Can you trust your financial plan if you don’t trust yourself?

A precise financial plan is a myth on par with Bigfoot or the Loch Ness monster. Predicting thirty years into the future is a laughable task. It’s not to say financial plans don’t have their place- they do. Employing them as a compass rather than a map is a preferable strategy.

Try thinking of a plan as a living, breathing document similar to our Constitution. (Void of all the political rancor)

Monitoring and adjusting in real-time is the chosen approach. Attempting to predict uncertainty, market volatility, inflation, and longevity risk is a form of financial fools gold. We need a baseline of assumptions, but including things we enjoy and following our instincts are vital.

What’s often missing in plans is trusting your intuition.

Music Producer Rick Rubin spoke about this in a recent Bari Weiss podcast. Rubin explained that self-trust could not be taught or learned from someone else. It comes from within and requires a willingness to be vulnerable and take risks.

You must trust yourself to know what you want, and once you know what you want, you must have the courage to go after it.”

Rubin noted we doubt self-trust because we fear failure, but failure is often necessary for future success. We’re bombarded with information overload, compounding this issue. The preferred path is seeking our experiences and forming opinions rather than blindly relying on others.

Self-Trust defines and clarifies goals.

I can personally vouch for Rubin’s philosophy.

After leaving college, I embarked on a career as a foreign exchange trader for a large international bank. Ignoring my conscious and instincts, I targeted money as my means of existence. After four years of misery, I walked away after making a fateful decision. Following my instincts and trusting myself replaced pleasing others and listening to their opinions.

The universe unfurled.

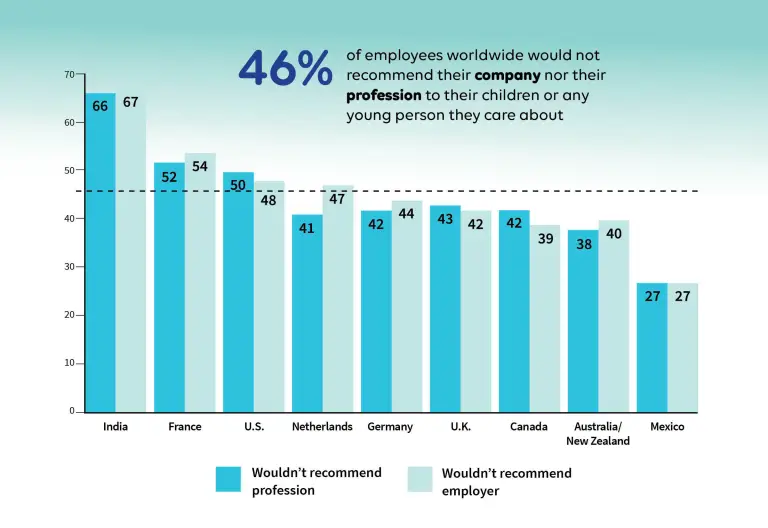

Source: UKG Workforce Institute

After returning to school and receiving a Master’s Degree in Secondary Education, I began a two-decade-long career as a public school teacher. Long-term type-A planning never entered the equation. Unlike some of my colleagues, I didnt go into teaching for summers off or a pension. Those thoughts never factored into the decision process. Wanting to work with kids and loving history were the sole motivational factors.

Teaching allowed me to incorporate two other interests, personal finance and economics, into my daily routine. Showing kids these practical concepts provided more profound life satisfaction than winning currency trades and following my instincts to teach about money set in motion my current path.

My colleagues began asking for advice concerning their finances, specifically their public school teachers’ 403(b) plans.

Soon, my lunch period filled up with appointments.

Eventually, with the help and encouragement from my wife, Dina, we started a business catering to this neglected retirement space saving teachers from financial predators. The business became so successful that I left teaching to focus on this pursuit.

Intuition and self-trust created the business. My intention to help students and my colleagues helped create a business opportunity, and the money followed, unlike my previous career, where I doubted myself and reversed the process. The results couldn’t have been more opposite.

After reading blogs by my current colleagues, Josh, Barry, Michael, and Ben, I reached out inquiring if there might be some synergies. My motivation was about respect, not joining the firm. Adding culturally aligned good people to our network was the goal.

Instead, we joined the crew, and eight years later, the ramifications of this decision were life-changing spiritually, emotionally, and professionally. If money were the sole motivation, the union never would’ve occurred.

Setting goals using financial software is only helpful if they come from your heart.

Having tried the alternative, I speak from experience.

Oscar Wilde said it best. Be yourself; everyone else is already taken.

Trust yourself first and plan later.