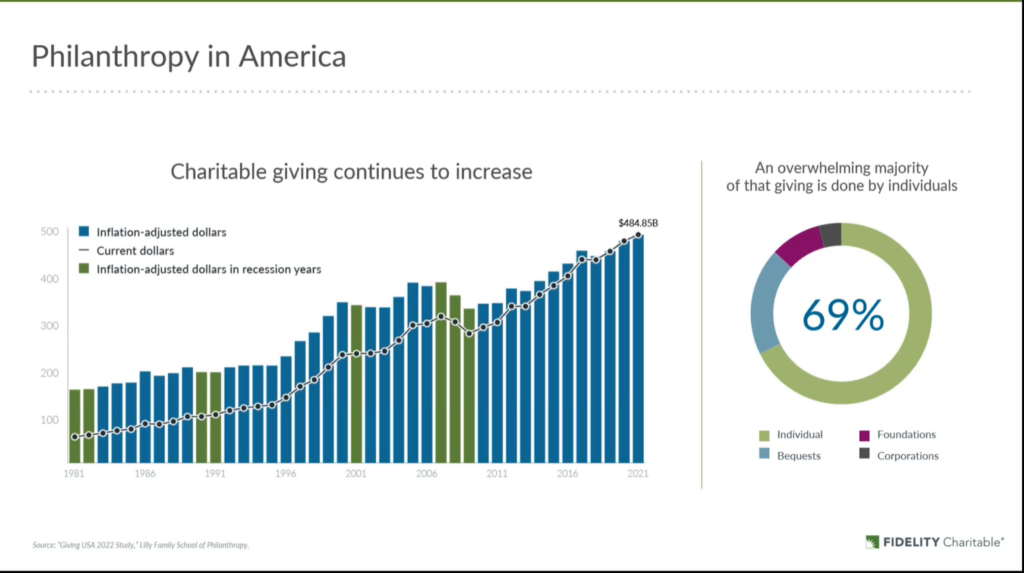

The only logical explanation is they’re not aware this option exists. Americans are charitable, and finding the best giving strategy benefits all stakeholders.

Here are five reasons why donating appreciated stock to charity is recommended:

- Increased Tax Benefits: Donating appreciated stock to a qualified charity allows a tax deduction for the total market value at the time of donation. This strategy eliminates capital gains taxes and possibly saves you more on taxes than if you sold the stock and donated the cash.

- More Charitable Impact: The charity can sell the stock without paying capital gains taxes. This can provide a more significant gift than just donating cash.

- Diversification: If your portfolio has become overweight with appreciated stock, donating some to a qualified charity is an excellent rebalancing technique for eliminating market risk.

- Easy to Give: Donating stock is a straightforward process. Most of the time, it can be done electronically through your custodian. This limits ponderous paperwork.

- Supporting Causes, You Care About: Donating appreciated stock allows investors to aid their cherished causes and organizations. As an added benefit, you can lower your tax bill and diversify your portfolio. Few can argue with Win-Win strategies.

Fidelity crunched the numbers providing an excellent sample of how this strategy works for high-income individuals. The charity receives more money, and investors slash their tax bills.

It’s important to note that implementing this strategy requires holding the stock for at least one year and donating stock directly to the charity of your choice.

Define your success by how much you give, not how much you take.

The Go-Giver offers a North Star for guidance regarding this philosophy.

All the great fortunes in the world have been created by men and women who had a greater passion for what they were giving- their product service or idea than for what they were getting. Many of those great fortunes have been squandered by others who had a greater passion for what they were getting than what they were giving.

Creating wealth in the stock market isn’t just about appreciating your portfolio.

Wealth appreciation generates from being grateful for what you have and using your assets to help those less fortunate.