Stress test your body and portfolio.

In contrast to popular opinion, stress isn’t bad for you. Constant stress kills, and targeted stress builds.

Evolution made us strong. Dealing with the elements and evading predators isn’t for the weak.

Hunting and gathering in freezing and stifling conditions taught us how to survive. Ingenuity, not technology, kept us alive.

Contrast that to the modern world.

Scott Carney provides more insight.

With no challenges to overcome, frontier to press, or threat to flee from, the humans of this millennium are overstuffed, overheated, and understimulated. The struggles of privileged residents of the developed world- getting a job, funding a retirement, getting kids into a good school, posting the exactly right social media update- pale compared to the threats of death or deprivation our ancestors faced. Despite this apparent victory, success over the natural world hasn’t made our bodies stronger. Quite the opposite: Effortless comfort has made us fat, lazy, and increasingly ill.

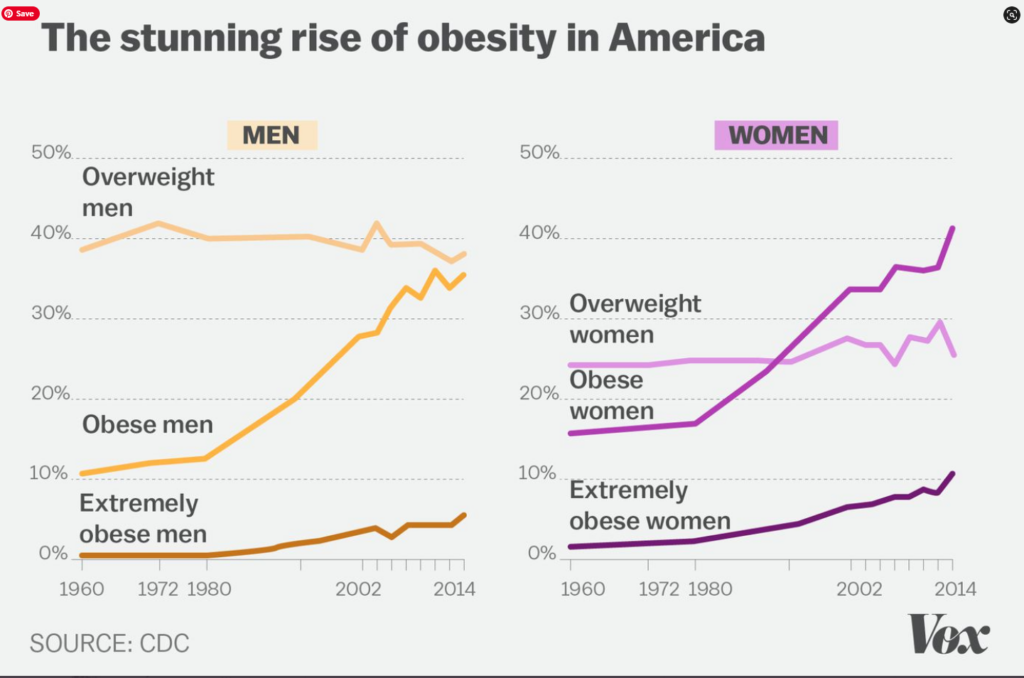

Diseases exploded this century. Obesity, diabetes, chronic pain, and hypertension cases are omnipresent. Autoimmune disorders, where the body attacks itself, are becoming more common.

Some speculate that since there are few external threats, the body’s stored energy targets our insides.

Wim Hof elaborates on this theme. Everything dies one day. It is just that, in our case, we aren’t eaten by wolves. Instead, without predators, we’re being eaten by cancer, diabetes, and our immune systems. There’s no wolf to run from, so our bodies eat themselves.

We are seldom cold or hungry. These uncomfortable states marshall the body’s anti-stress defenses, strengthening our immune systems and extending our health span.

Exercise works in the same manner. We destroy muscle fibers to rebuild them more robustly. The stress of physical activity creates inflammation. Our bodies respond with a disproportionate amount of anti-inflammatory hormones.

Iron sharpens iron.

What about our investment portfolios?

Does stress make them more resilient?

Should we welcome occasional stress in the markets?

The short answer is yes.

Without temporary stock market setbacks, there would be no risk premium. Without risk, annual average historical market returns of 8-10% are impossible.

When markets hibernate into bear modes, future expected returns rise significantly. For example, before last year’s bond market crash, investors could hope to receive less than 1% on many high-quality bonds. Today that number exploded to over 4%.

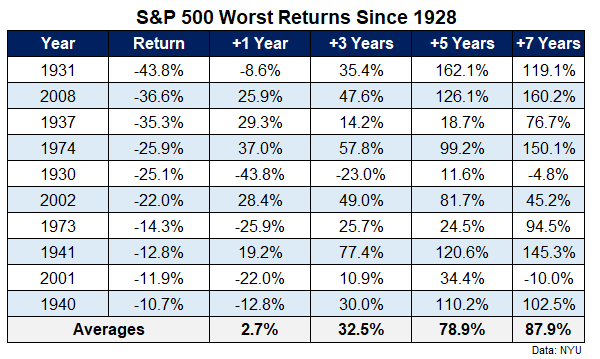

My Colleague Ben Carlson crunched the numbers to see how markets responded after temporary periods of stress.

Last year was one of the worst years ever for stocks and the worst year ever for bonds.

The logical next step is to look at what happened following the prior worst years for stocks, bonds, and diversified portfolios.

Past performance tells us nothing about future performance, but studying market history can provide some context around market behavior following significant events historically.

These were the ten worst years for the S&P 500 before 2022, along with the forward 1, 3, 5, and 7-year total returns:

What doesn’t kill investors makes them stronger.

There’s a caveat. This data doesn’t apply to stock picking. The numbers are based on a large group of 500 different stocks. Just like working a single muscle too much, single stock portfolios may lead to injury or worse. The same goes for children over-specializing in a sport by playing it year-round.

Our ancestors who survived our harsh and dangerous past produced more resilient and healthier offspring.

The same applies to sticking it out in a bear market. Selling your stocks at the worst possible moment poisons the well of the most well-constructed financial plan.

Resist the urge and emerge financially more potent than ever.

Our ancestors did this under much harsher conditions.

Comfort isn’t your ally regarding your health or investment returns.

Source: What Doesn’t Kill Us by Scott Carney